Europe's Nuclear Option: Dumping US Treasuries in Response to Greenland Tensions

European officials are discussing the possibility of offloading American government debt to counter aggressive US policies, though implementation could prove extremely challenging.

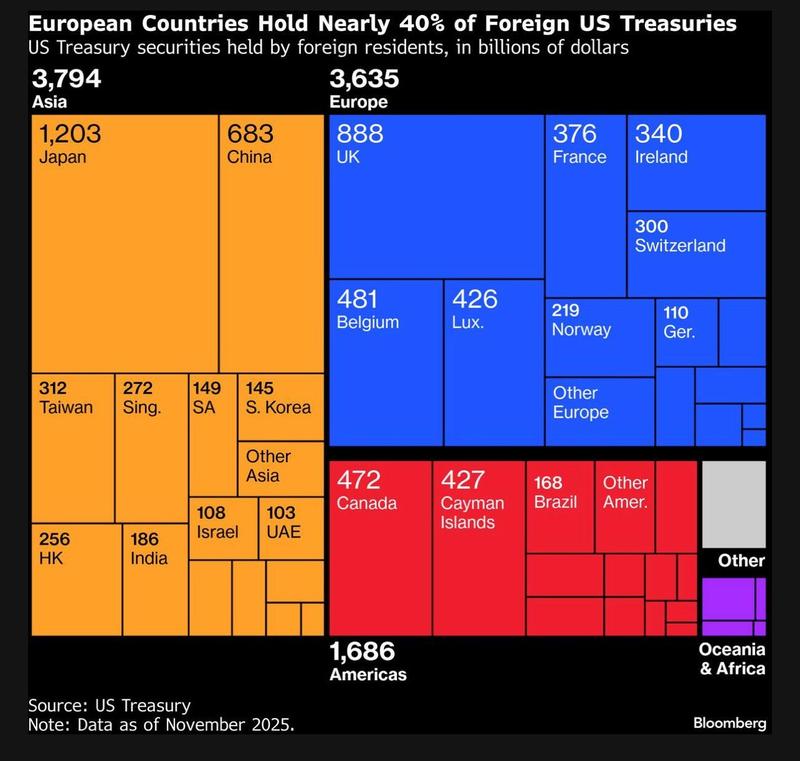

America's aggressive geopolitical positioning regarding Greenland has brought its financial connections with the European Union into stark focus. Leaders across Europe are evaluating what tools they possess to counter American aggression, including a so-called "nuclear option" involving the sale of American debt holdings.

The atmosphere has changed following a purported "framework of a deal" announced at Davos, with American designs on acquiring Greenland having moderated, at least temporarily. However, leaders of EU member states continue preparing potential countermeasures should tensions escalate again.

Among the possibilities was restricting American access to European markets via what's been termed the "trade bazooka." Activation of this measure would block American corporations from operating in EU markets, resulting in losses reaching into the billions. An additional possibility involves selling off the trillions of dollars worth of American assets currently held within Europe.

Yet concerns persist about whether such a move is practical, given that mass selling could fundamentally alter the worldwide economic environment. Additionally, it might produce cascading consequences for the American financial system's relationship with stablecoins.

Can the EU actually dump US debt?

Before Jan. 21, leaders throughout Europe were weighing potential countermeasures. As Denmark sent special forces to Greenland, other national leaders proposed the trade bazooka, which would block American access to markets across the EU.

Additional voices, including former Dutch Defense Minister Dick Berlijn, proposed that Europe might employ American debt as a bargaining chip. Berlijn stated, "If Europe decides to offload those bonds, it creates a big problem in the US. [The dollar] crashes, high inflation. The US voter won't like that."

George Saravelos, Deutsche Bank's chief FX strategist, wrote in a note last weekend, "For all its military and economic strength, the US has one key weakness: it relies on others to pay its bills via large external deficits."

