Bitcoin Market Eyes Potential $50K Floor: Key Developments This Week for BTC

Predictions for Bitcoin pricing continue to factor in potential macro lows ahead while risk-oriented asset investors stay anxious over macroeconomic developments in the United States and Japan.

As Bitcoin (BTC) enters the second week of February, the cryptocurrency is recovering from recent losses while market participants maintain a pessimistic outlook on BTC performance.

- Predictions across the market indicate Bitcoin's price movement has yet to establish a dependable bottom for the long term.

- The arrival of CPI data week coincides with diminishing market confidence in Federal Reserve interest rate reductions scheduled for March.

- The US dollar's power starts showing signs of weakness as experts consider a possible repeat of 2021's Bitcoin-dollar relationship pattern.

- Japan's recent election attracts attention, with forecasts predicting a declining yen and upcoming challenges for cryptocurrency markets.

- Bitcoin mining operations transfer substantial quantities to trading platforms following the recent sharp decline.

BTC price anticipated to challenge $60,000 support again

The flagship cryptocurrency maintains its position above $70,000 at the start of the week, yet market participants are far from optimistic regarding near-term BTC price trajectories.

Information from TradingView indicates minimal volatility surrounding the weekly closing period, with BTC/USD maintaining approximately 20% gains compared to the 15-month low points established during the previous week.

Through an X thread analyzing shorter timeframes, market trader CrypNuevo cautioned that the present recovery might prove to be a deceptive maneuver designed to liquidate belated short position entries.

"The rationale for initially driving price upward would be targeting short liquidation clusters concentrated primarily between $72k-$77k. However, this price movement represents mere speculation," the trader explained.

"Our actual expectation centers on the extended wick experiencing at minimum 50% retracement within upcoming weekly candle formations."

CrypNuevo suggested that recent low points might experience at least partial revisitation during the near term.

"An immediate wick-fill scenario remains possible. However, should an upward movement occur initially, the fill process could potentially require approximately 5-8 weekly candle periods," the forecast stated.

During the weekend period, Cointelegraph covered widespread agreement that pricing would establish fresh macro minimum levels in future periods — potentially driving BTC/USD toward $50,000 or beneath that threshold.

Market participant Daan Crypto Trades, conversely, anticipated less dramatic BTC price behavior ahead.

"Following such turbulent recent weeks, pricing will likely attempt establishing a range eventually. Given this recent volatility surge and substantial retracement observed yesterday, strong probability exists we're approaching that transition point currently," the trader communicated to X followers on Sunday.

"Anticipation centers on volatility gradually decreasing once more, range formation taking shape, and subsequent reassessment enabling opportunity identification."

CPI release approaches amid Federal Reserve policy concerns

Macroeconomic attention returns to United States inflation metrics this week as dramatic fluctuations in precious metal markets stabilize.

The Consumer Price Index (CPI) January measurement, scheduled for Friday release, represents the primary focal point and will follow multiple US employment statistics publications.

"Corporate earnings reporting season operates at full capacity while macroeconomic uncertainty remains elevated," trading resource The Kobeissi Letter noted regarding the week's outlook.

Following President Donald Trump's announcement of the Federal Reserve's new Chair, market anxiety concerning future monetary policy direction has not subsided. His selection, Kevin Warsh, is believed to hold positions fundamentally resistant to financial condition easing — a factor that has already impacted risk-asset market performance negatively.

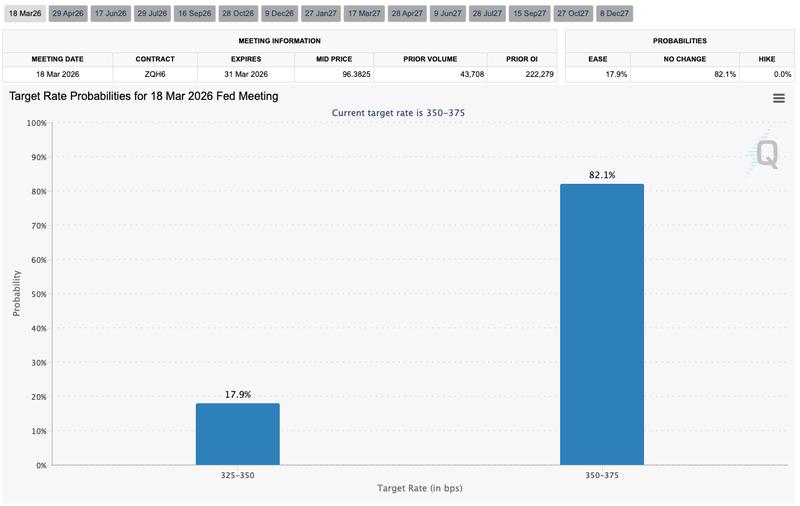

Consequently, markets demonstrate minimal confidence in interest rate reductions occurring at the Fed's upcoming mid-March meeting — despite Warsh's scheduled May takeover.

Information from CME Group's FedWatch Tool presently assigns 82% probability to rates remaining at existing levels.

Providing commentary, analytics resource Mosaic Asset Company highlighted "stubborn" US inflation figures as justification for a more restrictive Federal Reserve stance — alongside corresponding market unease.

Mosaic identified challenging Federal Reserve conditions as a "major catalyst behind the selloff in growth and AI stocks this year."

"Increasing rates diminishes the present value calculation for future corporate earnings in contemporary terms, while elevated rates simultaneously create competition for investor capital allocation," the analysis added.

As the week commenced, gold prices rebounded to the $5,000 threshold, while US stock futures accompanied Bitcoin in recovering from Friday's low points.

