Maintenance Error Forces Paradex to Return $650K Following Unintended User Liquidations

A scheduled database upgrade at Paradex temporarily corrupted funding information, leading the exchange to execute a chain rollback and issue refunds following unintended liquidations that affected several markets.

Approximately 200 users of Paradex, an onchain derivatives platform, received $650,000 in refunds after a software glitch during routine maintenance caused unwanted liquidations spanning several markets.

A post-mortem analysis published on X by Paradex on Friday revealed that the incident took place on Monday during a scheduled 30-minute database upgrade, during which a "race condition" led to corrupted market information being recorded onchain. The company clarified that the problem was purely operational and did not stem from a security breach or hacking attempt.

As a countermeasure, Paradex briefly shut down platform access, terminated all active orders with the exception of take-profit and stop-loss orders, and executed a chain rollback to a snapshot captured prior to the start of the maintenance period.

As an onchain derivatives platform, Paradex enables traders to establish leveraged perpetual positions while maintaining custody of their assets, eliminating the need to deposit funds with a centralized exchange.

This event represented the first time Paradex Chain underwent a rollback, an action the exchange characterized as "an undesired but necessary action to protect users and restore network integrity."

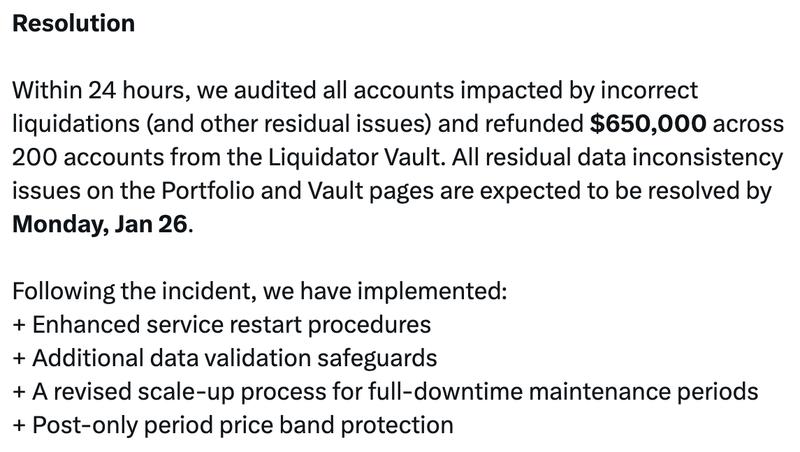

According to Paradex, multiple safeguards have been put in place to avoid similar occurrences in the future, including enhanced service restart procedures, supplementary data validation checks, a redesigned scale-up process for complete-downtime maintenance windows and price-band protections implemented during post-only trading periods.

Trading disruptions driven by technical failures

A series of recent events demonstrate how operational and infrastructure breakdowns, as opposed to security breaches, can interrupt derivatives trading and access to cryptocurrency markets.

In October, the decentralized exchange dYdX suspended trading for approximately eight hours following a code-ordering mistake and delayed oracle restarts that resulted in mispriced trading and liquidations. The platform initiated a governance vote to compensate impacted traders with as much as $462,000 from the protocol's insurance fund.

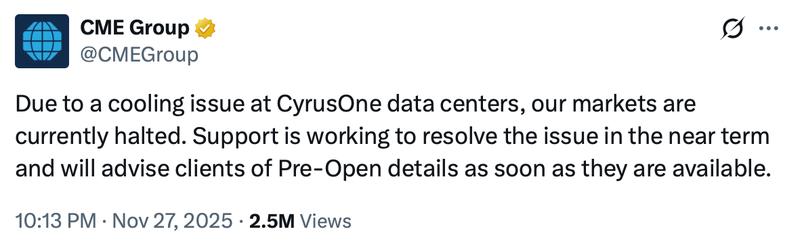

Traditional derivatives markets have also experienced technical disruptions. In November, trading at the Chicago Mercantile Exchange (CME) was suspended for roughly 10 hours following a cooling system failure at a CyrusOne data center located in Illinois that interrupted operations, prompting complaints from traders.

Cloudflare, an internet infrastructure provider, experienced an "internal service degradation" in November. This problem disrupted access to the front-end interfaces of multiple prominent cryptocurrency platforms, temporarily blocking users from accessing exchanges, wallets and data dashboards.

Crypto companies including Coinbase, Blockchain.com, BitMEX, Ledger and DefiLlama were affected by the outage.