Asset management powerhouse Apollo makes foray into digital asset lending through Morpho partnership

A major asset manager overseeing $940 billion in assets is partnering on decentralized finance lending systems and may purchase as many as 90 million MORPHO tokens.

Apollo Global Management Inc., a major player in conventional finance, has entered into a collaboration deal with Morpho, a decentralized lending platform, to acquire a substantial position in the protocol while providing support for its blockchain-based lending systems.

Friday brought the announcement from the Morpho Association, which serves as the nonprofit entity overseeing the decentralized finance (DeFi) platform.

Through this collaboration, described as a "cooperation agreement," Apollo or entities affiliated with it will purchase as many as 90 million Morpho (MORPHO) governance tokens across the coming four-year period, which accounts for 9% of MORPHO's complete supply of 1 billion tokens.

"Under the Agreement, Apollo or its affiliates may acquire MORPHO tokens through a combination of open-market purchases, OTC transactions, and other contractual arrangements, subject to an overall ownership cap of 90 million MORPHO tokens over a 48-month period as well as transfer and trading restrictions," the Morpho Association said.

According to the Morpho Association, the organizations will additionally collaborate to "support onchain lending markets on Morpho's protocol," though they did not elaborate on specific details.

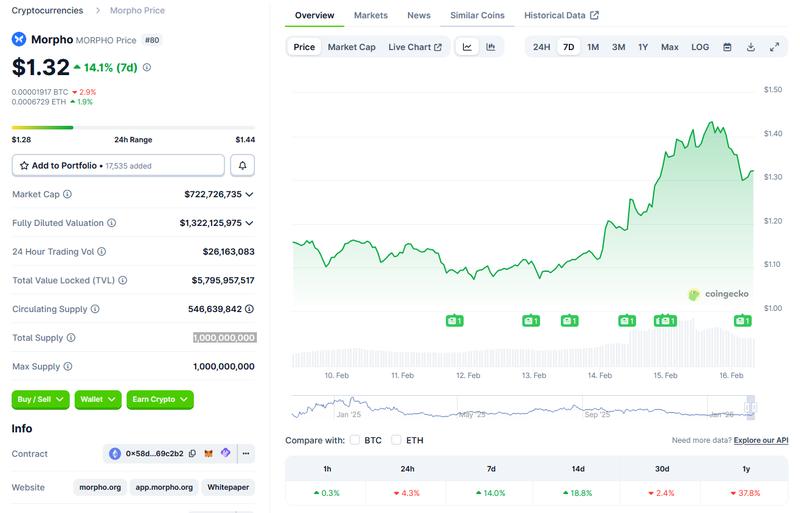

Following this announcement, MORPHO's price experienced a 17.8% increase throughout the weekend, climbing from approximately $1.12 on Friday to $1.32 as of this writing, based on CoinGecko data.

That said, the token has experienced a 38% decline across the last 12 months during a wider downturn in cryptocurrency markets.

Within the DeFi ecosystem, Morpho ranks as the sixth-largest protocol by market position, boasting $5.8 billion in total value locked, per DeFi Llama's metrics. The platform's core offerings include lending markets alongside curated investment vaults designed to help investors generate yield.

This agreement with Apollo, an international asset management firm holding close to $940 billion in assets under management, represents yet another major collaboration that Morpho has successfully established in the past several months.

Toward the end of January, Cointelegraph covered how digital asset management firm Bitwise had partnered with the platform to offer curated vaults delivering a 6% annual yield through Morpho. In the previous week, Lombard, a Bitcoin DeFi project, also revealed that Morpho had joined as an initial liquidity partner in connection with its Bitcoin Smart Accounts launch.

At the same time, Apollo has been steadily increasing its involvement with cryptocurrency and blockchain technology. During the previous year, the company formed a partnership with Coinbase to build stablecoin credit strategies and committed an undisclosed sum to Plume in support of its real-world-asset tokenization infrastructure.