Opera's MiniPay Wallet Gains Access to USDT and Tether Gold Through New Partnership

The collaboration between Tether and Opera aims to advance financial inclusion for millions across emerging regions including Africa, Latin America, and Southeast Asia, according to the stablecoin provider.

A new collaboration between Opera, the web browser company, and Tether, the leading stablecoin provider, seeks to broaden financial accessibility across developing nations via the MiniPay digital wallet application.

On Monday, Tether revealed its decision to broaden integration of both its flagship stablecoin USDt (USDT) and Tether Gold XAUT (XAUT) into MiniPay, the self-custodial digital wallet developed by Opera on top of the Celo blockchain infrastructure.

According to Tether, the partnership targets individuals living in developing regions including Africa, Latin America and Southeast Asia, offering them the ability to utilize dollar-pegged stablecoins for both storing value and conducting transfers.

"Tether's mission has always been to provide simple, reliable access to stable value for people who need it most," said Tether CEO Paolo Ardoino.

According to its own reporting, MiniPay currently operates across 60 nations worldwide, boasting 12.6 million wallets that have been activated and a total of 350 million transactions that have been processed through its platform. The service experienced a 50% increase in its user base during Q4, with the majority of this growth concentrated in developing market regions.

Demand for stablecoins, tokenized gold in emerging markets

The MiniPay application, accessible on both Android and iOS operating systems, requires only a user's mobile phone number to complete the activation process.

When looking at all platform integrations combined, MiniPay facilitated more than $153 million in sent or received transactions throughout December, "underscoring growing demand for stable, dollar-based payments in mobile-first regions."

Beyond providing access to the dominant global stablecoin, MiniPay additionally incorporates support for Tether's tokenized gold product XAUT, designed for "inflation-resistant savings." This digital asset reached an unprecedented all-time high price point of $5,600 during late January, moving in parallel with physical gold market prices.

According to data from CoinGecko, the tokenized real-world asset currently maintains a circulating supply totaling 712,747 XAUT tokens and commands a market capitalization valued at $3.4 billion.

Stablecoin exchange flows are falling

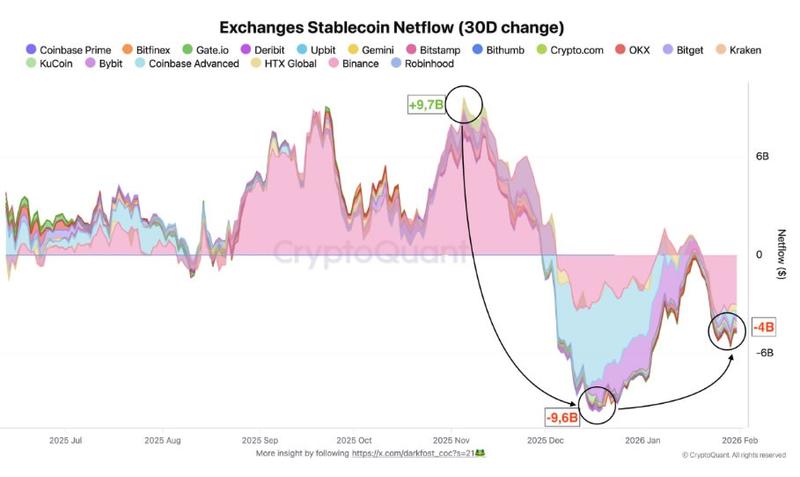

Notwithstanding robust demand across emerging market economies, both the overall market capitalization of stablecoins and their exchange flows have experienced downward trends in correlation with the wider cryptocurrency market downturn.

After a period of expansion spanning the previous two years, the aggregate stablecoin market capitalization entered a declining phase beginning in December, bringing to an end a prolonged growth trajectory, as documented in a Monday report from CryptoQuant.

According to analyst Darkfost, net inflows of stablecoins to exchanges "have been largely wiped out."

"After an initial sharp decline of $9.6 billion, followed by a brief period of stabilization, stablecoin flows have once again turned negative, with more than $4 billion in outflows," they added.

"Recent months clearly reflect a rise in risk aversion, or even capitulation among later entrants, who have chosen to withdraw their stablecoins from exchanges."

In the meantime, cryptocurrency markets overall have experienced a 38% contraction since reaching their peak total market capitalization of $4.4 trillion back in October.