Institutional Capital Returns to Cryptocurrency as Onchain Finance Gains Traction

Investment capital is gradually returning to the digital asset sector, with institutional players prioritizing infrastructure development and practical blockchain applications over speculation.

As 2026 begins, institutional capital and venture funding are making a measured return to blockchain and cryptocurrency enterprises, with market intelligence indicating approximately $1.4 billion in total commitments distributed between venture capital investments and equity market debuts.

Among the most significant capital events were Rain's $250 million funding round—a Visa-affiliated stablecoin platform now valued at $1.9 billion—alongside BitGo's public offering that exceeded $200 million when the crypto custody provider debuted on the New York Stock Exchange during January.

Despite ongoing market headwinds stemming from October's widespread deleveraging event that eliminated billions of dollars in positions across both centralized exchanges and decentralized protocols, institutional participation in the cryptocurrency ecosystem shows sustained momentum.

The current edition of VC Roundup examines conventional venture capital deployments, crypto-native investment vehicles and a significant onchain lending transaction that signals evolving patterns in how capital flows throughout the digital asset landscape.

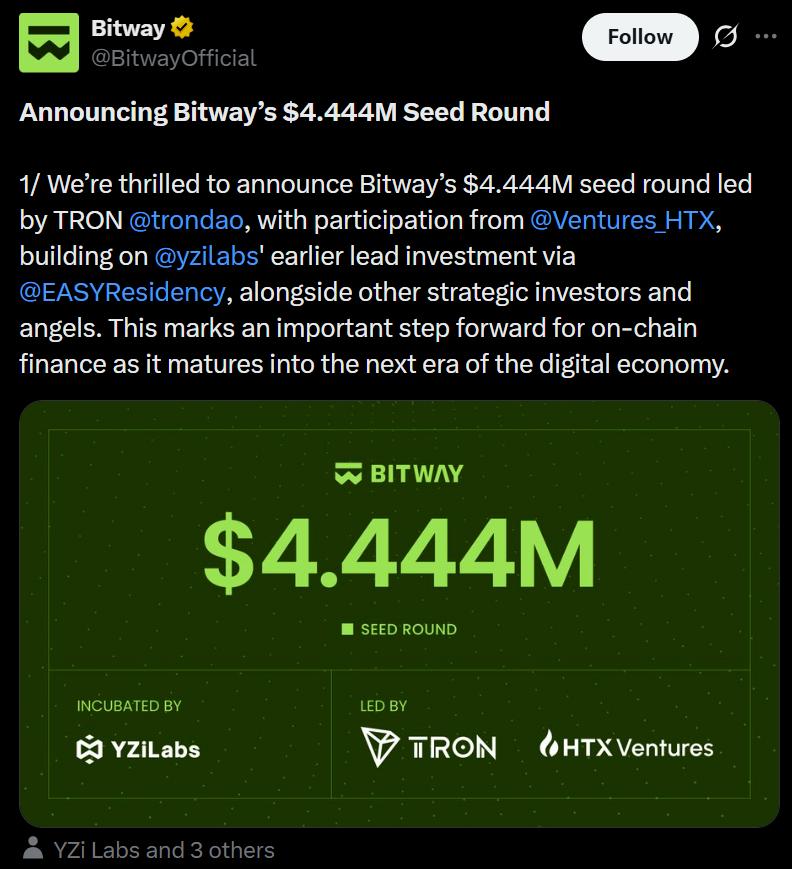

TRON DAO spearheads $4.4 million seed investment in Bitway

Bitway, a provider of onchain financial infrastructure solutions, successfully secured over $4.4 million through a seed stage financing led by TRON DAO, which saw additional backing from HTX Ventures. The funding round follows an initial commitment from YZi Labs via its EASYResidency program, complemented by contributions from multiple strategic partners and individual angel investors.

According to Bitway, the capital infusion will fuel the company's expansion of blockchain-native financial services, a segment continuing to draw investor attention even as overall transaction volume across the venture landscape experiences deceleration.

Everything secures $6.9 million in seed stage financing

Everything, a digital trading exchange platform, has successfully completed a $6.9 million seed funding round with Humanity Investments serving as lead investor, joined by Animoca Brands, Hex Trust and Jamie Rogozinski, who established WallStreetBets.

The organization is developing an integrated trading infrastructure that merges perpetual futures contracts, spot trading venues and prediction market functionality within a consolidated account framework. Everything intends to execute a staged launch beginning with a Telegram-integrated interface, aiming to democratize retail trader access to derivatives products while reducing automated trading activity through human identity verification mechanisms.

