Analysts Detail Why Bitcoin May Rally Back to $85K Price Level

A resurgence in spot Bitcoin ETF capital flows may drive BTC price upward, with technical indicators pointing to potential recovery toward $80,000 and $85,000 targets.

Bitcoin (BTC) was changing hands 5.5% higher than its nine-month bottom of $74,500 that was hit on Monday as market participants anticipated a potential recovery rally toward $85,000.

Key takeaways:

- Bitcoin's rebound from multimonth support levels sets the stage for a potential "squeeze" targeting $85,000.

- Renewed capital inflows into spot Bitcoin ETF products may provide the catalyst for short-term BTC price appreciation.

Can BTC price rebound toward $85,000?

Bulls in the Bitcoin market worked to maintain the latest recovery momentum pushing toward $78,000 as market participants anticipated additional upside price movement for BTC.

According to analyst Daan Crypto Trades in a Monday X platform post, Bitcoin "created a massive CME gap this weekend."

The gap in futures pricing occurred between Friday's closing price around $84,445 and the opening price near $77,400 on Monday.

Daan Crypto noted this represents the "largest gap we've created this cycle and definitely the biggest weekend move in many months," before elaborating:

"Keep that gap close area around $84K on your charts as it could be a good level to watch if price were to cross back over $80K at some point."

Another market analyst, Titan of Crypto, explained that following the sweep of the prior monthly low at $84,000 and the previous quarterly low around $80,000, BTC price may experience a rebound toward the initial fair value gap (FVG) situated between $79,000 and $81,000.

Beyond that level, the subsequent zone of interest lies in the second FVG ranging between $84,000 and $88,000.

A FVG occurs when price action accelerates rapidly, creating a gap within a three-candle formation. The wick of the first candle and the wick of the third candle fail to overlap whatsoever, demonstrating an imbalance where trading activity was absent.

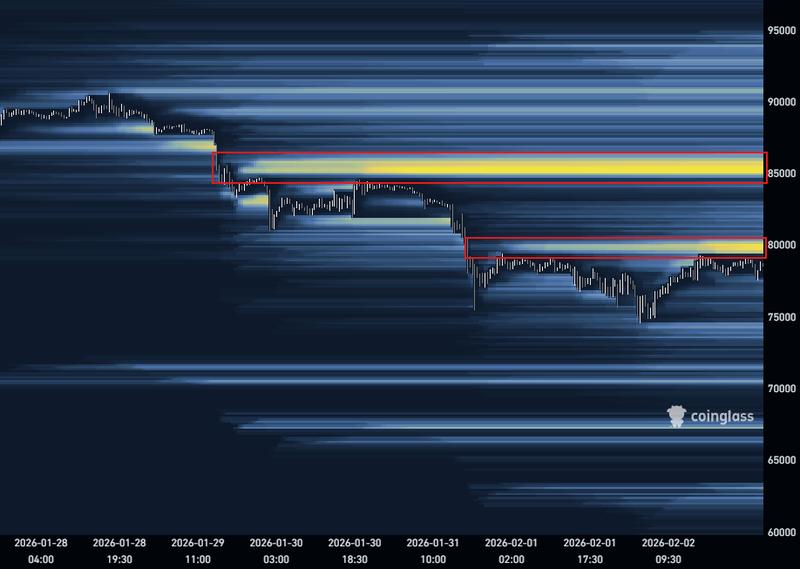

Furthermore, order-book liquidity information from exchange data aggregator CoinGlass revealed the price positioned beneath two concentrations of sell orders at $80,000 and slightly above $85,000.

Bitcoin analyst AlphaBTC observed in his most recent X platform post that "2 strong liquidity levels shining bright for $BTC," before adding:

"Will markets get enough of a bounce at the start of Feb to take both out? IMO yes, but it may take a little time and the US passing the Crypto bill as a catalyst."

Should the $80,000 price level be breached, this development could trigger a liquidation squeeze event, compelling short position holders to exit their trades and pushing prices higher toward $85,000, representing the subsequent major liquidity concentration.

