Binance holds 65% of CEX stablecoin reserves as outflows cool: CryptoQuant

Withdrawals of stablecoins drop to $2 billion while Binance amasses 65% of centralized exchange liquidity, indicating capital consolidation despite the continuing cryptocurrency bear market.

Withdrawals of stablecoins from centralized crypto exchanges have experienced a dramatic deceleration despite CryptoQuant's metrics continuing to signal fragile market circumstances, an indication that investor funds are consolidating within the ecosystem instead of exiting entirely, according to the analytics firm.

Activity on centralized exchanges (CEXs) has reached a point of stability, with total withdrawals amounting to merely $2 billion throughout the previous month, CryptoQuant revealed in a communication to Cointelegraph on Tuesday.

In comparison, the final months of 2025 witnessed $8.4 billion in withdrawals when the bear market commenced, underscoring the significant reduction in redemption activity, according to Nick Pitto, CryptoQuant's marketing head, in his conversation with Cointelegraph.

Capital isn't rushing out of crypto right now; it's consolidating, particularly on Binance

Nick Pitto, CryptoQuant marketing head

Pitto went on to explain that this trend would only shift to bullish territory when reserves start to increase or when capital gets allocated into higher-risk assets.

Binance holds 65% of CEX stablecoin reserves in USDT and USDC

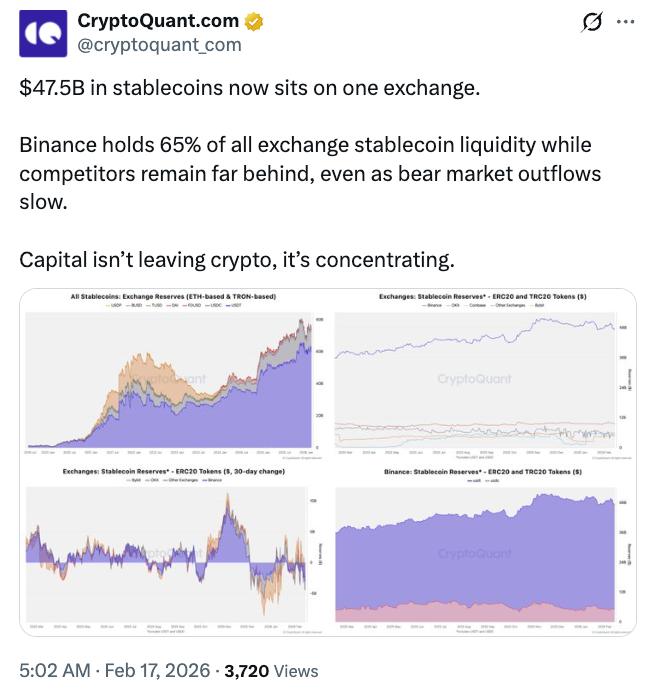

Based on CryptoQuant's analytics, Binance continues to serve as the dominant center for stablecoin liquidity, maintaining $47.5 billion in Tether's USDt (USDT) and Circle's USDC (USDC), which are the two most prominent stablecoins measured by market capitalization.

This amount represents 65% of the combined USDT and USDC balances held across all CEXs, marking a 31% increase from the $35.9 billion recorded one year earlier.

Leading exchanges including OKX, Coinbase and Bybit trail significantly behind Binance when it comes to stablecoin reserves, with OKX securing the second position at 13% and $9.5 billion.

Coinbase and Bybit represent 8% and 6%, respectively, maintaining reserves totaling $5.9 billion and $4 billion.

Capital isn't leaving crypto, it's concentrating.

CryptoQuant

Binance's stablecoin liquidity is mainly driven by USDT

Binance's holdings of stablecoins are predominantly composed of USDT, with the platform maintaining $42.3 billion in the stablecoin, in contrast to $5.2 billion in USDC.

The platform has expanded its USDT liquidity by 36% on a year-over-year basis, whereas USDC reserves have largely stayed flat.

Notwithstanding the deceleration in stablecoin withdrawals, which points toward possible market consolidation, CryptoQuant cautioned that Bitcoin (BTC) could still experience additional downside before hitting its ultimate low point.

Analysts from CryptoQuant reiterated last week that Bitcoin's realized price support level continues to hover near $55,000 and has yet to undergo a test.

Bitcoin's ultimate bear market bottom is around $55,000 today

CryptoQuant

As of the time of publication, Bitcoin was changing hands at $68,206, representing a decline of approximately 1.3% during the past 24 hours, based on CoinGecko data.