BTC struggles beneath $70K threshold while negative funding rates signal market concerns

A negative funding rate for Bitcoin combined with weakening momentum in US technology stocks creates market headwinds, keeping BTC price action contained under the $70,000 level.

Key takeaways:

Funding rates for Bitcoin futures momentarily dipped into negative territory, demonstrating that optimistic market participants are presently hesitant to employ leveraged positions.

Questions surrounding the extended-term returns on artificial intelligence investments have driven market participants toward US government bonds and gold.

Bitcoin (BTC) was unable to break back above the $70,000 threshold on Tuesday after S&P 500 futures experienced a pullback. Market participants are expressing concern that returns on artificial intelligence sector investments may require extended periods to materialize, creating downward pressure on shares of Nvidia (NVDA US), Apple (AAPL US), and Google (GOOGL US) on Friday. A pessimistic sentiment in Bitcoin futures markets became evident, prompting market participants to anticipate additional declines.

On Monday, the annualized funding rate for BTC futures temporarily moved into negative territory, demonstrating insufficient appetite for leveraged bullish positions. During normal market conditions, this metric generally fluctuates between 6% and 12%; as a result, hesitancy from optimistic traders has characterized the previous week. The recent outperformance of precious metals has additionally fueled frustration among Bitcoin market participants.

Gold and silver have distinguished themselves as decisive outperformers throughout the last two months as equity markets transitioned into a consolidation phase. The technology sector's upward trajectory has stalled as certain market analysts contend that valuations have grown too stretched, whereas others maintain that productivity improvements delivered by AI are beginning to bear fruit. Irrespective of which perspective proves accurate, market participants pursued safety in government bonds.

The 10-year US Treasury yields have fallen to their weakest points since November 2025, demonstrating that appetite for these government securities has grown. This development does not inherently suggest greater faith in the Federal Reserve's approach to preventing a recession while controlling inflation. Indeed, the US dollar has lost ground relative to a collection of international currencies, as illustrated by the DXY index.

Dario Amodei, co-founder and CEO of Anthropic, purportedly commented on Friday that revenue generation from AI investments is improbable to materialize within the coming years. As reported by Fortune, he cautioned that deploying enormous capital to construct data centers at an accelerated pace could prove "ruinous."

Amodei further observed that achieving $10 trillion of compute by mid-2027 is unattainable given existing capacity limitations. This ambiguity within the technology sector has driven market participants toward more conservative positioning.

Bitcoin options market stabilizes as macroeconomic uncertainty lingers

Appetite for neutral-to-pessimistic approaches utilizing BTC options has remained relatively flat throughout the past week. The alarm that followed the surprising plunge to $60,200 on Feb. 6 has mostly dissipated, though market participants remain considerably distant from adopting a bullish stance.

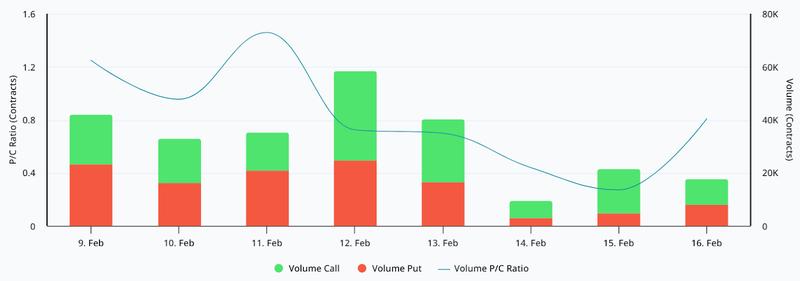

On Monday, the put-to-call ratio for BTC options at Deribit registered at 0.8x, reflecting equilibrium between put (sell) and call (buy) instruments. This measurement stands in stark contrast to the 1.5x reading observed last Wednesday, a threshold generally considered bearish. Although it will probably require several weeks for optimistic traders to restore complete confidence, current Bitcoin derivatives indicators demonstrate no evidence of distress among market participants.

Market participants may have chosen to exercise greater prudence, electing to secure gains following Bitcoin's approach toward the $70,000 level. This conservative approach was magnified as both US and Chinese markets remained shuttered for holidays on Monday. Based exclusively on the negative BTC futures funding rate, there exists no definitive signal that Bitcoin faces inevitable further declines. Nevertheless, establishing sustained optimistic momentum will probably hinge on a decrease in macroeconomic uncertainty.