Founders Fund Completely Exits ETHZilla Position Amid Growing Treasury Strain

Recent SEC disclosures reveal that investment entities associated with Peter Thiel's Founders Fund have completely divested their ETHZilla holdings, eliminating a 7.5% ownership position first reported in 2025.

Investment firms associated with billionaire technology investor Peter Thiel and his Founders Fund have completely divested their stake in Ether treasury firm ETHZilla, based on documents submitted to the United States Securities and Exchange Commission (SEC) on Tuesday.

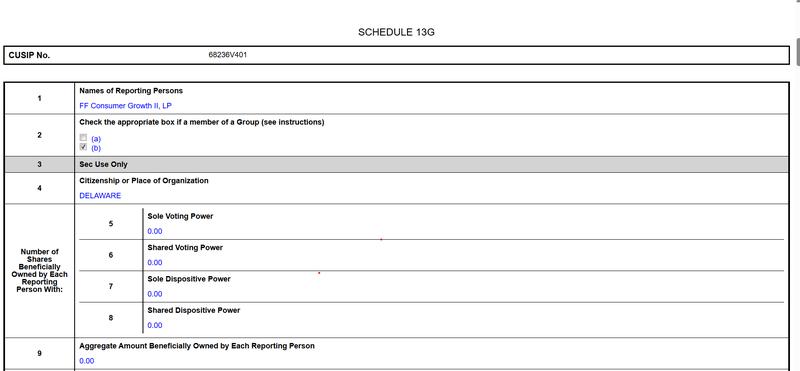

The Thiel-affiliated entities now report zero shareholdings in the company through a 13G amendment submitted on Feb. 17, marking a complete reversal from their prior disclosure of a 7.5% ownership stake filed on Aug. 4, 2025.

During the August disclosure period, the investment group held beneficial ownership of 11,592,241 shares in the entity formerly operating as 180 Life Sciences Corp., accounting for 7.5% of the total 154,032,084 outstanding shares and valued at approximately $40 million given the stock's trading price near $3.50 per share in early August.

180 Life Sciences transforms into ETHZilla

In July 2025, 180 Life Sciences secured $425 million in capital to pivot toward an Ether treasury business model and undergo a corporate rebranding as ETHZilla.

Following the initial capital raise, the firm pursued an additional $350 million through convertible bond offerings in September, aimed at expanding its Ether (ETH) portfolio and allocating these assets into decentralized finance (DeFi) platforms and tokenized asset vehicles, accumulating over 100,000 Ether at its peak.

As cryptocurrency markets experienced a downturn, ETHZilla commenced selling portions of its token reserves, liquidating 24,291 Ether for proceeds of $74.5 million in December 2025 at an average sale price of $3,068.69 per token, using the funds for debt reduction and retaining approximately 69,800 ETH in its treasury.

Mounting challenges for Ether treasury business models

The departure of Thiel's investment represents another concerning indicator for publicly traded corporations maintaining crypto treasury strategies centered on Ether instead of Bitcoin (BTC).

Alternative large-scale Ether accumulation firms are pursuing divergent strategies. BitMine Immersion Technologies, currently the largest publicly listed Ethereum holder, expanded its position by acquiring an additional 40,613 ETH on Feb. 9, increasing total holdings beyond 4.325 million ETH, representing approximately $8.8 billion in value at prevailing market rates.

Conversely, Trend Research initiated a complete divestment of its Ethereum treasury holdings during the current month, liquidating 651,757 ETH for approximately $1.34 billion on Feb. 8, resulting in an estimated realized loss of $747 million.

In response to these challenges, ETHZilla has pursued diversification initiatives, including the establishment of ETHZilla Aerospace, a corporate subsidiary providing tokenized investment exposure to leased aircraft jet engines. Nevertheless, the decision by Thiel to exit completely underscores the heightened volatility and risk associated with Ether-concentrated treasury approaches in a cryptocurrency market environment that continues adjusting from previous year's valuation peaks.