Stablecoins emerge as preferred choice for salaries and routine transactions: New BVNK study

An international study surveying 4,658 cryptocurrency users reveals that 39% now earn income through stablecoins while 27% utilize them for daily transactions, particularly in developing economies.

An international study commissioned by BVNK and executed by YouGov has revealed that 39% of cryptocurrency users and potential users spanning 15 nations are receiving compensation in stablecoins, with 27% deploying them for daily transactions, attributing this trend to reduced transaction costs and accelerated international transfer speeds as primary motivators.

The research involving 4,658 participants, carried out digitally during September and October 2025 among adults who either currently possess or intend to purchase cryptocurrency, discovered that stablecoin users maintain approximately $200 in their digital wallets on a global scale, although balances in higher-income nations average closer to $1,000.

The study additionally revealed that 77% of survey participants would establish a stablecoin wallet through their main banking institution or financial technology service provider if such an option became available, while 71% demonstrated enthusiasm for utilizing an associated debit card to make stablecoin purchases.

Individuals who obtain compensation through stablecoins indicated the digital assets represent roughly 35% of their yearly income on average, while those employing them for international money transfers documented cost reductions of approximately 40% when compared to conventional remittance services.

Over half of cryptocurrency holders have completed a transaction explicitly because a vendor accepted stablecoins, with this figure rising to 60% across emerging economies, whereas 42% indicated their desire to employ stablecoins for significant or lifestyle acquisitions compared to 28% who presently do so.

Possession rates were elevated in middle- and lower-income nations, where 60% of survey participants confirmed they maintain stablecoins, in contrast to 45% in high-income economies. The African continent registered the highest ownership percentage at 79% and the most substantial reported growth in holdings throughout the previous year.

Multiple tokens preferred

A representative from BVNK informed Cointelegraph that the research was structured to analyze usage behaviors among current and prospective cryptocurrency users instead of quantifying wider population-level adoption rates.

The spokesperson also noted that survey participants typically maintain a portfolio of dollar- and euro-backed stablecoins rather than depending on a solitary issuer, indicating users frequently preserve balances distributed across various tokens.

When questioned about their preferred platforms for managing stablecoins, 46% of participants chose exchange platforms, succeeded by payment applications featuring crypto functionality such as PayPal or Venmo at 40%, and mobile cryptocurrency wallet applications at 39%. A mere 13% stated they would favor storing stablecoins in a hardware wallet.

BVNK operates from its headquarters in London and was established in 2021 as a stablecoin-centered payments infrastructure supplier for enterprise clients. In June, the company formed a partnership with San Francisco-based Highnote to launch stablecoin-based funding for the embedded finance platform's card programs.

Stablecoins move into regulated payroll systems

Following the enactment of the GENIUS Act in the United States and the deployment of Europe's Markets in Crypto-Assets Regulation, stablecoins are progressively being incorporated into international payroll frameworks as corporations broaden digital asset settlement alternatives for wage distribution and cross-border compensation.

On Feb. 11, international payroll platform Deel announced it will commence providing stablecoin salary disbursements through a collaborative arrangement with MoonPay, beginning next month with employees in the United Kingdom and European Union prior to extending to the US.

Through this arrangement, workers can choose to obtain partial or complete wages in stablecoins to non-custodial wallets, with MoonPay managing conversion and onchain settlement operations while Deel maintains oversight of payroll and regulatory compliance.

Corporate engagement in the sector has similarly intensified. Paystand recently completed the acquisition of Bitwage, a platform specializing in cross-border stablecoin disbursements, enhancing digital asset settlement and foreign exchange functionalities throughout Paystand's B2B payments infrastructure, which has facilitated more than $20 billion in payment volume, according to the company.

Due to the fact that stablecoins are generally pegged at a 1:1 ratio to fiat currencies including the US dollar or euro, they deliver price stability that renders them more appropriate for payment purposes than cryptocurrencies that can experience dramatic value fluctuations.

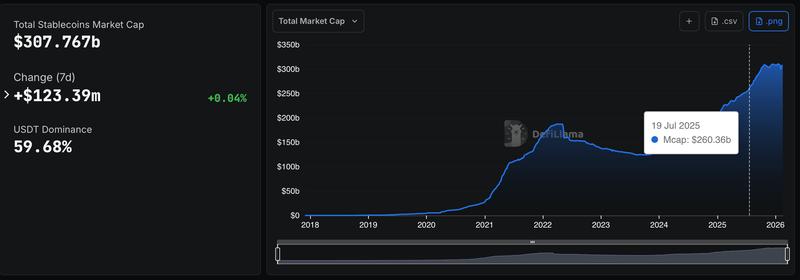

Based on data from DefiLlama, the stablecoin market presently totals $307.8 billion, an increase from $260.4 billion on July 19, approximately when the US GENIUS Act was enacted into law.