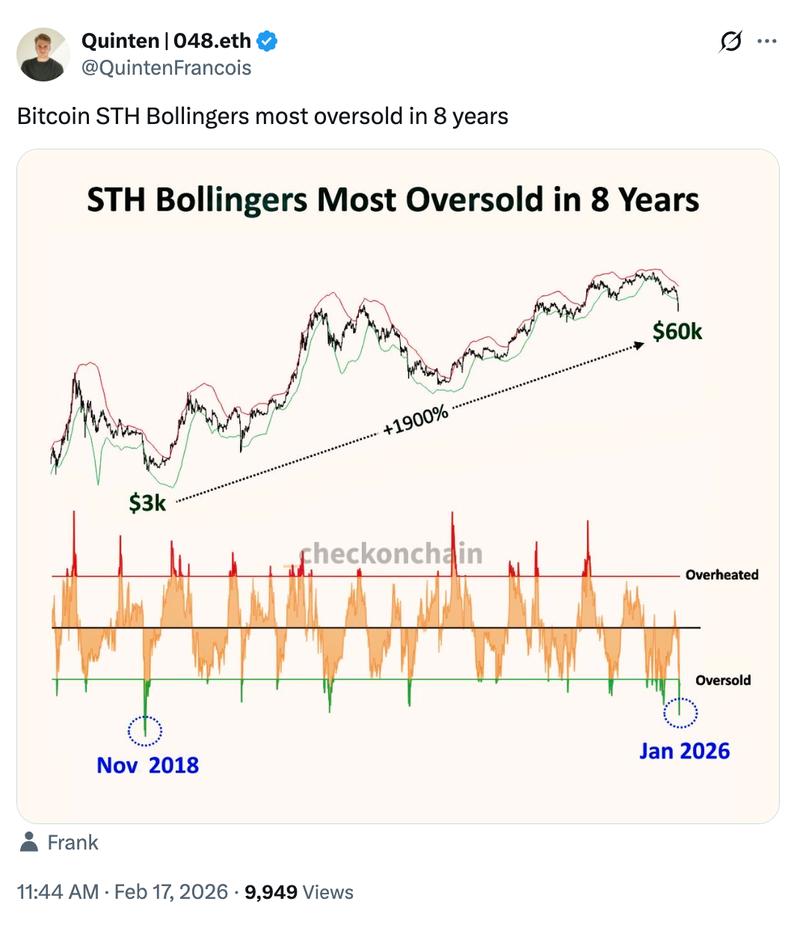

Historic Bitcoin Capitulation Indicator Returns, Signaling Potential Bottom Similar to Pre-1,900% Surge

The "short-term holder stress" indicator for Bitcoin has reached levels last observed during 2018, indicating potential market capitulation and the formation of a price bottom.

An important on-chain indicator for Bitcoin (BTC) is displaying its most severe capitulation reading since 2018, indicating the possibility of a cyclical bottom forming.

Bitcoin is mirroring 1,900% rally setup from 2018

The stress level among Bitcoin's short-term holders has reached its lowest point since the bear market bottom of 2018, based on fresh on-chain analysis from Checkonchain.

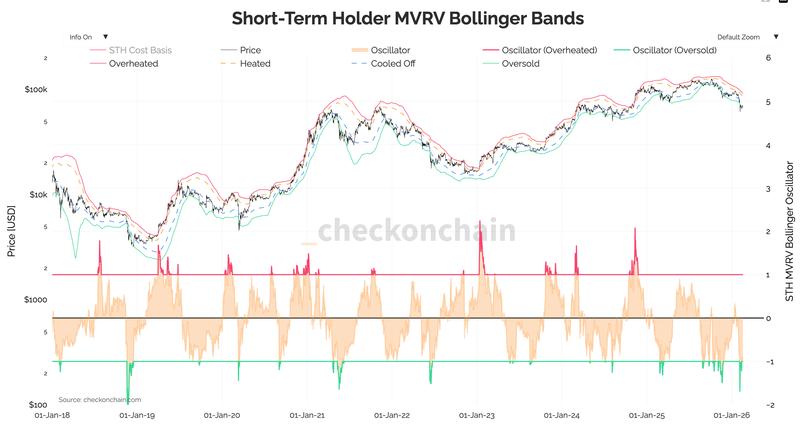

The metric tracking Short-Term Holder (STH) Bollinger Bands reveals the oscillator descending into its most deeply oversold zone in close to eight years.

This technical indicator utilizes Bollinger Bands to measure the difference between Bitcoin's current market price and the mean acquisition cost of short-term holders, which are characterized as wallets that have maintained BTC ownership for fewer than 155 days.

Whenever the oscillator breaks through the lower boundary of the statistical band, it indicates that Bitcoin is changing hands at prices substantially beneath what recent purchasers paid, exceeding typical historical price fluctuation patterns. Throughout history, this particular signal has coincided with major market bottoms.

As an example, a comparable oversold reading emerged in the final months of 2018 and came before an approximately 150% price surge within twelve months and a 1,900% BTC price appreciation over a three-year period.

The signal also appeared prior to the market bottom in November 2022, which was followed by a 700% upward movement to an all-time high approaching $126,270.

Furthermore, the realized losses experienced by whale-sized short-term holders have remained subdued following Bitcoin's October 2025 peak near $126,000, indicating that larger recent purchasers have not yet engaged in panic selling.

These on-chain metrics point toward exhaustion among sellers, supporting the bottom formation perspective shared by numerous analysts, including the team at crypto custodian platform MatrixPort.

Bitcoin may rebound by the end of March

Financial institution Wells Fargo also identifies an approaching near-term liquidity boost developing for Bitcoin.

Within a research note referenced by CNBC, Wells Fargo strategist Ohsung Kwon indicated that above-average US tax refunds expected in 2026 could resurrect the "YOLO" trading phenomenon, with potentially as much as $150 billion making its way into equity markets and Bitcoin before the end of March.

An occurrence of this magnitude could neutralize the remaining selling pressure, strengthening the thesis that Bitcoin may establish a bottom within the upcoming weeks.