AI Takes Center Stage for Family Offices While Cryptocurrency Investment Remains Minimal: JPMorgan Report

JPMorgan's survey reveals that nearly 89% of family offices maintain no cryptocurrency holdings, with mean allocations to Bitcoin and digital assets staying far below the 1% threshold.

According to fresh findings from JPMorgan Private Bank, artificial intelligence has solidified its position as the leading investment priority among the world's most prominent family offices, whereas digital currencies remain on the periphery of their investment strategies.

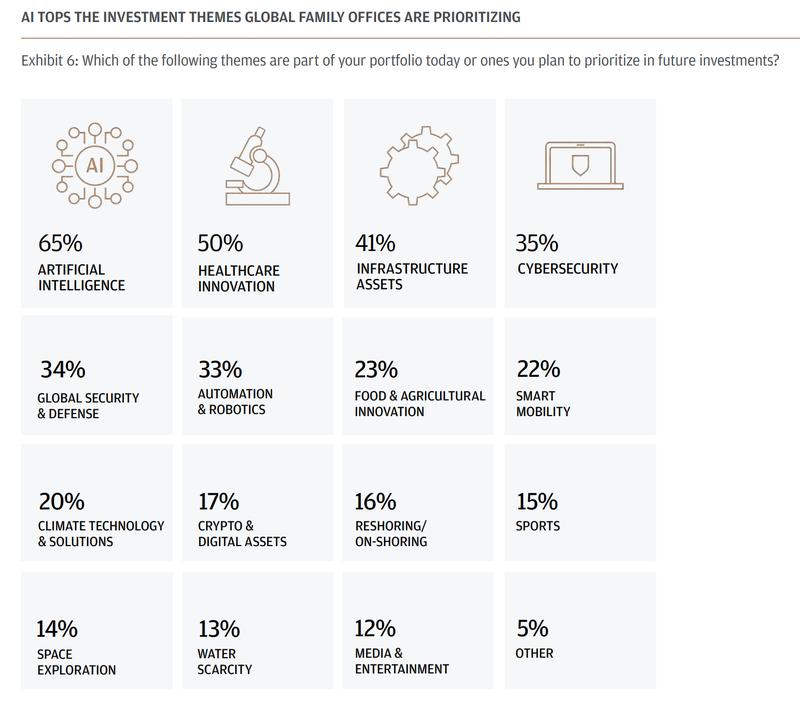

JPMorgan Private Bank's 2026 Global Family Office Report surveyed 333 single family offices spanning 30 nations during the period from May through July 2025. The findings reveal that 65% of survey participants, representing 216 offices, are making artificial intelligence-related investments a priority either at present or moving forward. In stark contrast, merely 17% (56 offices) identify cryptocurrency and digital assets as a central investment focus.

Cryptocurrency holdings remained notably scarce within family office investment portfolios. The report indicates that 89% of family offices presently maintain zero cryptocurrency exposure, whereas the worldwide average allocation to cryptocurrency and digital assets stands at a mere 0.4%. Bitcoin exposure registers even lower, with an average of 0.2%, the data reveals.

Gold, traditionally regarded as a reliable hedge during periods of uncertainty, also garners minimal interest, with 72% of survey participants indicating no exposure whatsoever. "Despite geopolitical fears, family offices avoid gold and crypto," the report wrote, adding that "appetite for traditional and emerging hedges remains limited."

Family offices show strongest interest in expanding private equity allocations

Approximately 59% of survey participants, totaling 197 offices, operate from the United States. The balance of participants are distributed throughout Europe, Latin America and the Asia-Pacific geographical zones.

Private equity emerges as the preferred asset category, with 37% of survey respondents intending to boost allocations within the coming 12 to 18 months. Growth equity along with venture capital, frequently regarded as the principal channels to access early-stage artificial intelligence innovation, are similarly experiencing increased interest, despite the fact that more than half of family offices continue to show no present exposure to these particular segments.

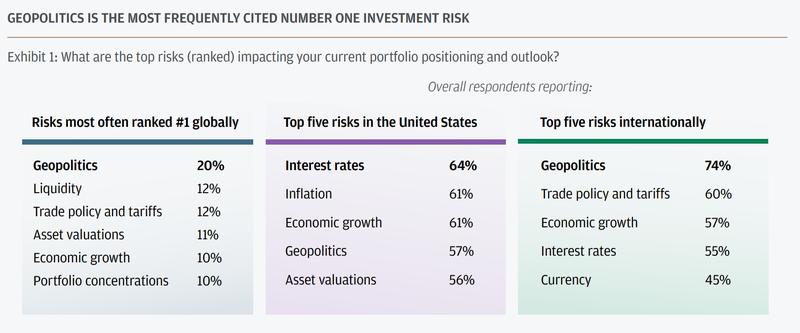

Geopolitical considerations represent the foremost risk factor for family offices on a global scale, mentioned by 20% as their primary worry, with liquidity and trade policy each following at 12%. Asset valuations, economic growth prospects and portfolio concentration round out the list of concerns close behind.

Family offices in Asia show growing cryptocurrency appetite

According to a report published last year by Reuters, affluent families and family offices throughout Asia have significantly increased their cryptocurrency exposure, with certain entities setting allocation targets of approximately 5% of their overall portfolios. The Reuters report documented rising interest throughout Singapore, Hong Kong and mainland China, fueled by heightened client inquiries, more robust trading volumes and renewed demand for cryptocurrency-focused investment funds.

In June, VMS Group, a Hong Kong-based multi-family office overseeing $4 billion under management, revealed intentions to venture into cryptocurrency for the first time, contemplating an investment of up to $10 million in Re7 Capital strategies.