Fundstrat's Tom Lee Attributes Ether's 21% Decline to Missing Leverage and Precious Metals 'Vortex'

Despite robust underlying fundamentals, Ether has experienced significant losses due to absent leverage and investor capital flowing toward precious metals, says Fundstrat's head of research.

Tom Lee, who serves as Fundstrat's head of research, contends that Ether's latest downturn represents an "attractive" opportunity because the cryptocurrency's underlying fundamentals continue to demonstrate strength, with the decline attributable solely to absent leverage and capital rotation toward precious metals.

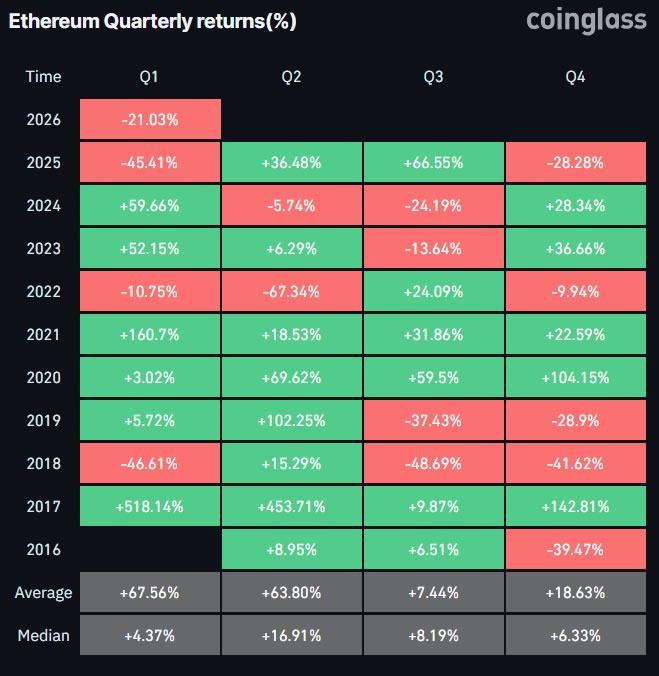

Based on data from CoinGlass, the opening quarter of 2026 is currently on track to become Ether's (ETH) third most challenging Q1 performance on record, with the digital asset experiencing a 21% decline year-to-date.

Nevertheless, Lee emphasized that this price deterioration has occurred during a period when the network's on-chain activity and core fundamentals have maintained their upward trajectory.

According to his analysis, Ethereum's daily transaction volume reached an unprecedented peak of 2.8 million on Jan. 15, while the number of active addresses in 2026 climbed to a maximum of 1 million daily, he noted.

Throughout the cryptocurrency bear markets of 2018 and 2022, Ethereum experienced drops in both transaction activity and active wallet counts, "which is counter to what we have seen in the past 12 months," Lee stated.

"Thus, non-fundamental factors are arguably more the factors explaining the weakness in ETH prices."

According to Lee, two primary factors are maintaining downward pressure on Ether valuations. The cryptocurrency market has not witnessed a return of leverage since the crash that occurred on Oct. 10, while simultaneously, the rally in precious metal valuations has "acted as a 'vortex' sucking away risk appetite from crypto."

BitMine buys dip after ETH drops 25% in a week

The Ethereum treasury company associated with Lee seems to be positioning for an upward reversal. Over the preceding seven days, BitMine has accumulated an additional 41,788 ETH.

"BitMine has been steadily buying Ethereum, as we view this pullback as attractive, given the strengthening fundamentals," Lee explained.

"In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance."

BitMine's current holdings stand at 4.28 million ETH tokens, representing 3.55% of the entire supply, bringing it 70% of the way toward achieving its 5% acquisition target. Approximately 2.87 million ETH from this total has been placed into staking.

Despite these strategic purchases, the digital asset treasury company approached $7 billion in paper losses as Ether valuations continued their descent.

The majority of this price decline materialized during the most recent seven-day period exclusively, with ETH plummeting more than 25% from approximately $3,000 to reach a bear market bottom of $2,200 on Monday, followed by a modest rebound.