Cathie Wood's ARK Invest Purchases $34M in Robinhood Stock Amid Bitcoin's Drop Under $66K

ARK Invest, managed by Cathie Wood, acquired approximately $50 million worth of shares in Robinhood, Bullish and Circle as Bitcoin experienced a decline and spot BTC ETFs in the United States registered $276 million in net outflows.

The investment management firm ARK Invest, under the leadership of prominent Bitcoin advocate Cathie Wood, made substantial acquisitions of cryptocurrency-related equities on Wednesday while Bitcoin momentarily fell beneath the $66,000 threshold.

According to trade notification documents examined by Cointelegraph, ARK acquired 433,806 shares of Robinhood (HOOD) at a total cost of roughly $33.8 million.

The investment management company additionally expanded its holdings in cryptocurrency exchange platform Bullish (BLSH) and the firm behind USDC, Circle (CRCL), purchasing 364,134 shares at a value of $11.6 million and 75,559 shares valued at $4.4 million, in that order.

These acquisitions were executed while all three equities experienced downward price movement during the trading session, with Robinhood's stock price declining by nearly 9%, based on information from TradingView data.

ARK refrained from acquiring additional Coinbase (COIN) stock following the sale of $17 million worth of the cryptocurrency exchange's shares the previous week.

Robinhood emerges as ARK's primary crypto-related investment in flagship ETF

The most recent Robinhood stock purchase by ARK occurred simultaneously with the company's official public testnet deployment of the Robinhood Chain, a permissionless second-layer (L2) blockchain platform designed specifically for financial services applications and the tokenization of real-world assets (RWAs).

During the earlier part of this week, Robinhood disclosed record-breaking net revenue figures reaching nearly $1.28 billion for the fourth quarter of 2025. Despite revenue experiencing a 27% increase compared to the same period in the previous year, the results came in below Wall Street analyst expectations of $1.34 billion, resulting in an approximate 8% decline in the company's share price.

According to the fund's official data as of Feb. 11, Robinhood now represents the most substantial cryptocurrency-related investment position within ARK's flagship investment vehicle, the ARK Innovation ETF (ARKK), comprising approximately 4.1% of the total portfolio, which translates to roughly $248 million.

US spot Bitcoin ETFs reflect BTC market weakness as positive flows come to a halt

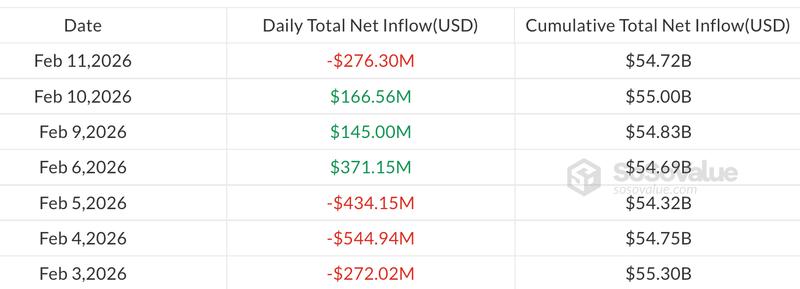

The broader market downturn has extended its impact to United States spot Bitcoin (BTC) exchange-traded funds (ETFs), which were unable to maintain positive trajectory following a three-day period of consecutive inflows.

Data compiled by SoSoValue indicates that Bitcoin ETFs experienced net outflows totaling $276.3 million on Wednesday, effectively eliminating nearly all weekly gains, which currently amount to merely $35.3 million. Total assets under management decreased to $85.7 billion, marking the lowest level observed since the beginning of November 2024.

Exchange-traded funds tracking Ether (ETH) similarly experienced negative performance, registering daily outflows amounting to $129.2 million. Investment funds focused on XRP registered zero inflows, whereas Solana (SOL) ETFs documented marginal inflows of approximately $0.5 million.

As of the time of publication, Bitcoin was exchanging hands at $67,227, representing a 0.4% increase during the preceding 24-hour period, according to data from CoinGecko.

This most recent market retreat follows earlier observations from market analysts who had identified a possible turning point in cryptocurrency investment products after experiencing three straight weeks of outflows that exceeded $3 billion in aggregate.