Tether's USDt Achieves Unprecedented $187B Valuation in Q4 Amid Market Turbulence

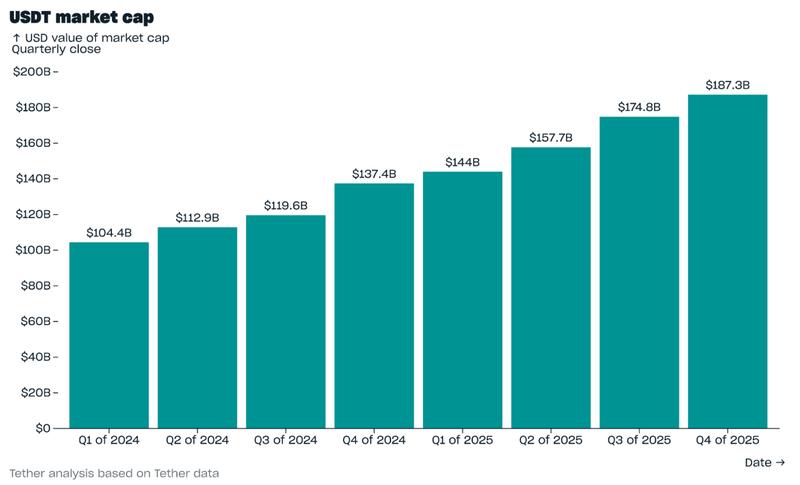

In the fourth quarter, USDt experienced remarkable growth of $12.4 billion, pushing its market capitalization to $187.3 billion while witnessing expanded user adoption and blockchain transactions, contrasting with competing stablecoins that suffered losses following the October liquidation crisis.

The dollar-backed stablecoin USDt from Tether achieved an all-time high market capitalization of $187.3 billion during the final quarter of 2025, defying the broader cryptocurrency market downturn that followed the liquidation cascade experienced in October.

Tether's most recent quarterly disclosure reveals that USDt (USDT) experienced market cap expansion totaling $12.4 billion throughout Q4.

Available market data demonstrates that USDt has been expanding its market dominance during a period when its competitors have been losing ground.

Following the significant liquidation crisis that occurred on Oct. 10, Circle's USDC (USDC), which holds the position of second-largest stablecoin, experienced market cap fluctuations during the remainder of Q4 but ultimately concluded the quarter with minimal net change. Meanwhile, Ethena's synthetic dollar offering USDe, which ranks as the third-largest stablecoin according to CoinMarketCap, experienced a sharp decline of 57%.

USDt onchain activity hits records

Blockchain-based activity similarly achieved unprecedented levels. The mean number of active USDt wallets per month increased to 24.8 million, constituting nearly 70% of the total population of wallets containing stablecoins. Transfer volume on a quarterly basis skyrocketed to $4.4 trillion, accompanied by onchain transfer counts reaching 2.2 billion.

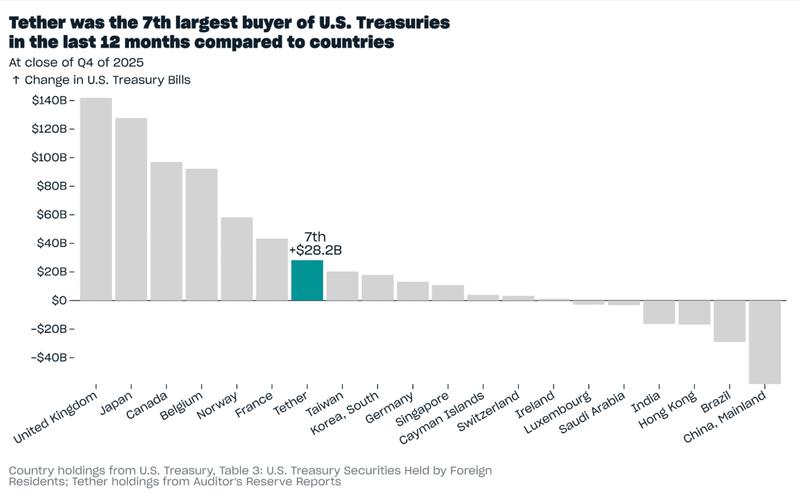

Additionally, Tether disclosed that its total reserves stood at $192.9 billion as Q4 concluded, representing an increase of $11.7 billion compared to the preceding quarter, resulting in net equity positioned at $6.3 billion. The company's holdings of US Treasuries grew to $141.6 billion, positioning Tether among the world's largest holders and surpassing the holdings of multiple sovereign governments.

The reported statistics also indicate a user base characterized by relative stability. Approximately two-thirds of the total USDt supply resides in savings wallets and centralized exchange platforms, with the final third facilitating activities connected to payments, cross-border remittances and decentralized finance applications.

USDt also holds the distinction of being the most frequently utilized stablecoin in transfers associated with illicit activities. According to Bitrace's findings, $649 billion worth of stablecoins, representing approximately 5.14% of aggregate stablecoin transaction volume, passed through high-risk blockchain addresses during 2024, with USDt operating on the Tron network comprising over 70% of such activity.

Tether has intensified initiatives aimed at reducing illicit usage, introducing collaborative partnerships with TRM Labs and Tron designed to monitor suspicious transactions and freeze funds connected to illegal operations.

Tether launches GENIUS Act–compliant stablecoin

During January, Tether introduced USAt, a dollar-backed stablecoin developed exclusively for distribution within the US market. Operating under the issuance of Anchorage Digital Bank, USAt represents a stablecoin designed for compliance with the US GENIUS Act, featuring an initial supply of $10 million deployed on Ethereum.

This Monday witnessed Tether and Opera entering into a partnership aimed at expanding accessibility to digital payment solutions across emerging markets through the integration of USDt and Tether Gold (XAUT) within Opera's MiniPay wallet platform.