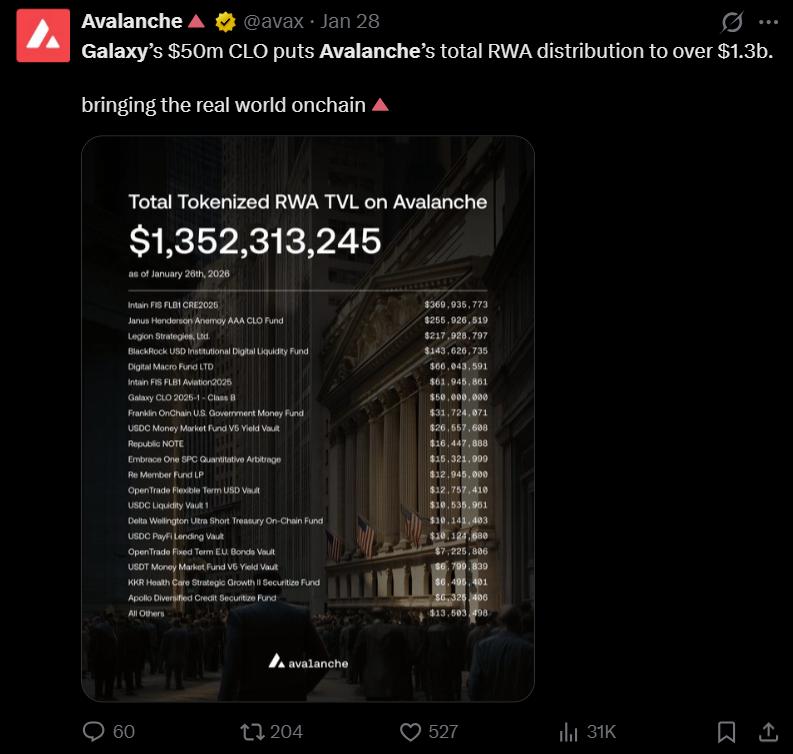

Galaxy executes $75 million blockchain-based credit transaction on Avalanche

Galaxy has finalized a $75 million credit facility conducted entirely on the Avalanche blockchain infrastructure, featuring a $50 million primary commitment from an institutional capital provider. The structured transaction converts private loan portfolios into tokenized securities that are originated and administered through blockchain systems, bypassing conventional administrative infrastructure.

Although this doesn't constitute a traditional venture investment, the transaction carries significance given Galaxy's substantial venture capital operations and extensive portfolio of cryptocurrency startup investments. The deal demonstrates increasing institutional willingness to conduct fundamental financial operations onchain, a transition that may shape future venture capital allocation strategies.

Veera secures $4 million to bring onchain finance to mainstream consumers

Veera, an onchain financial services infrastructure platform, has closed a $4 million seed financing round supported by CMCC Titan Fund and Sigma Capital. This latest capital injection elevates the company's aggregate fundraising to $10 million, adding to a $6 million pre-seed investment completed during 2024.

The platform is constructing a mobile-optimized application that consolidates various onchain financial capabilities including savings products, investment vehicles, token exchanges and payment functionality within a unified user experience. The proceeds will advance product engineering and market expansion efforts as Veera seeks to make decentralized finance accessible to mainstream users without technical expertise.

Prometheum expands funding base amid onchain securities development

Prometheum, operating as a US-regulated digital asset market infrastructure company, disclosed it has secured an additional $23 million in financing since early 2025 from accredited individual investors and institutional participants. The firm maintains an SEC-registered, FINRA-member broker-dealer operation providing custody solutions, clearing functions and settlement infrastructure for digital assets, including tokenized security instruments.

The fresh capital will facilitate the deployment of clearing services designed for US-based broker-dealers and advance development of blockchain-based securities offerings, as Prometheum pursues integration of digital assets within established brokerage systems.

Solayer introduces $35 million ecosystem investment vehicle

Solayer, an infrastructure developer aligned with the Solana ecosystem, has established a $35 million dedicated fund to provide capital for early-stage and scaling teams developing applications on its infiniSVM network infrastructure. The investment vehicle will concentrate on blockchain-native products demonstrating viable business models, encompassing initiatives across decentralized finance protocols, payment systems, consumer-facing applications and artificial intelligence-powered solutions.

The fund represents an extension of Solayer Accel, the organization's existing accelerator initiative, and aims to draw developers creating scalable applications leveraging Solana's infrastructure capabilities.