CoinShares Reports $1.7B in Crypto Fund Withdrawals for Second Consecutive Week

Digital asset investment products experienced their second straight week of withdrawals, with combined outflows reaching $3.43 billion and pushing year-to-date flows into negative territory at $1 billion, CoinShares data shows.

Digital asset investment vehicles extended their recent downturn through last week as market confidence deteriorated, recording a second straight week of investor withdrawals.

Digital currency exchange-traded products (ETPs) experienced $1.7 billion in net withdrawals throughout the week, according to a Monday report from European cryptocurrency investment firm CoinShares.

These withdrawals came in marginally lower than the prior week's $1.73 billion, bringing the two-week combined total to $3.43 billion. The consecutive outflows have pushed year-to-date net flows into negative territory, now standing at $1 billion in withdrawals.

We believe this reflects a combination of factors, including the appointment of a more hawkish US Federal Reserve Chair, continued whale selling associated with the four-year cycle, and heightened geopolitical volatility.

James Butterfill, CoinShares' head of research

Assets under management have declined $73 billion from October highs

As a result of the sustained withdrawals, total assets under management (AUM) across cryptocurrency investment funds decreased to $165.8 billion, representing a $73 billion decline from AUM levels recorded in October 2025, according to Butterfill's analysis.

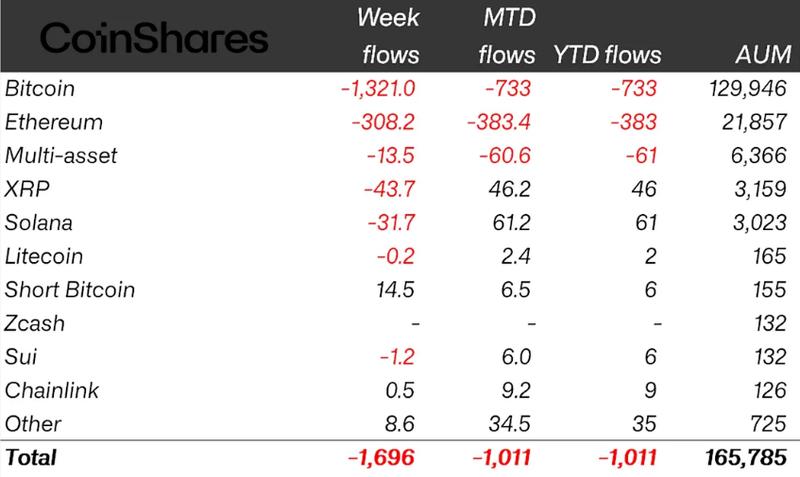

Bitcoin (BTC) dominated the outflow activity from digital asset funds with a substantial portion, as $1.32 billion exited BTC-focused investment vehicles, bringing year-to-date outflows to $733 million.

Ether (ETH) investment products recorded $308 million in outflows for the week, pushing YTD losses to $383 million. Solana (SOL) and XRP (XRP) also experienced the downturn's impact, registering outflows of $31.7 million and $43.7 million, respectively.

Conversely, investment products that short Bitcoin attracted $14.5 million in new capital, consistent with the prevailing bearish market sentiment.

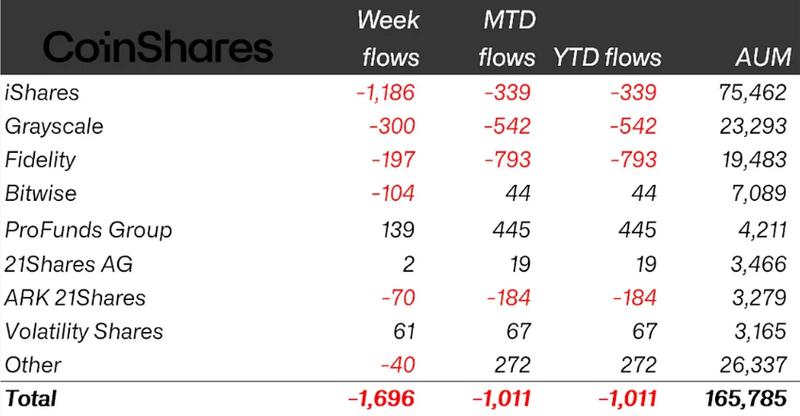

BlackRock's iShares experiences largest outflows once more

The majority of fund issuers faced withdrawals during the previous week, with BlackRock's iShares ETFs experiencing the heaviest losses at $1.2 billion. Grayscale Investments and Fidelity recorded the next largest outflows at $300 million and $197 million, respectively.

In contrast to the broader trend, ProFunds Group and Volatility Shares managed to attract capital, recording $139 million and $61 million in net inflows.

Butterfill from CoinShares further noted that Hyperliquid (HYPE) represented one of the noteworthy outliers, gaining from activity related to tokenised precious metals.

The previous week's cryptocurrency ETF withdrawals preceded a dramatic weekend market decline, with Bitcoin dropping beneath the $75,000 threshold on Sunday.

The Crypto Fear & Greed Index currently registers "Extreme Fear" at a reading of 14, indicating that digital asset investment funds could experience another week of negative flows unless market conditions improve significantly.

As of publication, Bitcoin was trading at $77,610, representing a 1.7% decline over the preceding 24 hours, based on data from CoinGecko.