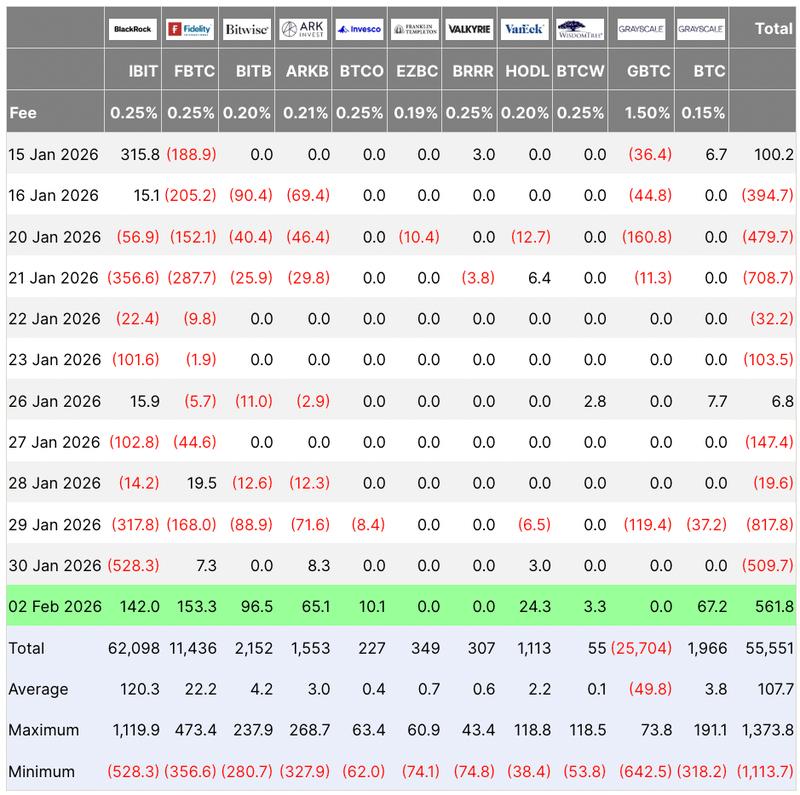

February's first Bitcoin ETF inflows give hope

Addressing the question of whether demand is making a comeback at reduced BTC price levels, market analyst CoinBureau expressed an optimistic outlook.

In a Tuesday X platform post, the analyst noted, "Bitcoin spot ETFs recorded $561.9M in net inflows yesterday, ending 4 straight days of outflows. Not a single ETF saw outflows," before continuing:

"February's first inflow day has already outpaced all of January. The bid is back."

According to analyst Danny Scott, institutional players are "buying the fear," a reference to the "extreme fear" that has taken hold of the market currently.

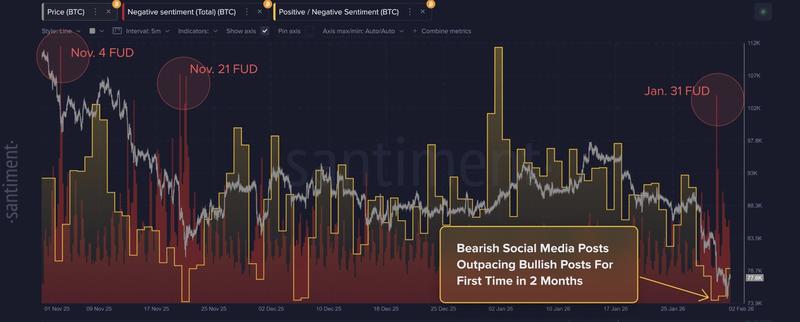

Information from market intelligence platform Santiment indicates that Bitcoin's most recent climb to $78,300 from $74,600 occurred after FUD (fear, uncertainty and doubt) sentiment reached its most elevated levels since November 2025.

This development suggests the possibility for a relief rally similar to what was observed in "previous two instances following FUD," according to Santiment.

As previously reported by Cointelegraph, the (MVRV) z-score has dropped to its lowest level ever recorded, indicating "fire-sale valuations for Bitcoin," while also suggesting a potential rebound in the near term.