Former executives from FalconX, BVNK, and Optimism join Monad team

The layer-1 blockchain strengthens its institutional crypto and traditional finance expertise through strategic executive appointments as it executes post-launch expansion plans.

Three veteran executives from FalconX, Optimism and BVNK have been recruited by the Monad Foundation as the organization intensifies efforts toward institutional adoption in the wake of its mainnet debut in November.

The foundation has brought on board Urvit Goel, who takes the position of vice president of go-to-market after his tenure at the Optimism Foundation, while Joanita Titan assumes the role of head of institutional growth following her leadership of custody and staking operations at FalconX. Additionally, Sagar Sarbhai has been appointed head of institutions for the Asia-Pacific region, joining from his recent position at BVNK.

The trio of new executives collectively bring experience from major financial and technology institutions including JP Morgan, Deutsche Bank, Anchorage Digital, Fireblocks and Amazon, contributing expertise spanning both traditional financial markets and institutional cryptocurrency infrastructure.

Based on an announcement provided to Cointelegraph, these strategic hires will concentrate their efforts on capital markets strategy development, brand establishment and driving institutional adoption throughout key Asia-Pacific markets such as Hong Kong, Singapore, Japan and South Korea.

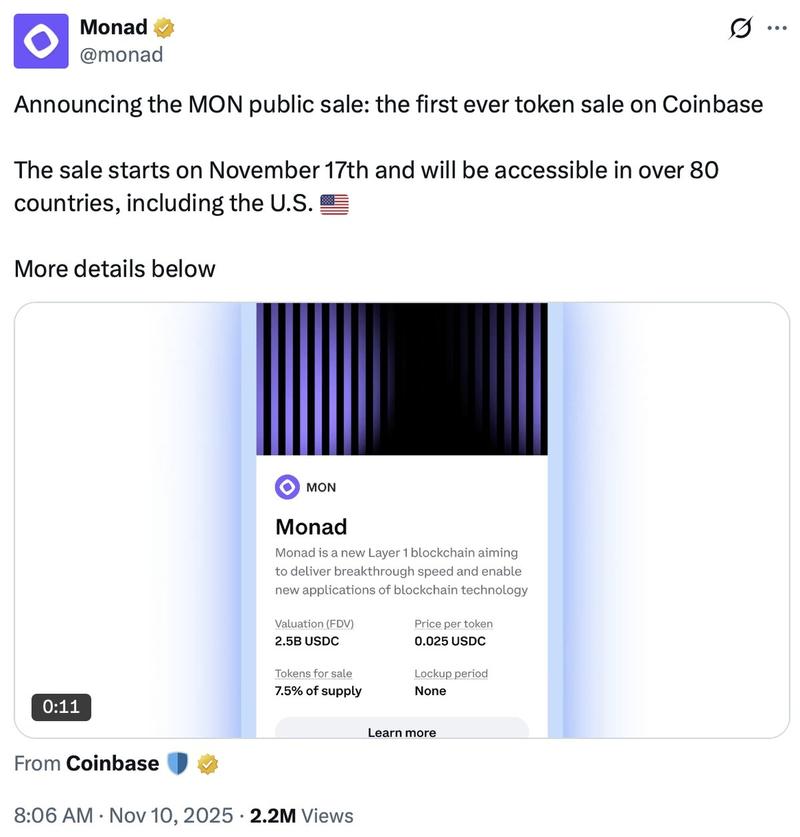

The network's public mainnet went live in November, accompanied by a token offering on Coinbase. Following the launch, the blockchain has accumulated approximately $450 million in stablecoin market capitalization alongside more than $200 million in total value locked within decentralized finance protocols, as reported by the foundation.

According to the network's specifications, it has the capability to handle up to 10,000 transactions per second while achieving sub-second finality, all while maintaining full compatibility with the Ethereum Virtual Machine. The foundation indicated that this technical design specifically targets applications such as high-frequency trading operations and payment processing.

During 2024, Monad Labs, the entity responsible for developing the network, successfully secured $225 million through a funding round with Paradigm serving as the lead investor. Following the mainnet deployment, the Monad Foundation has taken charge of overseeing ecosystem expansion and growth initiatives.

Recent layer-1 launches see steep token declines

The period spanning 2021 through 2023 witnessed a significant wave of layer-1 blockchain launches, with projects including Avalanche (AVAX), Near (NEAR), Aptos (APT), Sui (SUI) and numerous others entering the market, though the frequency of new mainnet deployments has decelerated throughout the past year. Nevertheless, Monad isn't alone among layer-1 blockchains making recent market entries.

Toward the end of 2024, ZetaChain deployed its mainnet with a strategic emphasis on interconnecting multiple cryptocurrency networks while eliminating the need for bridges or wrapped assets. Then in February 2025, the Berachain Foundation activated its EVM-compatible layer-1 platform, allocating nearly 80 million BERA tokens to qualified users through an airdrop with an estimated value of approximately $632 million.

In February 2026, the decentralized exchange Aster revealed that its layer-1 testnet had become available to public users, with plans targeting a mainnet deployment during the first quarter. The project's roadmap details intentions for implementing fiat on-ramps, releasing open-source code and pursuing comprehensive ecosystem development initiatives throughout the course of 2026.

However, not all market participants share optimism about the sustainability of the most recent generation of layer-1 blockchains. In November, cryptocurrency investor Arthur Hayes expressed his view that the majority of newly launched L1 networks are destined to fail, forecasting that only a limited selection of chains, specifically Bitcoin (BTC), Ether (ETH), Solana (SOL) and Zcash (ZEC), will maintain relevance in the long-term landscape.

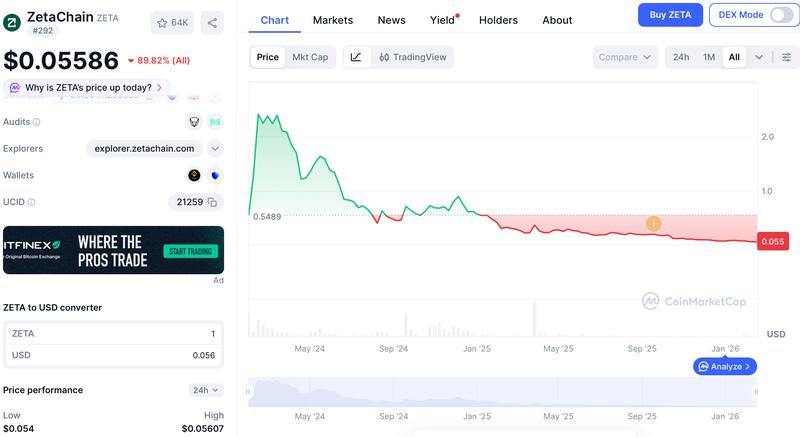

The difficulties confronting emerging blockchain networks are highlighted by recent token price performance data.

Data from CoinMarketCap indicates that ZetaChain's (ZETA) native token has declined approximately 98% from its all-time high valuation, while Berachain (BERA) has experienced a drop of roughly 95%. Meanwhile, Monad's token (MON) is currently trading approximately 52% beneath its peak price, at the time of writing.