xStocks Platform from Kraken Surpasses $25 Billion Trading Volume, Attracts Over 80,000 On-Chain Users

Tokenized representations of United States equities on blockchain networks are experiencing surging participation from investors, marked by rapid expansion in on-chain wallet adoption and multi-platform trading activity.

In fewer than eight months following its introduction, xStocks, the tokenized stock platform operated by Kraken, has exceeded $25 billion in aggregate transaction volume, highlighting the rapid uptake as the tokenization trend captures attention from conventional market participants.

According to Thursday's announcement from Kraken, the $25 billion metric encompasses trading executed on both centralized and decentralized exchange platforms, in addition to token minting and redemption operations. This achievement marks a 150% surge compared to November, when the platform initially achieved $10 billion in total transaction volume.

Backed Finance, a regulated provider of digital assets, issues the xStocks tokens as 1:1 backed tokenized versions of publicly listed equities and exchange-traded funds. While Kraken functions as a principal venue for distribution and trading activities, Backed handles the structuring and issuance of these tokenized financial instruments.

At the time of its 2025 launch, xStocks made available more than 60 tokenized equity offerings, featuring tokens linked to prominent US technology corporations such as Amazon, Meta Platforms, Nvidia and Tesla.

According to Kraken, on-chain engagement has served as a critical catalyst for expansion since the platform's inception, with xStocks recording $3.5 billion in on-chain transaction volume and accumulating more than 80,000 distinct on-chain holders.

In contrast to transactions confined exclusively to the internal ledgers of centralized trading platforms, on-chain operations execute directly on publicly accessible blockchain networks, providing transaction transparency and enabling wallet holders to maintain self-custody of their digital assets.

The expansion of on-chain user engagement indicates that participants are doing more than simply exchanging tokenized stocks—they are also incorporating these assets into the wider decentralized finance (DeFi) infrastructure.

According to Kraken's announcement, eight among the 11 most widely held tokenized equity instruments by unique holder numbers are now included within the xStocks platform, demonstrating growing dominance in the burgeoning tokenized stock marketplace.

Tokenized stocks mirror stablecoins' early growth

The tokenization of real-world assets (RWAs) continues to represent one of the most rapidly expanding categories within the digital asset industry, despite broader cryptocurrency valuations trending downward since the beginning of the year.

Based on industry metrics, tokenized RWAs have registered a 13.5% increase in aggregate value during the preceding 30 days. In contrast, the wider cryptocurrency marketplace experienced approximately $1 trillion in market capitalization decline throughout the identical timeframe.

Industry analysts suggest that tokenized equities may be undergoing their own "stablecoin moment," drawing parallels to the swift initial acceptance that drove dollar-backed digital currencies into widespread adoption.

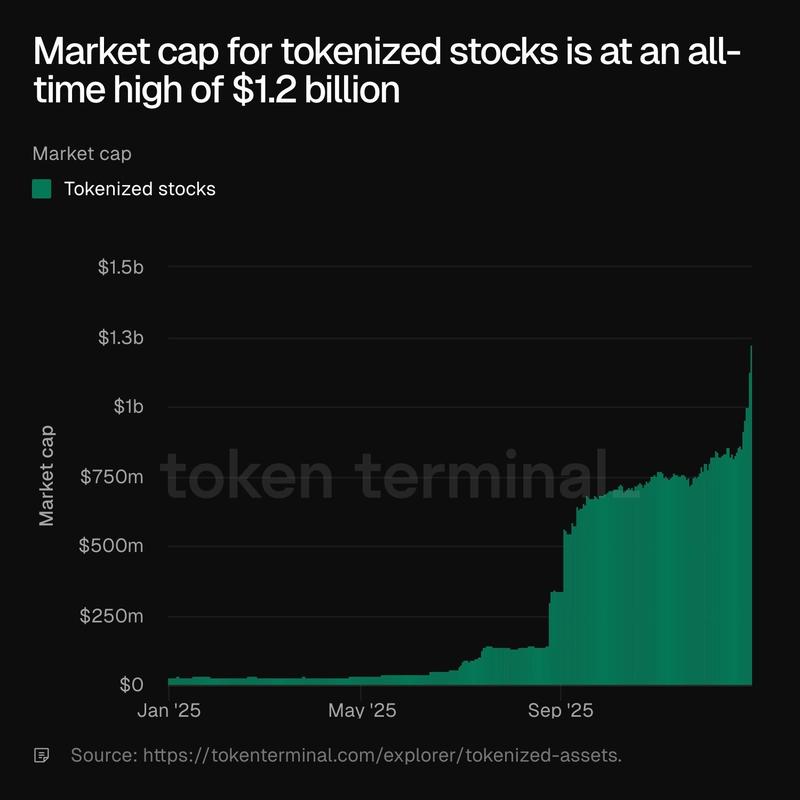

Information from Token Terminal indicates that tokenized stock instruments attained a market capitalization of $1.2 billion in December, having been essentially absent from the market just six months prior.