Bithumb faces regulatory scrutiny over $43B erroneous Bitcoin distribution

Regulatory authorities in South Korea have initiated a formal investigation into cryptocurrency exchange Bithumb following an error that resulted in 620,000 BTC being incorrectly distributed to customer accounts, raising fresh questions about reserve transparency and 'paper Bitcoin' practices.

Financial regulators in South Korea have initiated an official investigation into cryptocurrency exchange Bithumb following a major error in which the platform incorrectly distributed hundreds of thousands of Bitcoin to customer accounts despite not possessing the actual digital assets.

The country's Financial Supervisory Service (FSS) has begun investigating Bithumb over suspected platform infractions connected to the mistaken distribution of billions of dollars worth of Bitcoin (BTC) that did not exist to customer balances, according to a Tuesday report from Yonhap News.

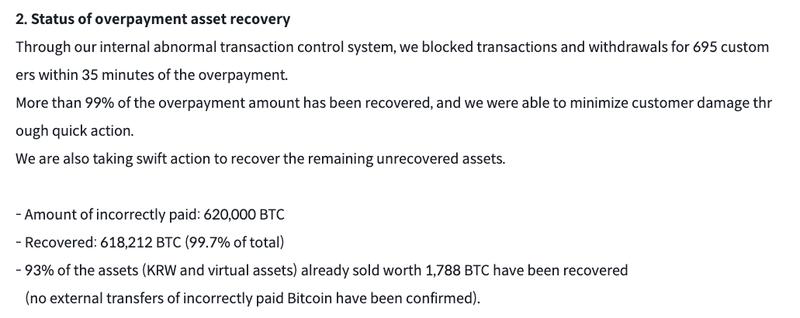

The exchange publicly acknowledged the error on Saturday, stating that it "incorrectly paid" 620,000 BTC ($42.8 billion) to customers as part of a promotional campaign.

Although the platform successfully retrieved the majority of the erroneously distributed BTC, approximately 125 BTC ($8.6 million) has yet to be recovered, which has sparked discussions about operational security at centralized exchanges (CEXs) and intensified community anxiety regarding "paper Bitcoin."

Authorities point to multiple alleged violations by Bithumb

Despite Bithumb's assertion that the error did not lead to any financial losses or harm to customer holdings, financial regulators in South Korea have emphasized the incident's potential ramifications for the wider cryptocurrency market.

"We are taking this case very seriously," an FSS official reportedly said, adding: "The FSS will take stern legal actions against acts that harm the market order."

The financial watchdog drew attention to Bithumb's suspected infractions, which include discrepancies between the cryptocurrency stored in the exchange's wallets and the quantities shown in customer accounts.

The FSS further pointed to weaknesses in Bithumb's internal oversight mechanisms, observing that the mistake originated from a single point of failure — reportedly, one employee was solely responsible for the erroneous BTC distribution.

"Paper Bitcoin" concerns intensify

"The 620,000 BTC were not 'real' Bitcoin," CryptoQuant analyst Maartunn told Cointelegraph, adding that the distributed BTC existed exclusively in a digital format and were accessible only through Bithumb's internal infrastructure.

The platform's marketing campaign, which was designed to distribute 2,000 South Korean won ($1.4) to customers, ended up distributing 2,000 BTC per customer because an employee incorrectly selected "BTC" as the denomination instead of "won," he said.

"To put in into perspective, Bithumb currently holds around 41,798 BTC in reserves, far less than the virtual 620,000 BTC that shortly existed on its books," Maartunn said, adding that some users did benefit from the incident:

"Around that time, 3,875 BTC, or around $268 million, were withdrawn from the exchange. This may partly reflect users who managed to withdraw the mistakenly credited BTC, but it could also indicate a broader loss of confidence among other users."

The figures reported by Bithumb are therefore lower than what the on-chain data suggests, Maartunn said.

Cointelegraph approached the FSS and Bithumb for comment regarding the reported investigation, but had not received a response by publication.

Bithumb's news adds to growing community concerns over "paper Bitcoin," or Bitcoin that does not exist on the blockchain but is traded on CEXs or stock exchanges in the form of products like derivatives and exchange-traded funds.

Some even suggested that paper Bitcoin trading has contributed to the ongoing market turmoil, with Bitcoin losing around 43% of its value since October 2025.