Truflation's Real-Time Data Reveals Dramatic US Inflation Decline as Federal Reserve Holds Rates

Live inflation tracking via Truflation indicates declining price pressures across the United States, potentially altering Federal Reserve policy outlook and affecting digital asset and broader risk markets.

Non-traditional inflation metrics are indicating a significant decline in pricing pressures throughout the United States, strengthening arguments for monetary policy easing and holding wider ramifications for risk-oriented assets, cryptocurrencies among them.

Following the Federal Reserve's decision to hold rates steady last week and its communication that immediate rate reductions are unlikely, live inflation monitoring suggests central bank officials may not be aligned with swiftly improving inflationary dynamics.

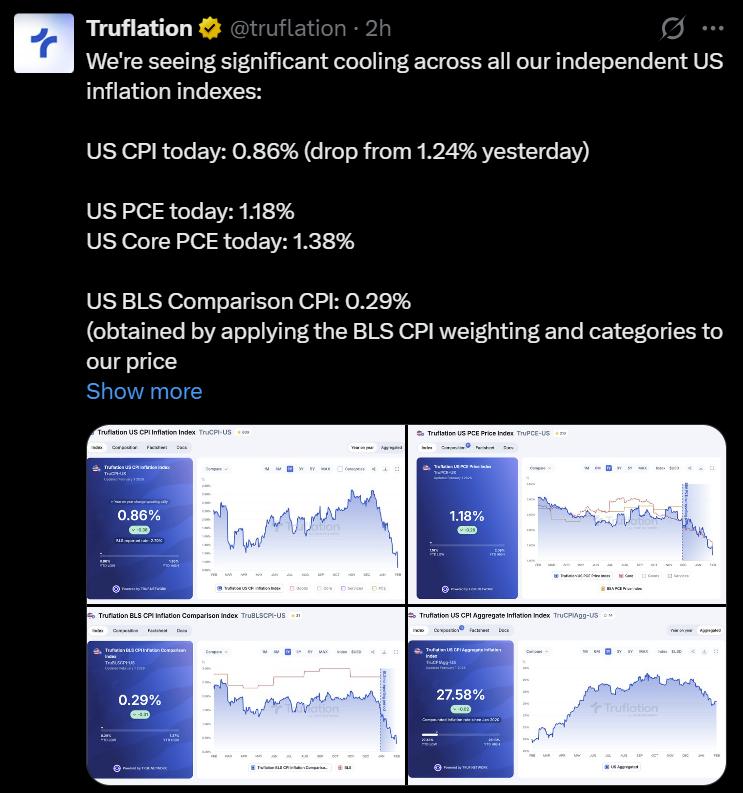

An alternative inflation monitoring system called Truflation, which compiles millions of daily pricing data points sourced from dozens of independent data suppliers, demonstrated widespread deceleration throughout its United States inflation measurements.

By Sunday's reading, Truflation's measurement of the US Consumer Price Index (CPI) registered 0.86% on a year-over-year basis, representing a decline from the prior day's figure of 1.24%.

The service's calculation of core personal consumption expenditures (PCE), which serves as the Federal Reserve's primary inflation metric, measured 1.38%, notably beneath the central bank's established 2% objective.

"All our indexes are calculated daily as a year-over-year percentage rate, using millions of data points from tens of data providers," Truflation said Sunday.

These measurements present a striking divergence from official governmental statistics, which indicated yearly CPI reaching 2.7% during December and core PCE standing at 2.8% throughout November.

As reported recently by Cointelegraph, the Federal Reserve's path regarding interest rates carries substantial consequences for the United States dollar, worldwide liquidity circumstances and financial markets broadly. Monetary policy easing is commonly interpreted as creating challenges for dollar strength, a relationship that has traditionally benefited risk-oriented assets including Bitcoin (BTC) and the wider cryptocurrency ecosystem.

US dollar hangs in the balance

Current market indicators point toward the possibility that the United States dollar may be nearing a critical juncture, with technical chart patterns and fundamental structural elements playing an increasingly important role in determining its direction independent of Federal Reserve policy decisions.

The US Dollar Index, a measure tracking dollar strength relative to a collection of six major global currencies, recently recorded a weekly closing price beneath a significant long-duration support threshold that had remained intact for over ten years, based on information from Barchart. This technical breach may indicate additional downward pressure should the breakdown prove durable.

Investors focused on macroeconomic trends have consistently maintained that dollar weakness represents not merely an acceptable outcome but a preferred scenario given present economic conditions. Real Vision founder Raoul Pal has stated in the past that "everyone needs and wants a weaker dollar to service their dollar debts," especially within a worldwide financial architecture that depends extensively on obligations denominated in US dollars.

Pal has additionally contended that diminished dollar strength corresponds with the Trump administration's overarching economic expansion goals, including initiatives connected to fiscal policy and industrial strategy, given that currency weakness generally produces looser financial conditions and bolsters international liquidity flows.