Strategy Purchases $90M Worth of Bitcoin Above Average Cost Basis

Strategy, led by Michael Saylor, acquired $90 million in BTC at approximately $78,800 per coin, failing to capitalize on last week's temporary plunge to $60,000.

Strategy, helmed by Michael Saylor and recognized as the largest publicly-traded Bitcoin holder globally, purchased an additional batch of BTC during the past week, increasing its cryptocurrency reserves while failing to reduce its aggregate cost basis.

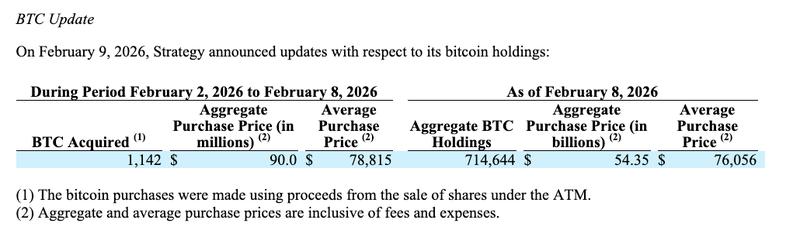

The company procured 1,142 Bitcoin (BTC) valued at $90 million over the course of last week, as disclosed in a filing submitted to the US Securities and Exchange Commission on Monday.

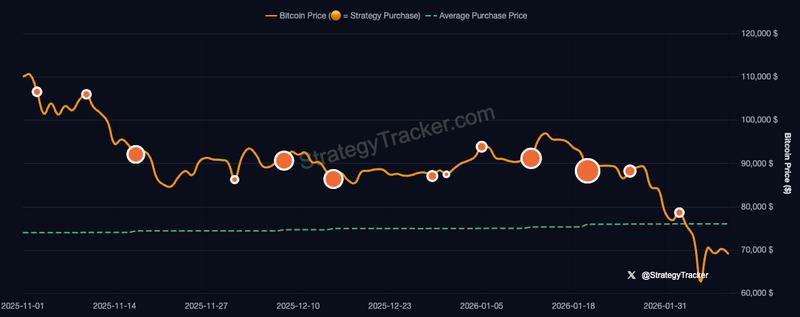

These Bitcoin purchases were executed at an average cost of $78,815 per BTC, even though Bitcoin was trading beneath that threshold throughout most of the week and experienced a brief plunge to $60,000 on the Coinbase exchange last Thursday.

This most recent acquisition elevated Strategy's cumulative Bitcoin reserves to 714,644 BTC, obtained for approximately $54.35 billion at an average cost of $76,056 per coin.

Strategy misses the Bitcoin dip?

Through purchasing Bitcoin at nearly $79,000 per coin, Strategy prevented lowering the average acquisition cost of its current holdings.

Bitcoin, nonetheless, has been trading substantially beneath that price point for nearly a week. The cryptocurrency experienced a steep decline below $78,000 last Tuesday and has failed to rise above the $72,000 threshold since then, based on Coinbase data.

This acquisition represents Strategy's second Bitcoin purchase made while the cryptocurrency was trading beneath the firm's average acquisition cost of $76,056.

The company encountered a comparable scenario in 2022 when Bitcoin dropped below $30,000 while its average cost per coin was approximately $30,600. During that period, Strategy substantially decelerated its purchasing activity, although it persisted in making smaller acquisitions even at price levels below its cost basis.

Prior to this purchase, certain market participants had speculated that Strategy would attempt to refrain from purchasing below its average cost during this market cycle, considering the negative optics associated with unrealized losses.

Several users made light of the situation, joking that Michael Saylor might instead reveal another purchase at significantly elevated price levels.

"Saylor on Monday: We've added another 1,000 bitcoins at an average price of $95,000,"

one market observer joked in an X post on Friday.

Strategy (MSTR) stock has reflected Bitcoin's price fluctuations, declining to approximately $107 last Thursday, based on TradingView data.

Consistent with a modest recovery across cryptocurrency markets, the shares began climbing on Friday, experiencing a surge of 26% to settle at roughly $135.