Africa Embraces Stablecoins for Remittances, Surpassing Traditional Aid in Importance

At the World Economic Forum in Davos, Switzerland, economist Vera Songwe highlighted remittance transfers and protection against inflation as primary factors fueling stablecoin adoption throughout the African continent.

Across the African continent, stablecoins are gaining traction as a more affordable and expedient alternative for remittance transfers, with these financial flows now representing a greater significance than traditional foreign aid, according to statements made by Vera Songwe, who previously held the position of UN under-secretary-general.

During her participation in a World Economic Forum panel discussion held in Davos, Switzerland on Thursday, Songwe highlighted that conventional money transfer platforms operating in Africa typically charge approximately $6 in fees for every $100 transferred, resulting in costly and time-consuming cross-border payment processes.

According to her remarks, stablecoins are dramatically reducing both transaction fees and the time required for settlement, enabling both individual users and small business operators to transfer funds within minutes instead of enduring the multi-day waiting periods traditionally associated with international payment clearing processes.

During her presentation, Songwe noted that inflation rates have surpassed 20% in "about 12 to 15 countries" throughout the African continent following the onset of the COVID-19 pandemic, making the case that stablecoins offer a mechanism for preserving value in currencies that are less vulnerable to inflationary pressures and function as a form of financial protection. She stated:

650 million people don't have access to a bank account in Africa. With a smartphone you have access to stablecoins, so you can save in a currency that is not exposed to fluctuations of inflation and making you poor.

Based on Songwe's observations, the greatest levels of stablecoin adoption are occurring in Egypt, Nigeria, Ethiopia and South Africa, nations characterized by elevated inflation rates or stringent capital control measures. She further noted that the majority of these transactions are being conducted by small- and medium-size enterprises, suggesting that stablecoins are operating as an expansive tool for financial inclusion.

Songwe currently holds the positions of chair and founder of the Liquidity and Sustainability Facility and serves as a nonresident senior fellow at the Brookings Institution. Her previous roles include serving as a UN under-secretary-general and holding the position of executive secretary of the UN Economic Commission for Africa.

African countries advance crypto legislation

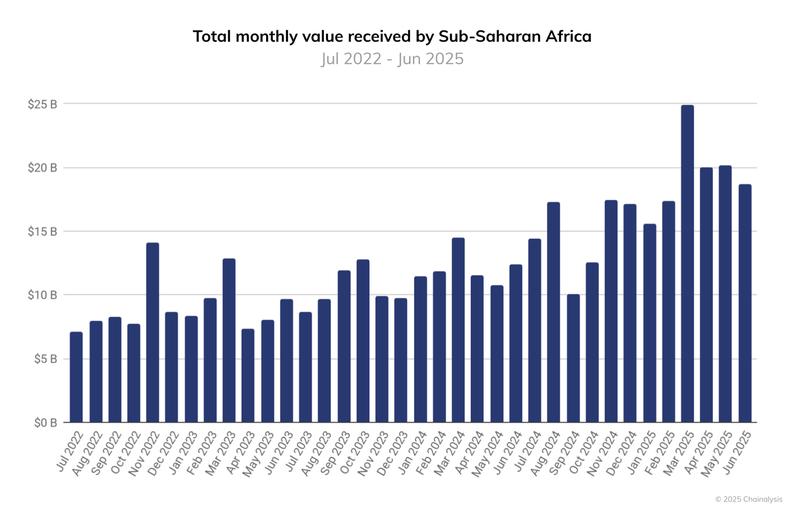

Research published by Chainalysis in September revealed that Sub-Saharan Africa ranks among the most rapidly expanding regions globally in terms of cryptocurrency adoption. Between July 2024 and June 2025, the region processed more than $205 billion in onchain value, representing an approximately 52% increase year over year, which positioned it as the third-largest region worldwide.

As the pace of cryptocurrency adoption intensifies throughout the continent, national governments are beginning to take divergent approaches, with responses spanning from official legalization and integration into tax systems to more conservative, risk-oriented regulatory oversight measures.

During December, Ghana took the step of legalizing cryptocurrency trading following parliamentary approval of the Virtual Asset Service Providers bill, which created a formal regulatory structure for the cryptocurrency industry. Johnson Asiama, Governor of the Bank of Ghana, indicated that the legislation permits crypto-related activities while simultaneously providing authorities with mechanisms to manage the risks associated with them.

On Jan. 13, Nigeria put into effect new regulatory requirements mandating that crypto service providers connect transactions to the tax identification numbers of their users. This modification is intended to incorporate cryptocurrency activity into the taxation system through identity-based reporting mechanisms, minimizing the necessity for regulators to conduct direct blockchain surveillance.

In South Africa, the nation's central bank has recently identified crypto assets and stablecoins as an emerging threat to financial stability as domestic adoption rates continue their upward trajectory.