CLARITY Act delay sparks renewed DeFi governance and regulatory debate: Finance Redefined

The CLARITY Act faces a temporary halt as decentralized finance advocates raise concerns about developer risks, while DAOs reconsider their governance frameworks amid growing regulatory scrutiny.

Legislators in the United States have delayed a scheduled markup session for the Digital Asset Market Clarity Act (CLARITY), pushing back advancement on legislation designed to establish regulatory frameworks for cryptocurrencies and decentralized finance (DeFi) platforms, which has triggered fresh criticism from DeFi advocates who argue the legislation remains insufficient in safeguarding developers.

Crypto venture capital firms and industry advocacy organizations have expressed concerns that suggested amendments might impose obligations that are incompatible with decentralized architectures. Spokespeople from Variant and Paradigm indicated that the existing version contains unresolved questions regarding whether infrastructure providers and DeFi developers might be required to adopt Know Your Customer (KYC) protocols, obtain registration from financial authorities or adhere to regulations originally crafted for centralized entities.

This postponement arrives amid intensifying backlash from throughout the cryptocurrency industry, including vocal criticism from Brian Armstrong, CEO of Coinbase, prompting Tim Scott, Chair of the Senate Banking Committee, to declare a "brief pause."

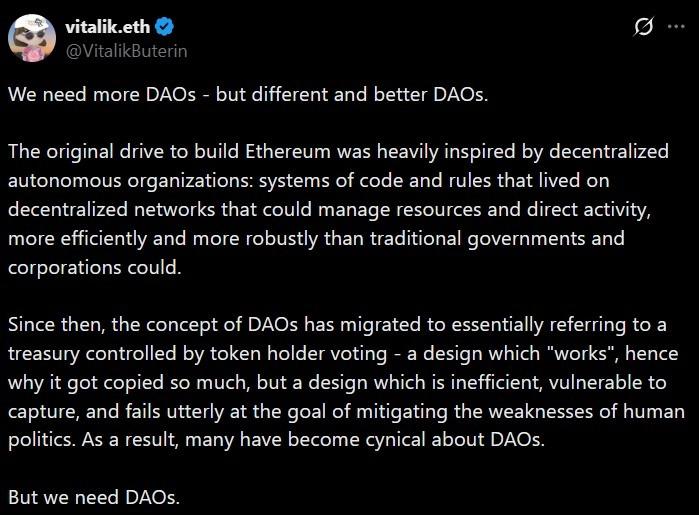

Vitalik Buterin calls for a new DAO design for onchain disputes and governance

Vitalik Buterin, co-founder of Ethereum, has advocated for a fundamental redesign of decentralized autonomous organization (DAO) structures, contending that the majority of DAOs have devolved into nothing more than token-voting-based treasury management systems.

According to Buterin, this approach is inefficient, susceptible to exploitation and does not represent an improvement over conventional governance frameworks. He emphasized that DAOs ought to be specifically engineered to facilitate critical infrastructure components including oracles, onchain dispute resolution mechanisms, insurance determinations and long-term stewardship of projects.

He further detailed how varying governance challenges necessitate distinct structural approaches, drawing distinctions between scenarios that benefit from strong leadership and those requiring broad-based consensus.

Buterin cautioned that significant obstacles persist, including minimal participation rates, domination by large token holders and decision fatigue, emphasizing that privacy-enhancing technologies, constrained AI integration and improved governance architecture are essential to the future of DAOs.

