Bed Bath & Beyond moves to purchase Tokens.com as part of real estate tokenization strategy

Following its 2023 bankruptcy restructuring, the retail brand is preparing to launch a blockchain-based platform for real-world asset tokenization, marking a significant pivot from traditional e-commerce.

Bed Bath & Beyond has entered into a definitive agreement to purchase Tokens.com in a strategic move toward real estate financing and tokenized real-world assets, merging conventional financial offerings with blockchain technology infrastructure.

A company statement released on Monday revealed that Tokens.com, a financial infrastructure firm specializing in blockchain technology, will serve as the foundation for developing a platform centered on real estate financing, tokenized securities and additional real-world assets (RWAs), bridging blockchain systems with compliant financial service offerings.

Bed Bath & Beyond currently maintains ownership positions or strategic investments in multiple blockchain-oriented enterprises, including tZERO and GrainChain. Tokens.com is set to operate as a fully owned subsidiary and will leverage the existing regulatory framework and operational infrastructure spanning the company's portfolio of blockchain ventures.

The announcement indicates that the platform will consolidate both traditional and tokenized assets within a unified interface, enabling users to monitor ownership details, projected valuations and accessible liquidity alternatives, while facilitating issuer-driven tokenization, lending backed by assets and cryptocurrency access.

Functions related to capital markets, such as tokenization, custody services and trading operations, will be executed on tZERO, while mortgage and home-equity offerings will be delivered through collaborative partners like Figure Technologies.

According to company representatives, users who obtain financing via the platform will have the option to receive funding in traditional currency or digital assets, including stablecoins. The platform is projected to launch and become fully operational by mid-2026, contingent upon satisfying closing requirements.

Bed Bath & Beyond initiated Chapter 11 bankruptcy proceedings in April 2023 following an extended period of diminishing sales and commenced the liquidation of its United States retail footprint. In the aftermath of the bankruptcy filing, the Bed Bath & Beyond brand identity and intellectual property assets were purchased by Overstock during a 2023 bankruptcy auction.

Overstock later underwent a corporate rebranding to become Beyond Inc. and relaunched Bed Bath & Beyond with a digital-first business model, as reported by Reuters.

Companies expand into tokenized real-world assets

Bed Bath & Beyond's strategic entrance into tokenized RWAs, which leverage blockchain technology to represent conventional assets, arrives as an increasing number of corporations and financial service platforms embrace onchain financial systems.

In October, Telegram entered the tokenized equities market by providing users with access to approximately 60 tokenized US stocks via a collaborative arrangement with Backed and Kraken.

ETHZilla (ETHZ), a former biotechnology enterprise that transformed its business model to become an Ethereum treasury company, has similarly ventured into RWA tokenization through multiple onchain credit transactions.

In December, the company purchased a 20% ownership stake in Karus through a $10 million deal to facilitate tokenized auto-loan portfolios utilizing AI underwriting technology; the company additionally secured a 15% stake in digital housing lender Zippy to introduce manufactured-home loans onchain.

On Dec. 10, Mubadala Capital, the asset management division of Abu Dhabi's sovereign wealth fund, announced it is collaborating with Kaio to investigate bringing its private-market investment approaches onchain.

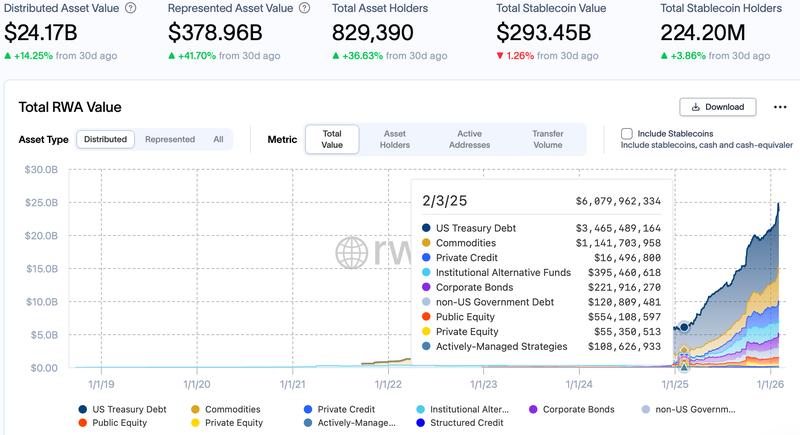

Based on information from RWA.xyz, the tokenized real-world asset marketplace has expanded to approximately $24.2 billion in distributed value, increasing from roughly $6.1 billion on Feb. 3 last year, representing a nearly 300% year over year growth rate.