WLFI, Trump Family-Backed Venture, Set to Launch Currency Exchange and Money Transfer Service: Sources

The new service aims to secure a share of the foreign exchange market's massive daily trading volume exceeding $9.6 trillion.

On Thursday, World Liberty Financial (WLFI), a decentralized finance (DeFi) initiative supported by US President Donald Trump's family, revealed plans to introduce foreign currency exchange (FX) and remittance capabilities for platform users.

According to Reuters, the forthcoming foreign exchange and money transfer platform, dubbed World Swap, aims to compete with established remittance and FX providers by offering reduced fees and an enhanced user experience.

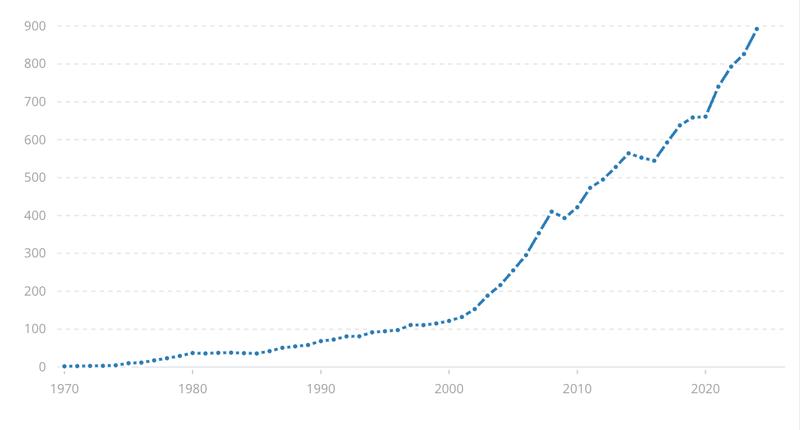

Data from the Bank of International Settlements (BIS) indicates that global FX trading volume exceeded $9.6 trillion daily in April 2025, while World Bank statistics show the personal remittances market reached an annual volume of more than $892 billion in 2024.

The company has not provided a specific timeline for when the service will launch. Cointelegraph attempted to contact World Liberty Financial for comment but had not received a reply at the time of publication.

This move into FX and remittances comes after WLFI submitted an application for a national trust bank charter in January and introduced World Liberty Markets, a platform for lending, as the company continues its expansion while drawing scrutiny from Democratic members of Congress.

World Liberty Financial under investigation over foreign investment connections

A Wall Street Journal article published in January disclosed that an investment entity based in the United Arab Emirates acquired a 49% ownership stake in WLFI for $500 million, just four days prior to Trump's inauguration on Jan. 20, 2025.

Sheikh Tahnoon bin Zayed Al Nahyan, the United Arab Emirates National Security Advisor, backs the investment entity known as Aryam Investment 1.

Democratic Representative Ro Khanna launched an investigation into WLFI and the transaction following the report's release.

This is about public trust and transparency, stated the California congressman.

Trump claimed he had no awareness of the transaction.

My sons are handling that — my family is handling it, Trump stated, continuing,

I guess they get investments from different people.

Nevertheless, Democratic legislators expressed serious concerns regarding the transaction during a Wednesday hearing before the US House Committee on Financial Services.

Representatives Stephen Lynch of Massachusetts and Maxine Waters of California described the transaction as a possible threat to national security that could enable the president's administration to leverage influence and participate in foreign pay-to-play arrangements.