Trump's Greenland Ambitions Prove Bitcoin Fails as Safe Haven Asset

Following President Donald Trump's announcement that military force won't be used to acquire Greenland, Bitcoin experiences a price recovery, highlighting how geopolitical tensions continue to impact the cryptocurrency's valuation.

Global markets experienced a moment of calm on Wednesday following US President Donald Trump's declaration that military intervention would not be employed to acquire Greenland, announced during an extensive, hour-long address delivered to international leaders assembled in Davos.

During his remarks, Trump laid out his reasoning for why the United States ought to possess sovereignty over Greenland, primarily framing it as a strategic defense against potential Russian or Chinese territorial expansion in the Arctic region. Nevertheless, he retreated from earlier concerning statements regarding possible military operations, clarifying that armed force would not be utilized to seize control of Greenland, an autonomous territory currently under Danish governance. His administration abandoned strategies involving tariff implementation as a mechanism to compel allied nations into supporting his territorial acquisition objectives.

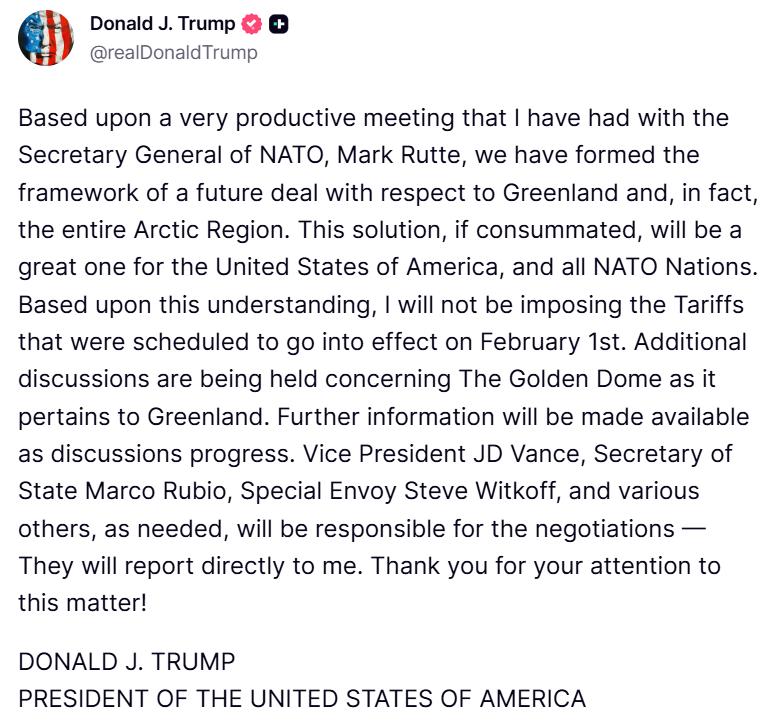

In fact, Trump departed from the Davos summit claiming to have established a "framework of a future deal." The cryptocurrency Bitcoin (BTC) exhibited a favorable reaction to these developments, climbing from approximately $87,000 to reach $90,000 as trading concluded for the evening.

Against the backdrop of intensifying geopolitical uncertainties that have been building throughout the past month, a growing number of market analysts are highlighting the significant impact these tensions have on Bitcoin's valuation.

Greenland situation demonstrates Bitcoin remains a risk-on asset

Throughout the early weeks of the year, the current administration intensified its rhetoric regarding the acquisition of Greenland. Pursuing such an objective through military means would effectively constitute an act of war against Denmark, which serves as a fellow member nation of NATO.

The President went further by threatening to impose an additional 25% tariff on nations that resisted his agenda to take control of Greenland. In private correspondence that Trump subsequently shared on his social media platforms, French President Emmanuel Macron expressed confusion, stating, "I do not understand what you are doing on Greenland."

Bitcoin's market performance reflected similar bewilderment. The cryptocurrency declined from approximately $110,000 at the start of November 2025 to slip beneath $90,000 by Nov. 21. Following that downturn, it has encountered resistance attempting to surpass $90,000. Throughout the previous week alone, Bitcoin dropped from $96,000 down to $88,000.

