USDC Functions as Shared Infrastructure, Not Visa or Mastercard Competitor, Says Circle Chief

Jeremy Allaire told attendees at Davos that Circle's stablecoin serves as neutral infrastructure for the financial system instead of competing with traditional payment networks or banking institutions.

Jeremy Allaire, the chief executive officer of Circle, stated that the firm regards its stablecoin pegged to the US dollar as infrastructure that serves the financial system neutrally and benefits from network effects, as opposed to being a product designed to challenge established payment processors.

During an appearance on CNBC's Squawk Box at the World Economic Forum held in Davos, Switzerland, Allaire explained that Circle doesn't consider payment card networks like Visa or Mastercard to be rivals, characterizing these companies as "significant partners" instead.

Allaire explained that stablecoins function as "network effect businesses," where adoption and circulation expand as a growing number of developers and financial institutions incorporate them, further noting that Circle positions itself as a "neutral company" that refrains from competing against banking institutions, payment processors or cryptocurrency exchanges.

The Circle CEO also noted that the future ramifications of stablecoins are still uncertain.

Over time, the cost of storing and moving money around goes to zero. In that future world, where AI agents are doing the money movement, it's going to be hard to know exactly what the payment business model is over that period of time.

When questioned about the possibility of the Digital Asset Markets Clarity bill passing through the US Congress during the current year despite its stalled status, Allaire responded: "There's clearly a bipartisan desire to do that," further noting that the legislation goes beyond just stablecoins and tackles the wider application of digital tokens within capital markets, which serves the interests of both conventional banking institutions and cryptocurrency firms.

As the entity responsible for issuing USDC, which holds the position of second-largest stablecoin measured by market capitalization, Circle completed its public market debut in June 2025, setting its initial public offering price at $31 per share prior to commencing trading at $69.

The company's stock climbed to a peak of $263.45 during late May, though it has subsequently declined to $72, based on data from Yahoo Finance.

Stablecoin competitors emerge in 2025

The accelerated growth of the stablecoin sector has introduced numerous new rivals that are challenging Circle's market standing.

During March, reports indicated that Fidelity Investments had reached the concluding phases of testing for a stablecoin pegged to the US dollar. The asset management giant, which oversees $5.8 trillion, intends to introduce the stablecoin via its cryptocurrency division, Fidelity Digital Assets.

Approximately one month following that announcement, Stripe revealed its plans to develop a stablecoin backed by the US dollar targeted at businesses located outside the United States, the United Kingdom and Europe. Bridge will provide the underlying technology for the stablecoin.

Additionally, cryptocurrency payments provider MoonPay has announced the development of a US dollar–backed stablecoin designed for routine payment transactions, with an anticipated rollout scheduled for early 2026.

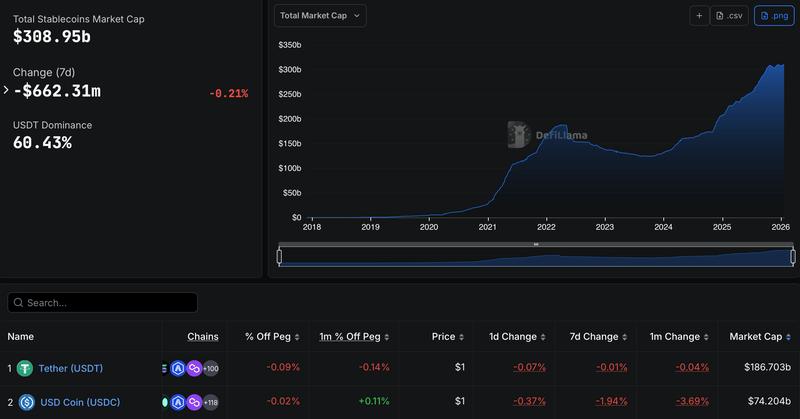

On Thursday, the aggregate market capitalization for stablecoins stood at $309 billion, based on information from DefiLlama data.

Circle's USDC represents approximately $74.2 billion of this total market, securing the second position after Tether's USDt, which continues to hold its position as the leading issuer with roughly $186.7 billion currently in circulation.