US dollar reaches critical ten-year junction

Regarding both Bitcoin and broader risk-asset markets, US dollar strength emerges as an increasingly significant potential volatility driver.

The US dollar index (DXY), which experienced a recovery rally subsequent to reaching multiyear minimum levels near 95.5 during late January, struggles to recapture territory above 98.

A robust dollar typically generates downward pressure for Bitcoin, and although this correlation has experienced numerous transformations across recent years, the extended-term pattern may furnish bulls with more dependable supporting momentum.

"Support at that level persists. However, this represents a truly critical threshold for the extended-term trend," analyst Aksel Kibar noted in recent dollar analysis.

"$DXY may present an excellent trading setup opportunity shortly. Either long or short. regardless of ultimate direction."

Kibar considered DXY potentially breaking below a decade-long trading channel toward the downside currently, though indicated additional data would prove necessary before confirmation.

A contrasting viewpoint emerges from Henrik Zeberg, chief macro economist at cryptocurrency market insight firm Swissblock.

Through an X post during the previous week, Zeberg drew parallels between current BTC and DXY dynamics to early 2021 conditions — approximately ten months preceding BTC/USD's blow-off peak in its previous bull market cycle.

Rather than breaking down, DXY might actually be initiating its subsequent bull run phase.

"Powerful DXY represents BEARISH conditions for BTC - though not during the Bull's initial phase. Presumably because ROTATION into US Assets occurs," he explained.

"During 2021 - we witnessed 12 weeks of BTC rally entering the new DXY Bull. That rally accumulated 130% gains into the TOP for BTC. I observe identical development recurring! +100% gain in BTC - into its FINAL TOP."

An included chart indicated a target for that "final top" at $146,000.

Yen depreciation remains under observation

For the immediate term, nevertheless, Bitcoin confronts another macroeconomic obstacle: a fresh fiscal policy period in Japan.

Following Prime Minister Sanae Takaichi's reelection, Japanese equity markets surged to unprecedented heights — and current analysis anticipates negative consequences for US investment instruments and cryptocurrency.

"The decisive victory of Sanae Takaichi signals Japan's transition toward aggressive fiscal stimulus measures and acceptance of currency depreciation," analyst XWIN Research Japan stated in a blog post released on onchain analytics platform CryptoQuant.

"The 'Takaichi Trade' has propelled the Nikkei to record peaks while transforming global capital flow patterns."

XWIN cited findings cautioning about "slowing inflows" into US equity exchange-traded funds (ETFs), attributed to a weakening yen enhancing Japanese bond appeal.

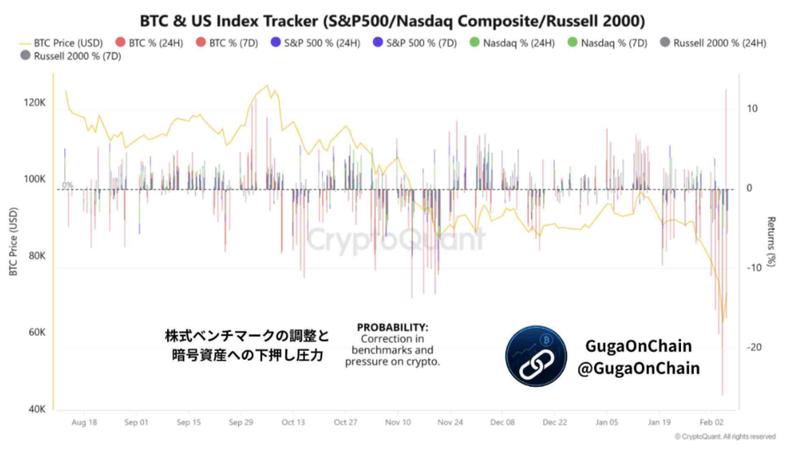

"Within this context, Bitcoin encounters near-term downward risk exposure," the analysis proceeded.

"During risk-off periods, BTC demonstrates tendency to correlate with U.S. equity markets, permitting equity-driven de-risking to affect crypto markets. This pressure does not indicate deterioration in Bitcoin's on-chain fundamentals, but cross-asset risk management."

As Cointelegraph documented, cryptocurrency markets maintain elevated sensitivity to Japan-related developments, with one hypothesis even attributing the yen carry trade to the previous week's BTC price collapse.

Examining the yen situation preceding the election, Robin Brooks, a senior research fellow at Brookings, characterized its weakness as a "political liability."

"With the election concluded, particularly if Takaichi performs well, the optics of Yen depreciation won't hold nearly the same significance," he projected.

"Therefore the election potentially serves as a catalyst for the subsequent round of Yen weakening."

Bitcoin mining operations record "exceptional" exchange transfers

Bitcoin mining operations are actively adapting to present circumstances following Bitcoin's 15-month low points — though research cautions that sell-off risk persists.

Miner transfers to exchanges achieved their maximum levels since 2024 during recent days, with Feb. 5 independently recording total deposits totaling 24,000 BTC.

Characterizing that figure as "exceptional," CryptoQuant contributor Arab Chain indicated that the market undergoes a "redistribution phase."

"Particularly, this increase in miner activity emerges within a market environment defined by evident volatility and diminished risk appetite among trader segments, which could introduce an additional layer of near-term selling pressure," a blog post detailed.

"Nevertheless, these inflows do not inherently signal the commencement of a sustained downtrend, but rather may constitute a natural redistribution phase within the market cycle."

The traditional Hash Ribbons indicator, which monitors periods of miner stress, similarly continues its response to Bitcoin's flash crash event.

The indicator's dual moving averages of hash rate demonstrate no indication of generating a traditional bullish cross, definitively invalidating its most recent "buy" signal from early January.