Brazilian Crypto Giant Mercado Bitcoin Issues $20M Tokenized Credit on Rootstock, Eyes $100M Goal

Mercado Bitcoin, one of Brazil's leading digital asset exchanges, has launched over $20 million worth of tokenized private credit instruments on the Rootstock Bitcoin sidechain, with plans to reach $100 million in total issuances by April.

Brazil's prominent digital asset exchange Mercado Bitcoin announced it has successfully launched over $20 million worth of private credit tokens on the Rootstock Bitcoin sidechain, marking a significant expansion of its real-world asset (RWA) initiatives with an ambitious goal of reaching $100 million in total issuances by April.

Based on information provided to Cointelegraph in a press release, multiple credit offerings have already achieved their target subscription levels since the platform went operational.

This strategic expansion incorporates Rootstock into Mercado Bitcoin's broader multichain approach to asset tokenization, which encompasses forthcoming RWA launches on both Stellar (XLM) and the XRP Ledger, providing global investors with Bitcoin-backed access to private debt opportunities across Latin America.

In an interview with Cointelegraph, Lucas Pinsdorf, who serves as business director at Mercado Bitcoin, explained that the recently launched tokenized assets represent a diverse portfolio comprising receivables and corporate debt instruments, supporting both domestic Brazilian entities and international borrowers.

What is particularly interesting is that these are not limited to Brazilian companies. Within the issuances, Mercado Bitcoin also chose to issue debt for an American company.

RWA demand expanding globally

Pinsdorf indicated that the initial $20 million credit offering experienced rapid sellout, reinforcing expectations that the ambitious $100 million milestone would be "a sell‑out … very soon."

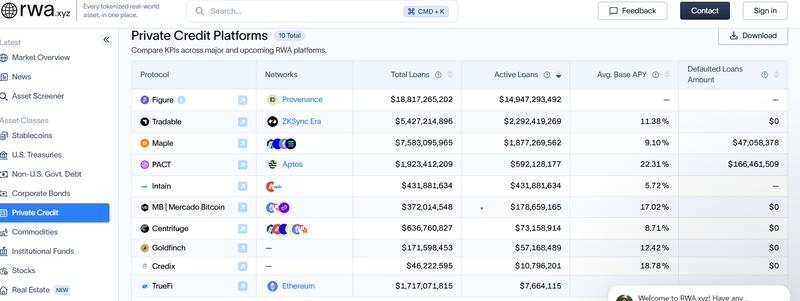

Data compiled by RWA.xyz positions Mercado Bitcoin within the global top 10 platforms for tokenized private credit issuance, having facilitated more than $370 million in aggregate loan volume.

However, the platform remains significantly behind industry frontrunners. The leading three issuers monitored by RWA.xyz have each facilitated a minimum of $5.4 billion in tokenized credit.

According to Pinsdorf, Mercado Bitcoin has designed its tokenized private credit products to operate within Brazil's established regulatory infrastructure, leveraging various licenses held by entities within its corporate group that fall under the oversight of Brazil's securities regulator, the Comissão de Valores Mobiliários (CVM), as well as the Central Bank of Brazil.

Latin America's tokenized credit race

The RWA development roadmap at Mercado Bitcoin reflects a wider regional trend toward bringing yield-generating financial instruments onto blockchain networks.

In neighboring Argentina, established cryptocurrency platform Ripio has recently introduced local currency-denominated stablecoins alongside tokenized sovereign debt exposure, as financial institutions throughout Latin America work to create bridges between conventional credit markets and decentralized blockchain-based liquidity.

Pinsdorf noted that Mercado Bitcoin maintains ongoing dialogue with financial regulators to help define the future trajectory of tokenized financial products.

We hope for clearer and more objective frameworks on how the path to tokenization in the financial market will be paved.