Standard Chartered cuts BTC forecast as Bitcoin ETFs witness $410M exodus

Spot Bitcoin ETFs in the United States face their fourth straight week of negative flows while Standard Chartered reduces its Bitcoin price projection for 2026 to $100,000.

Exchange-traded funds tracking Bitcoin in the United States experienced intensified withdrawals on Thursday, with capital outflows gaining momentum on the same day that Standard Chartered revised downward its Bitcoin price prediction for 2026.

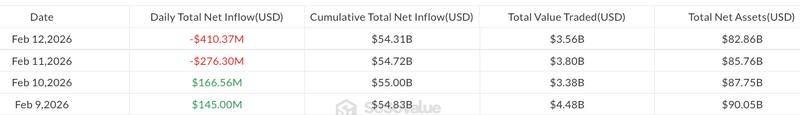

Exchange-traded funds focused on spot Bitcoin (BTC) witnessed outflows totaling $410.4 million, pushing weekly withdrawals to $375.1 million, based on data from SoSoValue.

Barring significant capital inflows on Friday, these investment vehicles are poised to register their fourth straight week of negative flows, with total assets under management (AUM) approaching $80 billion — a substantial decline from the October 2025 peak of nearly $170 billion.

The wave of selling aligned with Standard Chartered's decision to reduce its Bitcoin price target for 2026 from $150,000 down to $100,000, cautioning that the cryptocurrency's value might decline to $50,000 before mounting a comeback.

"We expect further price capitulation over the next few months," the bank said in a Thursday report shared with Cointelegraph, forecasting Bitcoin to drop to $50,000 and Ether (ETH) to $1,400.

"Once those lows are reached, we expect a price recovery for the remainder of the year," Standard Chartered added, projecting year-end prices for BTC and ETH at $100,000 and $4,000, respectively.

Solana ETFs the only winners amid heavy crypto ETF outflows

Bearish sentiment spread throughout all 11 Bitcoin ETF offerings, with the iShares Bitcoin Trust ETF (IBIT) from BlackRock and Fidelity Wise Origin Bitcoin Fund experiencing the most substantial withdrawals at $157.6 million and $104.1 million, respectively, based on Farside data.

Exchange-traded funds tracking Ether encountered comparable challenges, registering $113.1 million in outflows that pushed weekly flows to $171.4 million — setting up a possible fourth consecutive week of negative movements.

ETFs focused on XRP (XRP) experienced their initial outflows totaling $6.4 million since Feb. 3, whereas Solana (SOL) ETFs defied the broader pattern, posting modest inflows of $2.7 million.

Extreme bear phase not yet here as analysts expect $55,000 bottom

The updated Bitcoin projection from Standard Chartered comes after earlier analyst predictions suggested Bitcoin might fall beneath $60,000 prior to attempting a rebound.

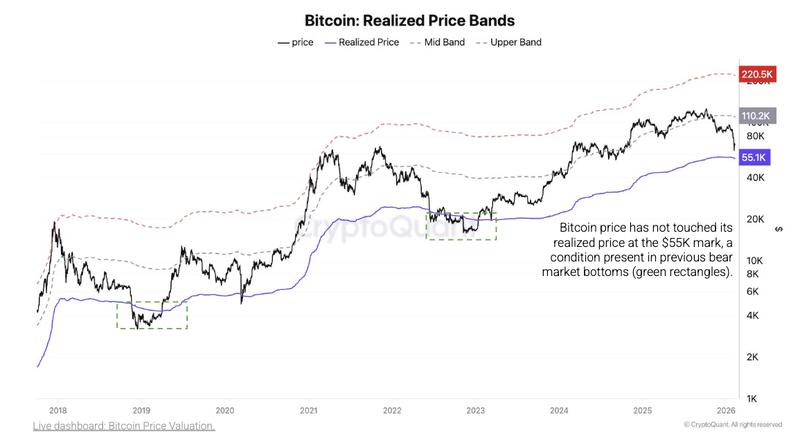

CryptoQuant, a cryptocurrency analytics platform, reaffirmed that support at the realized price level continues to hold at approximately $55,000 and has yet to face a significant test.

"Bitcoin's ultimate bear market bottom is around $55,000 today," CryptoQuant said in a weekly update shared with Cointelegraph.

"Market cycle indicators remain in the bear phase, not extreme bear phase," CryptoQuant noted, adding: "Our Bull-Bear Market Cycle Indicator has not entered the Extreme Bear regime that historically marks the start of bottoming processes, which typically persist for several months."

The price of Bitcoin fluctuated near $66,000 throughout Thursday, momentarily declining to $65,250, based on information from CoinGecko data.

Notwithstanding the persistent selling activity, the behavior patterns of long-term holder (LTH) participants do not suggest capitulation, as these holders are presently selling approximately at their cost basis. "Historical bear market bottoms formed when LTHs endured 30–40% losses, indicating further downside may be required for a full reset," CryptoQuant added.