Cryptocurrency spot trading activity crashes to yearly lows amid declining market participation

Trading activity for spot cryptocurrency markets has experienced a 50% decline from October levels as market liquidity evaporates and participation from investors diminishes.

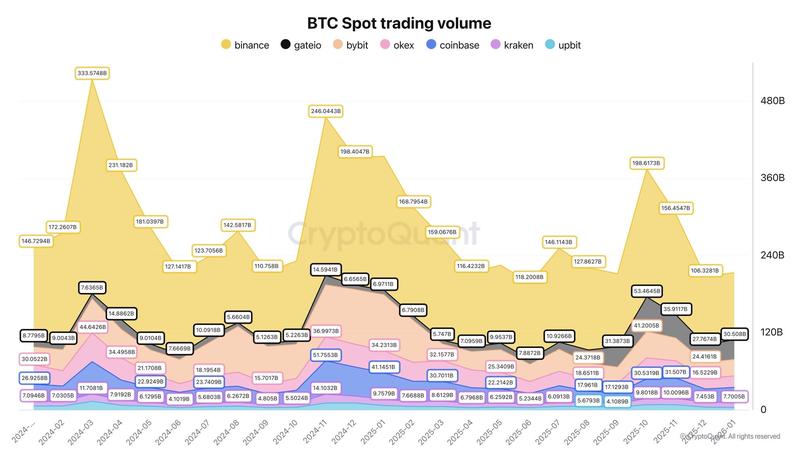

Trading volumes for spot cryptocurrency markets across leading exchanges have experienced a dramatic decline from approximately $2 trillion during October down to $1 trillion by the conclusion of January, signaling "clear disengagement from investors" alongside diminishing demand, market analysts report.

Bitcoin (BTC) has currently declined 37.5% from the peak it achieved in October during a period marked by liquidity shortage and significant risk aversion, which has resulted in volume contraction.

"Spot demand is drying up," CryptoQuant analyst Darkfost stated on Monday, further noting that the correction "has been largely driven by the Oct. 10 liquidation event."

Beginning in October, spot crypto volumes across leading exchanges have experienced a 50% reduction, data from CryptoQuant shows. Taking Binance as an example, the platform registered $200 billion in Bitcoin volume during October, which has subsequently decreased to approximately $104 billion.

"This contraction in volumes has brought the market back to levels among the lowest observed since 2024, suggesting a clear disengagement from investors in the crypto market and, consequently, weaker demand."

Nevertheless, this represents just one element contributing to the current situation, the analysts noted.

Market liquidity faces additional strain, evidenced by stablecoin withdrawals from exchanges alongside approximately $10 billion in reductions to stablecoin market capitalization, the analysts continued.

Bitter medicine, but a necessary market move

Speaking with Cointelegraph, Justin d'Anethan, head of research at Arctic Digital, explained that the most significant short-term risks facing BTC throughout the coming months appear to be macro-driven.

"Uncertainty around Kevin Warsh's hawkish stance as Fed Chair could mean fewer or slower rate cuts, a stronger dollar, and higher real yields, which all pressure risk assets, including crypto," he explained.

"I don't think the narrative of BTC as a debasement/inflation hedge is over — Bitcoin was built to hedge against reckless monetary policies and very long-term currency debasement," he offered as a contrarian take.

"The resumption of strong ETF inflows, clearer pro-crypto legislation, or softer economic data that forces the Fed back toward easier policy" has the potential to trigger a meaningful rally, according to d'Anethan.

"It might be a bitter medicine, but the recent move feels ultimately necessary and healthy to clear out leverage, tone down speculation, and force investors to reconsider valuations."

Not close to the Bitcoin price bottom yet

Joao Wedson, founder and CEO of Alphractal, highlighted that two conditions must be satisfied for a Bitcoin price bottom to materialize.

Short-term holders (STH) must be holding at a loss, which represents the present scenario, while long-term holders (LTH) need to "start carrying losses," a development that has yet to occur.

Wedson elaborated that bear markets reach their conclusion only when the STH realized price drops beneath the LTH realized price, while bull markets commence when this metric crosses back to the upside.

At present, the STH realized price remains positioned above LTH, although a decline beneath critical support at $74,000 has the potential to push BTC into bear market territory.