Traditional banking and cryptocurrency sectors may converge with similar offerings, Bessent indicates

Treasury Secretary Scott Bessent indicates the banking and cryptocurrency industries could converge to provide comparable products, while committing to address deposit flight issues blocking crucial crypto legislation.

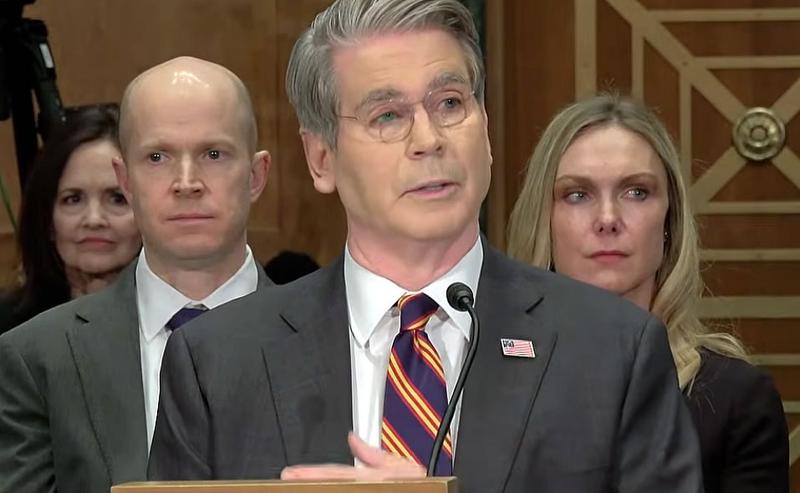

Scott Bessent, serving as US Treasury Secretary, informed congressional members that the lines between traditional banking offerings and cryptocurrency services could blur as the industries evolve together in coming years.

During his Thursday appearance before the Senate Banking Committee, Bessent fielded questions from Senator Cynthia Lummis, a Republican, who inquired about the possibility of traditional banking institutions and the crypto sector eventually providing identical product categories.

"I think that can happen over time," Bessent said. "We've actually been working with small and community banks to discuss how they can be part of the digital asset revolution."

Bessent tells those resisting regulations to move to El Salvador

According to Bessent, moving forward without establishing clear regulatory guidelines for cryptocurrency would be "impossible to proceed," urging the industry to support the pending crypto market structure legislation known as the CLARITY Act currently under congressional consideration.

"We have to get this CLARITY Act across the finish line, and any market participants who don't want it should move to El Salvador."

"We've got to bring safe, safe, sound, and smart practices and the oversight of the US government, but also allow for the freedom that is crypto," Bessent said. "I think it's a balance that is being worked out."

Working to prevent bank deposit volatility

Progress on the crypto market structure bill has reached an impasse within the Senate Banking Committee, with bipartisan negotiations concerning specific provisions in the legislation currently deadlocked.

Congressional members have pushed for the inclusion of limitations on yields offered by stablecoins, provisions that certain crypto firms, particularly Coinbase, have opposed. According to Bessent, volatility in deposits is "very undesirable" given that the stability of these deposits enables banks to provide loans to their local communities.

"We will continue to work to make sure that there is no deposit volatility associated with this," he said.

Reports this week indicated that multiple cryptocurrency firms have put forward compromise proposals, recommending an expanded role for community banks within the stablecoin framework as a means to advance the bill's passage through the Senate.