XRP Dips Under $1.60 Mark: February Price Floor Predictions

Technical analysis reveals XRP could drop to $1.22 as bearish patterns emerge, accompanied by weakening demand metrics and falling open interest levels.

The price of XRP (XRP) descended beneath the $1.50 threshold during the weekend, marking its weakest position in more than 14 months. A concerning bearish technical formation is now emerging on the price charts, hinting that the declining trajectory could persist through the entirety of February.

Key takeaways:

- A bear pennant formation on XRP's four-hour timeframe points to a potential target of $1.22.

- Open interest in XRP futures has declined to $2.61 billion, offering a potential silver lining for bullish investors.

Textbook bear pennant formation appears on XRP price chart

During Saturday's trading session, the XRP price experienced approximately 14% decline, sliding from a peak of $1.75 down to $1.50, marking the first instance of breaking below the $1.60 support threshold since November 2024.

This most recent decline has positioned the cryptocurrency in the breakdown stage of a bear pennant formation, which can be observed clearly on the four-hour timeframe chart presented below.

The cryptocurrency breached the pennant's lower boundary line on Tuesday, followed by a bounce attempting to retest this level as potential support. Should this retest prove unsuccessful and a four-hour candle closes beneath the $1.58 level, the price faces a high probability of further downward movement.

According to the measured move technique for the bear pennant pattern, which involves adding the initial drop's height to the breakout location, the projected target sits at $1.22, which would constitute a 23% decline from current price levels.

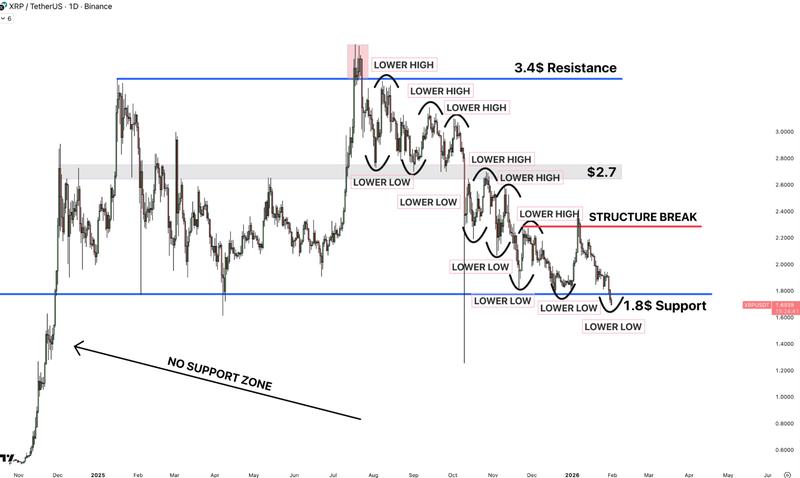

The rally that took XRP to $2.40 during January has proven to be a "fakeout" as the asset has continued to establish "price formed a fresh lower lows," according to pseudonymous analyst AltCryptoGems in a recent post on X, who further stated:

"The downtrend remains intact and we are on the verge of a disastrous collapse in a huge no-support zone."

According to trader and investor Alex Clay, following the breach of the double bottom pattern's support line positioned at $1.60, the route has been cleared for a potential descent toward $1 or even lower territory.

According to Cointelegraph's previous reporting, the next significant support zone for XRP is located near its aggregated realized price at $1.48. Should this critical level fail to hold, it would result in the average holder entering negative territory, a scenario that bears striking resemblance to the 2022 bear market phase that ultimately culminated in a 50% drawdown reaching $0.30.

Purchasing activity among XRP buyers shows retreat

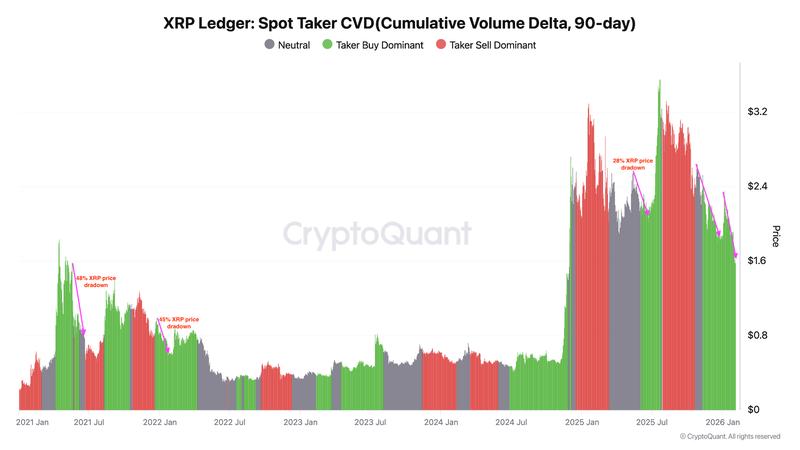

The 90-day Spot Taker Cumulative Volume Delta (CVD), which serves as a metric for tracking whether market orders are being driven by purchasing or selling activity, shows that buy-orders (taker buy) have experienced a sharp decline since the beginning of January.

Although demand-side pressure has maintained dominance in the order book starting from November 2025, buy orders have experienced a dramatic decrease throughout the past 30 days, based on data from CryptoQuant.

This trend points to diminishing enthusiasm or exhaustion among participants in the XRP market, suggesting reduced bullish momentum and heightened downside risk for the cryptocurrency's price action.

Historical instances of sharp declines in spot CVD have coincided with price drawdowns ranging from 28%-50% occurring within a matter of weeks.

Nevertheless, amid the current bearish trend, one potential bright spot for bullish investors lies in the decreasing XRP futures open interest (OI). This metric has experienced a significant drop to $2.61 billion as of Wednesday, down substantially from $4.55 billion recorded on Jan. 6.

In situations where OI experiences decline in conjunction with decreasing prices, this typically signals a weakening bearish trend or suggests the possibility of a trend reversal on the horizon.

This dynamic could potentially supply sufficient momentum for bullish traders to challenge the significant overhead resistance level positioned around $1.85, a price point that functioned as support during the majority of 2025.