BTC Analysts Eye Price Targets Below $50K as Bear Market Patterns Reemerge

Analysis suggests Bitcoin bear market patterns are "repeating" themselves following the breakdown of critical support levels and realized price transforming into fresh resistance.

Bitcoin (BTC) was trading beneath the $50,000 threshold approaching Sunday's weekly close as bullish traders struggled to mount a recovery from lows not seen in ten months.

Key points:

- Price targets for BTC remain negative as Bitcoin bulls struggle to recover at their lowest levels in ten months.

- Gaps in CME futures markets could offer some brief respite heading into the upcoming week.

- Research indicates Bitcoin continues to mirror trajectories from previous bear markets through the loss of realized price support.

BTC price: "So far, history is repeating"

Information from TradingView revealed BTC price activity remained under $80,000 following a greater than 6% decline in BTC/USD the previous day.

Following the breakdown of important bull market support zones, which included the true market mean positioned at $80,700, Bitcoin caused numerous traders to adopt a bearish stance for the time period ahead.

X account Cmt_trader projected that "$74,400 and $49,180 are the two major downside liquidity targets for this bear market."

Trader CryptoBullet highlighted specifically the breakdown of the 21-week exponential moving average (EMA) — a development that came before past bear markets.

Building upon the previous week's bull market EMA crossover discussion, trader and analyst Rekt Capital concurred that historical precedent supported "additional downside continuation."

"So far, history is repeating, with downside occurring after the Bull Market EMA crossover," he communicated to X followers.

"Bitcoin has dropped -17% from $90,000 to $78,000 since the crossover took place."

The crossover is characterized by the interaction between the 21-week and 50-week EMAs, and was last activated in April 2022.

Expectations for a near-term bounce, in the meantime, rested on freshly created "gaps" within CME Group's Bitcoin futures market.

Frequently functioning as short-time frame price "magnets," the closest gap was currently positioned near $84,000.

Trader Killa therefore forecasted that $84,000 would be filled "over the next few weeks."

Bitcoin risks new "extended bearish phase"

Taking a broader perspective, the most recent onchain research continued to maintain a firmly risk-off posture across longer time frames.

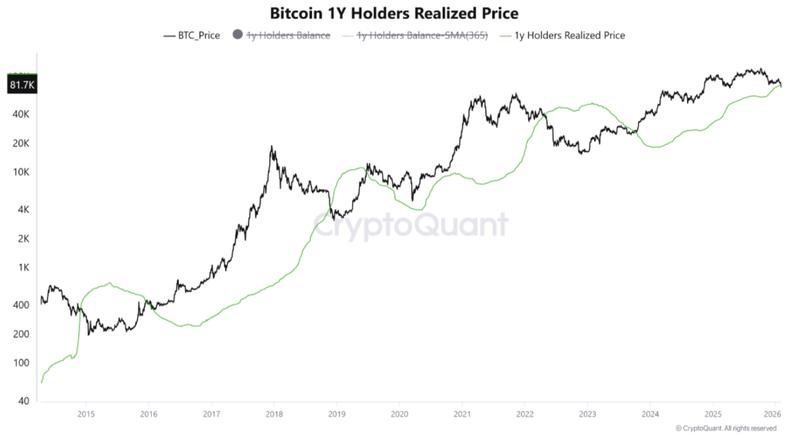

According to onchain analytics platform CryptoQuant, spot price moving beneath the realized price of investors who have held BTC between 12 and 18 months represented the writing on the wall.

Realized price represents the aggregate cost basis at which their BTC last moved.

"Historically, when price breaks and sustains below this cost basis, market behavior transitions from normal corrections into structural bearish regimes, not short-term pullbacks," contributor Crazzyblockk cautioned in a "Quicktake" blog post.

Realized price itself, according to the research, remained stable — a characteristic "reinforcing its role as overhead resistance."

"When spot price remains below a flat or rising realized cost, rallies tend to fail as supply seeks breakeven exits," Crazzyblockk continued.

"From a cycle perspective, the combination of price below realized cost, negative unrealized profitability, and slowing balance growth has historically aligned with extended bearish phases."