Saylor outlines 3-6 year plan to transform convertible bonds into equity

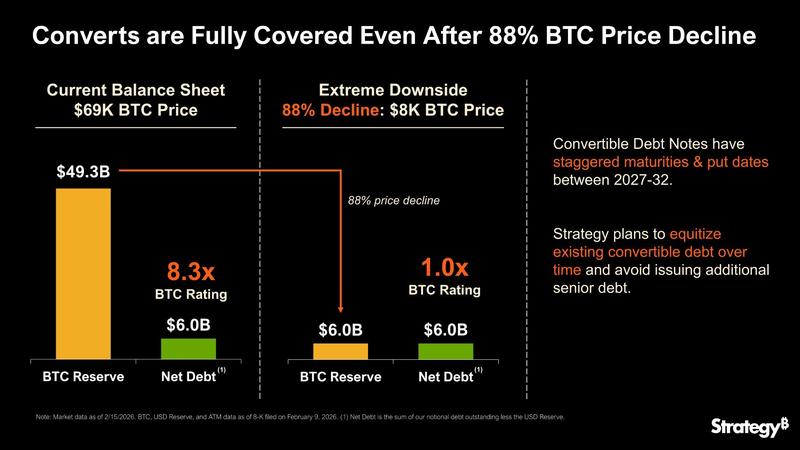

The leading DAT company worldwide intends to transform its $6 billion convertible bond portfolio into equity stakes, asserting resilience against an 88% decline in Bitcoin value.

Michael Saylor, who founded Strategy, has disclosed that the company intends to transform its $6 billion convertible bond portfolio into equity holdings — a strategic decision designed to lower the debt burden shown on its financial statements.

"Strategy can withstand a drawdown in BTC price to $8,000 and still have sufficient assets to fully cover our debt," stated the firm on X on Sunday, prompting Saylor's response.

The company specializing in Bitcoin (BTC) treasury management presently maintains Bitcoin reserves valued at $49 billion, consisting of a total holding of 714,644 BTC.

With convertible debt obligations totaling approximately $6 billion, Bitcoin's price would require a collapse of roughly 88% for these figures to reach parity, yet the company would still maintain adequate coverage for its debt commitments, according to the firm's explanation.

The process of equitizing convertible debt involves transforming bond obligations into equity through the issuance of stock shares instead of settling the debt through cash payments, effectively converting bondholders into equity shareholders of the company.

While this strategy would alleviate the debt burden facing the organization, it carries the potential to dilute the ownership stakes of current shareholders due to the creation and distribution of additional stock.

Strategy down 10% on average BTC purchase price

Strategy's average acquisition cost for Bitcoin sits at approximately $76,000, indicating that the company is presently experiencing roughly a 10% unrealized loss on its holdings given the current asset price of $68,400.

In other developments, Saylor hinted at an imminent Bitcoin acquisition when he shared the Strategy accumulation chart on X on Sunday, which has historically served as an indicator of upcoming purchases.

Should the acquisition materialize, it would represent the twelfth consecutive week of Bitcoin accumulation as the organization persists in building its position despite significant depreciation in both the underlying digital asset and the company's equity valuation.

Strategy stock down 70% from ATH

The stock price of Strategy (MSTR) advanced 8.8% during Friday's session to close out the week at a trading price of $133.88, based on data from Google Finance.

This upward movement occurred as Bitcoin successfully regained the $70,000 price threshold during late trading hours on Friday, though this rally proved temporary as the cryptocurrency surrendered a portion of those gains during early trading on Monday morning, retreating to $68,400, based on data from CoinGecko.

At the same time, the company's shares have declined 70% from their all-time peak of $456 reached in mid-July, while BTC valuations have experienced a 50% drawdown from their highest point in early October.