How CoreWeave's Journey Illustrates Cryptocurrency Infrastructure's Transformation Into AI Foundation

The evolution from digital currency mining operations to artificial intelligence computing reveals how ex-crypto miners are revolutionizing data center business models while diminishing Big Tech's infrastructure dominance.

The evolution of CoreWeave from its origins as a cryptocurrency mining operation into a prominent provider of AI infrastructure demonstrates a wider transformation in the way computational resources get repurposed throughout different technology waves.

According to earlier coverage by Cointelegraph, CoreWeave initiated its departure from cryptocurrency mining operations as far back as 2019, transitioning initially toward cloud services and high-performance computing capabilities before completely restructuring itself as a provider of GPU infrastructure designed specifically for artificial intelligence workloads.

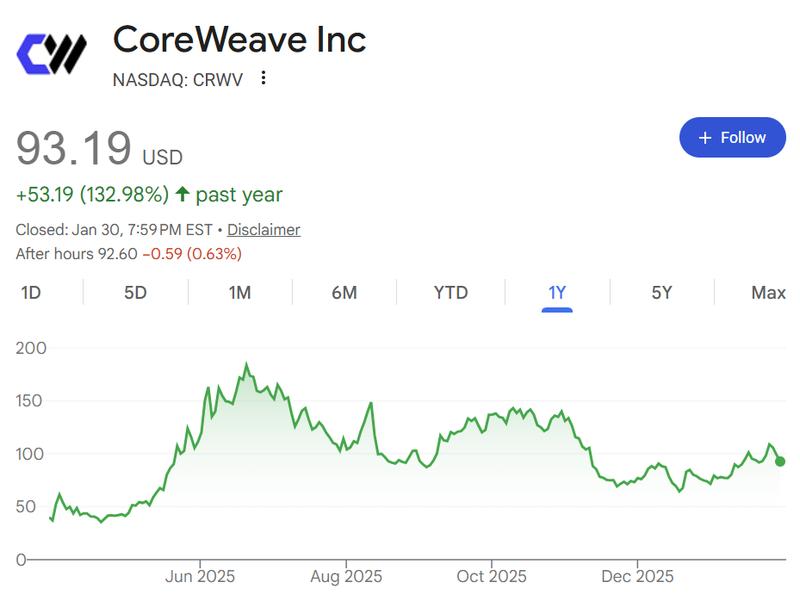

The company's strategic pivot has accelerated considerably since then. Graphics processing unit manufacturer Nvidia recently confirmed a $2 billion equity investment in CoreWeave, a transaction that Miner Mag indicated strengthened the firm's standing as among the most significant independent GPU infrastructure operators outside traditional major cloud service providers.

The expansion at CoreWeave has additionally resulted in substantial financial returns for the company's leadership team, who have collectively realized approximately $1.6 billion in revenue from equity sales following the corporation's initial public offering that took place in March last year, according to Miner Mag.

From crypto mining to AI data centers

The transition into AI workload support has delivered strong financial returns for multiple cryptocurrency mining operations, including HIVE Digital, TeraWulf, Hut 8 and MARA Holdings.

Similar to CoreWeave's approach, these organizations have successfully converted energy infrastructure and computational resources that were initially constructed for cryptocurrency mining purposes into facilities that now provide support for artificial intelligence and high-performance computing applications.

Nevertheless, AI data center operations are starting to encounter certain obstacles that Bitcoin (BTC) mining operations experienced during their formative period. Recent reporting by Cointelegraph highlighted that local resistance connected to electricity consumption, electrical grid stress and property usage is surfacing across multiple regions where substantial AI infrastructure facilities are located.

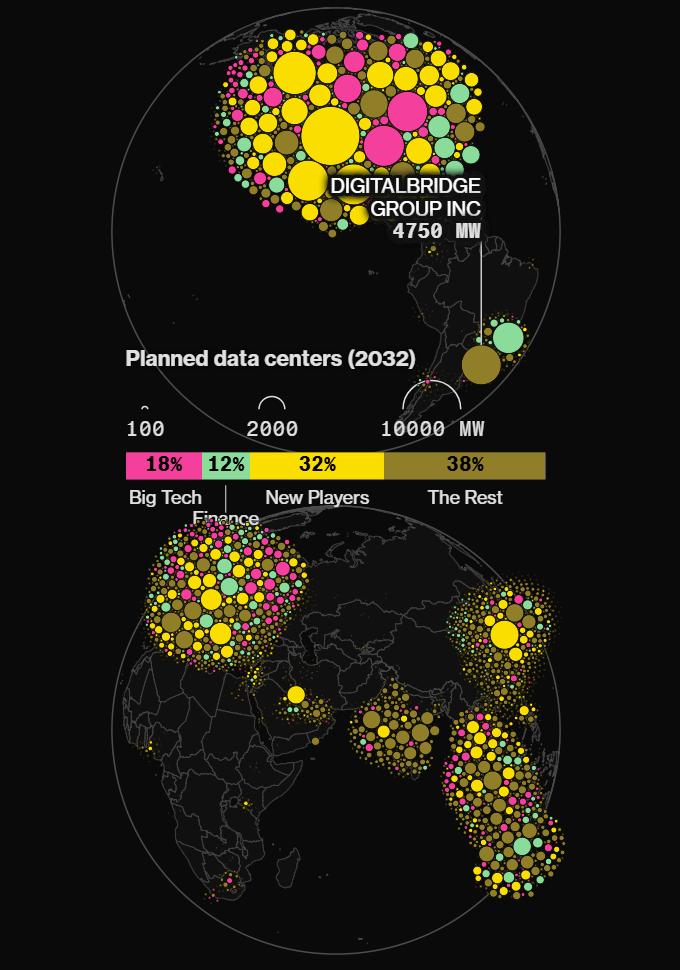

Despite these challenges, the marketplace continues to experience significant transformation. Information referenced by Bloomberg, derived from research conducted by DC Byte, indicates thousands of new participants are joining the data center industry. Looking ahead to 2032, Big Tech corporations may witness their portion of worldwide computing capacity decline to under 18%, pointing toward a landscape that becomes increasingly fragmented and competitive.

Should this trajectory continue, AI data center operations, similar to cryptocurrency mining operations that preceded them, could progressively function beyond the immediate oversight of major technology corporations.