One analyst observed that "Bitcoin's run at $100K was stopped in its tracks last week, and while the $90,000 level has yet to be tested it looks like the recovery is on pause for now." The Greenland controversy contributed to "what was an already busy week," which included major crypto exchange Coinbase withdrawing its support from a crypto framework bill.

"Markets are waiting to see if the EU goes for a tough response that may simply escalate the situation, or opts for a back-channel approach," he said.

For the time being, at least, more measured judgment appears to have won out. In a posting on Truth Social yesterday, Trump referenced the framework for establishing a cooperative partnership:

Taking to X, Danish Foreign Minister Lars Løkke Rasmussen commented, "The day is ending on a better note than it began. We welcome that POTUS has ruled out to take Greenland by force and paused the trade war. Now, let's sit down and find out how we can address the American security concerns in the Arctic while respecting the red lines of the [Kingdom of Denmark]."

However, Nigel Green, CEO of deVere Group, cautioned that from a market perspective, "a negotiated pause could limit immediate disruption, but uncertainty would persist because leverage has been established."

"Transatlantic trade underpins confidence across global supply chains. Disruption there feeds into investment decisions, currency stability, and diplomatic alignment worldwide."

Both Greenland and international financial markets, Bitcoin included, may still face ongoing challenges ahead.

Trade agreements suspended, "trade bazooka" threats, and major deals in limbo

Specific commercial agreements have already been terminated as a direct consequence of the aggressive language emanating from Washington. On Jan. 21, the European Parliament withdrew from a trade agreement that had been under development since July.

This arrangement, known as the "Turnberry proposals," was designed to reduce US tariffs on the majority of European products from 30% down to 15%, which formed part of Trump's comprehensive "Liberation Day" tariff initiative. As part of the reciprocal arrangement, the EU committed to increasing investment in the United States and making concerted efforts to boost imports from American sources.

During Wednesday's proceedings, Bernd Lange, chair of the European Parliament's International Trade Committee, announced, "We have been left with no alternative but to suspend work on the two Turnberry legislative proposals until the U.S. decides to re-engage on a path of cooperation rather than confrontation, and before any further steps are taken."

In the days leading up to the Davos conference, Macron had floated the possibility that Europe might counter American hostility with the "trade bazooka," a term referring to the EU's Anti-Coercion Instrument (ACI). While the legislation would require six months for the EU to fully implement, it would effectively close European markets to American businesses. Such a move, consequently, could result in billions of dollars in financial damages for US corporations.

While Trump may have placed tariffs on hold temporarily, his administration's approach to trade policy has demonstrated notorious inconsistency throughout the duration of his second presidential term.

Any renewed intensification of trade hostilities between the US and EU could present a significant obstacle for Bitcoin, as historical patterns have demonstrated. Speaking on Wednesday, Cory Klippsten, CEO of Bitcoin financial services firm Swan, commented, "The biggest drag on Bitcoin price the past year has been tariffs [...] That's the drag on risk assets in general, and in particular [with] Bitcoin, there's just uncertainty around what's gonna happen."

"If you had Trump being pro-Bitcoin and even just running all the grifts, and emoluments and self-enrichment on the crypto side, but absent tariffs, I still think you would have had a ripping Bitcoin price run in 2025."

Writing at the conclusion of last year, market analyst Kshitiz Kapoor noted that "macro pressure, tariffs, tightening liquidity, and shifting risk sentiment pulled price back. By year-end, Bitcoin never came close to those targets."

"Lesson: Markets don't move on conviction alone. They move on liquidity, positioning, and macro."

Throughout the past year, Bitcoin has experienced growing acceptance across multiple nations worldwide. Yet paradoxically, as the cryptocurrency has gained greater legitimacy within the established global financial infrastructure, it has simultaneously become more vulnerable to the geopolitical dynamics that shape and influence that very system.