According to Saravelos, the US presently holds $8 trillion in US bonds and equities, representing "twice as much as the rest of the world combined."

However, is Europe truly capable of offloading this debt? Uncertainties exist regarding both how the EU might enforce such a sale and, within an increasingly de-dollarizing global economy, identifying prospective purchasers.

Yesha Yadav, a professor of law and associate dean at Vanderbilt University, told Cointelegraph, "Foreign government buyers tend to be sticky, meaning that they will not easily move their holdings unless there is a serious need for them to do so."

Moreover, as reported by the Financial Times, a substantial portion of American debt held in Europe isn't owned by governments directly, but rather by private sector entities including pension funds, banks and other institutional investors. Yadav observed that hedge funds operating in the UK, Luxembourg and Belgium have become significant purchasers of US Treasurys.

Consequently, even if European authorities desired to sell off American debt, they would need to force these private purchasers to divest. Yadav stated that it "does not seem likely in the near term that European governments may impose restrictions on hedge funds buying US Treasurys."

SocGen's chief FX strategist, Kit Juckes, wrote, "The situation probably needs to escalate a fair bit further before they damage their investment performance for political purposes."

Nevertheless, "they may potentially think about opening up the kinds of government debt that are considered most secure as collateral," said Yadav.

The fundamental challenge is the scarcity of substitutes for American debt as a defensive investment vehicle. Treasurys continue to enjoy a "risk-free" designation and typically offer high liquidity.

"Even as other highly stable and safe countries, such as Germany, begin to issue debt, their debt markets remain relatively small, such that it is very difficult to envision them ever taking the place of the US Treasury market," said Yadav.

There's additionally a shortage of viable purchasers. China has been reducing the pace of its American debt acquisitions, Yadav noted.

Buyers in Asia lack the capacity to absorb such a volume of American assets. The market capitalization of the MSCI All-Country Asian index, which monitors large and mid-cap stocks throughout developing and emerging Asian markets, stands at approximately $13.5 trillion. According to the Financial Times, the FTSE World Government Bond Index totals around $7.3 trillion.

Rabobank's analysts wrote, "While the US's large current account deficit suggests that in theory there is the potential for the USD to drop should international savers stage a mass retreat from US assets, the sheer size of US capital markets suggests that such an exit may not be feasible given the limitations of alternative markets."

Stablecoins become major buyers of US debt

An increasingly important purchaser of American debt has emerged in the form of stablecoin issuers.

Based on the GENIUS Act, America's groundbreaking legislation establishing a regulatory framework for stablecoins, companies issuing these assets within the United States must maintain reserves of dollars and US Treasurys to support their coins.

"That [stablecoin issuers] are growing as fast as they are means that their need for Treasurys is correspondingly high. To the extent that this trend continues, it offers a great advantage for US policymakers, but it also deepens the link between the continuity of stablecoin issuers and that of the ability of US Treasury markets to continue remaining liquid and popular," said Yadav.

The expansion of stablecoin issuers as purchasers of American debt brings its own set of risks. This development, coupled with a declining number of American debt purchasers, especially if the EU dumps or even substantially reduces its holdings, could create problems for US Treasury markets.

Yadav and Brendan Malone, who previously worked in payments and clearing at the Federal Reserve Board, have documented liquidity shocks in American debt markets, occurring in both March 2020 and April 2025.

Should a run on stablecoin issuers occur, this liquidity shortage and increasing scarcity of counterparties willing to buy could prevent the issuer from liquidating its securities. This would lead to insolvency and also substantially damage the credibility of US Treasury markets.

Economic and military tensions in an increasingly multi-polar global order have generated divisions between previous allies. Though optimism exists for productive dialogue between the EU and US, Latvian President Edgars Rinkēvičs said, "We are not yet out of the woods [..] Are we in an irreversible rift? No. But there is a clear and present danger." The threat appears directed not merely at Europe and Greenland's sovereignty, but equally at American debt markets.