Professional traders brace for Bitcoin decline while positioning for accumulation, options data reveals

Analysis of Bitcoin derivatives indicates traders are maintaining positions, though reaching $95,000 again hinges on renewed institutional capital after the market witnessed $1.58 billion in outflows this week.

Key takeaways:

- Funding rates for Bitcoin remain at 7%, indicating bullish market participants continue to show reluctance toward expanding leveraged long positions.

- Spot Bitcoin ETFs experienced $1.58 billion in capital outflows as gold reached all-time highs, pointing to investors favoring safe-haven assets.

Since Tuesday, Bitcoin (BTC) has remained trapped under the $91,000 threshold, despite equity markets experiencing gains driven by robust US economic expansion and positive employment figures. With BTC failing to generate upward momentum, subdued interest in leveraged long positions has prompted market participants to wonder if the $88,000 support zone will continue to hold.

On Thursday, the annualized funding rate for perpetual Bitcoin futures registered at 7%, falling just below the standard neutral band of 6% to 12%. Although this represents an improvement from Monday's reading, which approached zero, substantial appetite for bullish leverage remains absent in the marketplace.

Large Bitcoin holders anticipated to continue buying

The absence of optimism within the Bitcoin trading community can be partially attributed to the impressive 4.4% GDP growth recorded in the third quarter in the United States. Strong economic performance typically supports corporate earnings growth, creating favorable conditions for stock market appreciation. For the week concluding Jan. 10, continuing jobless claims decreased by 26,000 to reach 1.85 million.

In spite of this lukewarm sentiment, there hasn't been any meaningful increase in traders seeking downside protection through BTC options contracts.

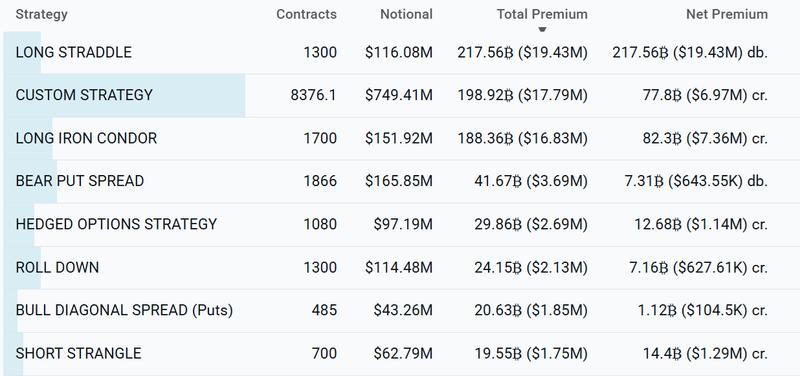

Data from Laevitas reveals that throughout Wednesday and Thursday, the two most popular BTC options strategies were the long straddle along with the long Iron Condor. These approaches emphasize volatility exposure rather than directional market bets. The pattern indicates that major players and market makers are preparing for a consolidation phase instead of expecting a significant decline from Bitcoin's current $89,500 price point.

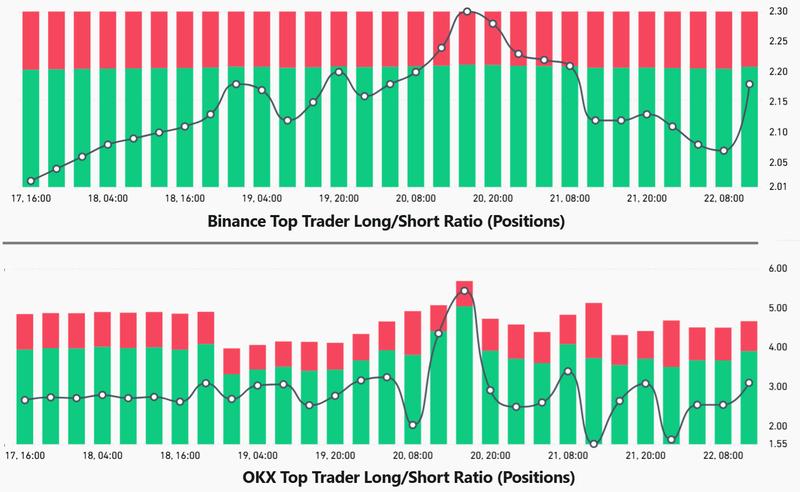

Understanding whether professional market participants are maintaining their positions after an 11% weekly decline from the Jan. 14 high of $97,900 requires examining exchange long-to-short ratios. This measurement provides a more comprehensive perspective than individual contracts by consolidating positions from futures, perpetuals, and margin trading.

Leading traders on Binance expanded their bullish positioning on Thursday, pushing the long-to-short ratio from 2.08 to 2.18. In a similar fashion, the top 20% of margin users on OKX enhanced their long positions on Thursday even as Bitcoin remained unable to break above $90,000. These onchain indicators support the notion that market participants are maintaining a neutral-to-bullish stance notwithstanding the present reluctance to employ high-leverage strategies.

Focus in the market is now turning to upcoming corporate earnings announcements. Multiple major corporations will report results next week, with Microsoft (MSFT US) and Tesla (TSLA US) scheduled for Wednesday, while Apple (AAPL US) and Visa (V US) follow on Thursday. Consumer spending trends will receive close examination as General Motors (GM US) and Starbucks (SBUX US) publish their results on Tuesday and Wednesday respectively.

On Thursday, gold prices achieved an all-time record high while 10-year US Treasury yields climbed near 20-week peaks. This unusual divergence often reflects diminishing faith in US fiscal stability, with investors evidently concerned that additional economic stimulus could ignite inflation amid the growing US deficit.

Increasing Treasury yields suggest diminished purchasing demand and elevated borrowing expenses for the federal government. On Thursday, the 10-year yield climbed to 4.25%, advancing from the prior week's level of 4.14%.

In conclusion, Bitcoin derivatives markets are demonstrating strength following the retest of the $88,000 level, with minimal indications of bearish positioning. Nevertheless, any recovery toward $95,000 relies substantially on the return of institutional capital flows. This reversal has not yet emerged after Bitcoin spot ETFs recorded $1.58 billion in net outflows during the previous two trading days.