GraniteShares and Bitwise enter competitive field of election-focused ETF products

A pair of additional fund providers have submitted regulatory filings for half a dozen exchange-traded funds linked to US political election prediction markets, providing investors with access to electoral outcome speculation.

ETF providers Bitwise and GraniteShares have submitted documentation to the United States Securities and Exchange Commission seeking approval to introduce investment vehicles connected to event contracts centered on the results of American political elections.

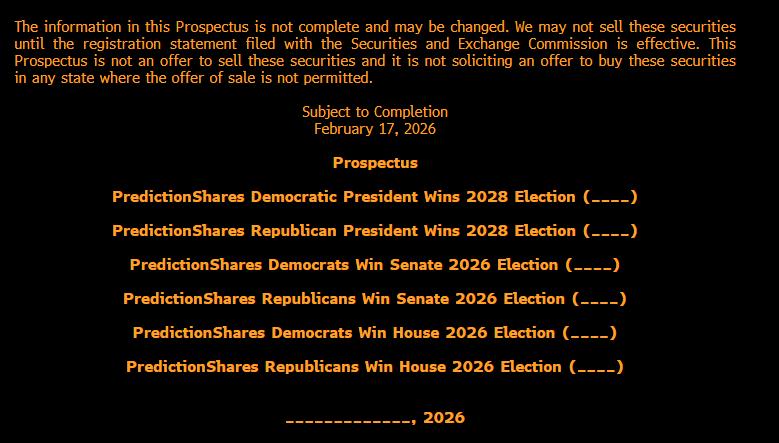

On Tuesday, Bitwise submitted regulatory documents for a fresh series of exchange-traded funds marketed under the PredictionShares brand, encompassing six ETFs focused on prediction markets listed on NYSE Arca.

The initial pair of investment vehicles will deliver returns should either a Democrat or a Republican secure victory in the U.S. presidential contest scheduled for November 2028. The subsequent two funds are designed to yield payouts if either Democrats or Republicans gain control of the Senate during the November 2026 elections, while the remaining two will compensate investors based on which party captures the House.

"The fund's investment objective is to provide capital appreciation to investors in the event that a member of the Democratic Party is the winner of the US Presidential election taking place on November 7, 2028," read the prospectus.

Every fund commits a minimum of 80% of its total net assets to binary event contracts, which are political prediction market derivatives that trade on exchanges regulated by the CFTC. Such contracts are structured to settle at a value of $1 when the specified outcome materializes and $0 when it does not.

"In the event that a member of the Democratic Party is not the winner of the 2028 Presidential election, the fund will lose substantially all of its value," it explained.

Betting on a prediction market wrapped in an ETF

Fundamentally, Bitwise is providing distinct exchange-traded funds for every electoral contest — with one designated for each political party — giving investors the ability to select which fund aligns with their outlook.

Each fund's share price on any particular trading day represents the market's calculated probability of that specific outcome taking place, with valuations moving between $0 and $1 influenced by opinion polls, current events, and overall market sentiment.

Fund issuer GraniteShares similarly submitted a prospectus on Tuesday presenting six comparable investment products featuring identical structures tied to US electoral results.

"The financialization and ETF-ization of everything continues," commented Bloomberg ETF analyst James Seyffart.

Not the first prediction market-style ETF filings

"This is not the first filing of this kind, and I think it's extremely unlikely that these will be the last," added Seyffart, in reference to the Roundhill filing for similar funds on Feb. 14.