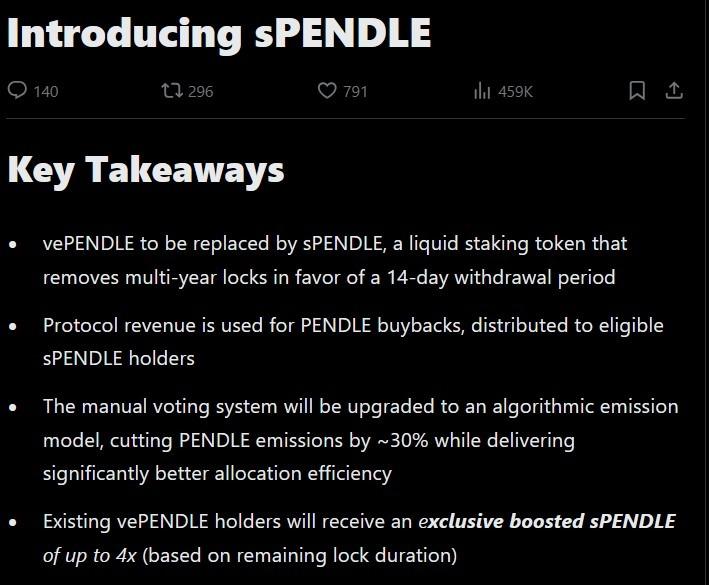

DeFi protocol Pendle revamps governance token, citing low adoption

The DeFi protocol Pendle has announced a comprehensive overhaul of its governance framework by discontinuing its vePENDLE token and launching a new liquid staking and governance token known as sPENDLE.

According to the development team, vePENDLE's extended lock-up requirements, inability to be transferred and intricate voting systems restricted user engagement, despite the protocol achieving approximately $3.5 billion in total value locked (TVL).

The redesigned token seeks to reduce participation barriers by permitting withdrawals following a 14-day unwinding timeframe, facilitating integration with additional DeFi platforms and making governance participation more straightforward.

Pendle has also announced plans to simplify voting requirements and intends to allocate as much as 80% of protocol revenues toward governance incentives and token buyback programs.

New SEC submissions press on self-custody and DeFi regulation

A pair of recent submissions directed to the US Securities and Exchange Commission's cryptocurrency task force are intensifying pressure on regulatory bodies to provide clarity regarding the treatment of self-custody rights and DeFi operations under forthcoming market structure regulations.

One filing, which references Louisiana legislation protecting retail investors' self-custody rights, cautioned that excessively expansive exemptions in federal regulatory proposals could undermine investor safeguards and elevate fraud risks.

A separate submission from the Blockchain Association contended that firms engaging in trades of tokenized equities or DeFi assets using their proprietary accounts should not be automatically designated as regulated dealers.

These submissions emerge as Congressional negotiations progress, with industry leaders and policymakers advocating for a balanced solution.

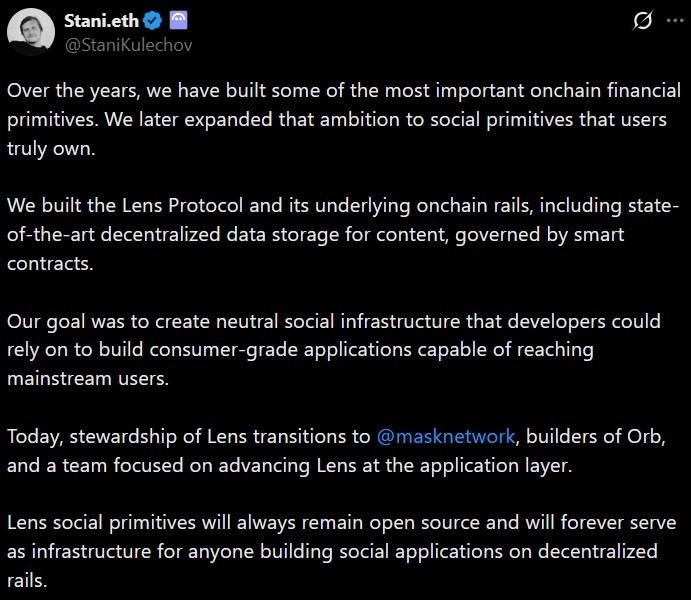

Aave refocuses on DeFi, hands Lens stewardship to Mask Network

The lending protocol Aave has transferred stewardship responsibilities for Lens Protocol to Mask Network, limiting its involvement to technical advisory functions as it concentrates efforts on DeFi operations.

Through this transition, Mask Network will assume leadership over consumer-oriented development and product implementation for Lens-based social applications, whereas the protocol's foundational infrastructure will continue to be permissionless and open-source.

Vitalik Buterin, Ethereum's co-founder, expressed support for the transition and noted that decentralized social networks constructed on shared data infrastructure are vital for encouraging competition and enhancing the quality of online discourse.

DeFi market overview

Data sourced from Cointelegraph Markets Pro and TradingView indicates that the majority of the 100 largest cryptocurrencies ranked by market capitalization closed the week with negative performance.

The White Whale (WHITEWHALE) token experienced a decline exceeding 57% during the week, representing the most significant decrease over the seven-day period. Following this was a token known as Merlin Chain (MERL), which suffered a 48% decline throughout the previous week.