CIRO Establishes Temporary Cryptocurrency Custody Rules for Canada

Canada's self-regulatory body has established custody restrictions, minimum capital requirements and disclosure obligations as it develops comprehensive long-term crypto regulations.

The Canadian Investment Regulatory Organization (CIRO) has officially established a temporary regulatory framework that governs how crypto assets and tokenized securities must be held in custody.

The regulatory initiative detailed the expectations for how dealer members should protect assets belonging to clients during the period when comprehensive crypto regulations are still being formulated.

According to a notice released on Tuesday, CIRO explained that the framework establishes its oversight expectations for investment dealers that operate cryptocurrency trading platforms, covering custody restrictions, asset segregation protocols, disclosure requirements and graduated standards for external digital asset custodians.

The regulatory body explained that the framework functions through mandatory terms and conditions attached to membership status, as opposed to modifying its fundamental rulebook. The approach aims to ensure investor safeguards and regulatory transparency during the ongoing development of comprehensive policy measures.

We expect that, over time, elements of this framework may inform the development of permanent rules or harmonized regulatory instruments as crypto asset markets mature.

CIRO

Tiered custody model and capital requirements

According to the framework, dealer members are required to store crypto assets either through CIRO-authorized digital asset custodians or through in-house custody systems that satisfy fundamental standards.

The regulatory authority unveiled a graduated custodian structure that correlates capital reserves, insurance coverage, corporate governance and technological verification standards to the percentage of client holdings a custodian may store.

Tier 1 and Tier 2 crypto custodians have authorization to store as much as 100% of a dealer's cryptocurrency holdings, provided they meet elevated capital benchmarks and strengthened verification protocols, which include independent cybersecurity assessments.

Custodians in lower tiers encounter more restrictive limitations, with Tier 3 and Tier 4 custodians authorized to store a maximum of 75% and 40% of a dealer's cryptocurrency holdings, in that order. At the same time, dealers' in-house custody operations are restricted to 20% of client cryptocurrency assets.

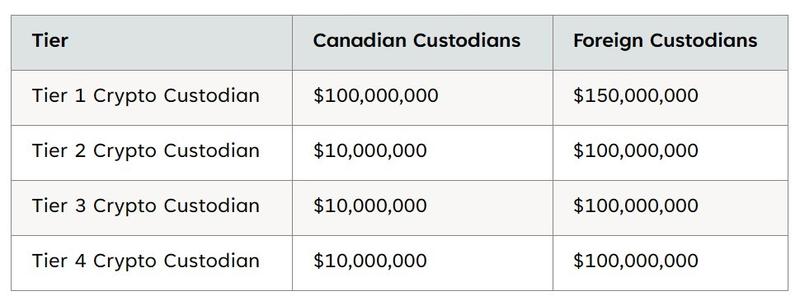

CIRO additionally established minimum capital standards for custodians that increase proportionally with risk level and geographic location, imposing greater requirements on international entities to compensate for uncertainties related to cross-border legal enforcement and bankruptcy proceedings.

CIRO indicated that custodial oversight is being implemented through continuous monitoring activities, reporting mechanisms and enforcement actions linked to dealer membership terms, providing the regulator with the ability to address emerging threats rapidly without incorporating requirements into fixed regulations.

Canada's broader crypto policy situation

The framework builds upon previous risk-oriented actions implemented by CIRO to manage cryptocurrency market operations. On Feb. 6, 2025, CIRO removed crypto funds from reduced margin qualification, referencing price volatility, liquidity concerns and regulatory ambiguity.

The custodial guidelines additionally arrive while Canadian regulators persist in developing more extensive cryptocurrency regulations.

On Dec. 17, 2025, the Bank of Canada announced it would exclusively endorse premium-quality, fiat-backed stablecoins as a component of its proposed regulatory structure, underscoring the nation's prudent, incremental methodology toward cryptocurrency market supervision.