Strong Public Backing Fuels Israel's Cryptocurrency Sector Campaign for Regulatory Overhaul

A KPMG analysis suggests that overhauling Israel's cryptocurrency regulations could contribute $38 billion to the nation's economy and generate 70,000 employment opportunities.

A major lobbying campaign aimed at driving regulatory reform was initiated last week by the Israeli Crypto Blockchain & Web 3.0 Companies Forum, with KPMG research indicating the potential to inject 120 billion shekels ($38.36 billion) into Israel's economy by 2035 while generating 70,000 employment opportunities.

During a Tel Aviv gathering held on Feb. 3, Forum leader Nir Hirshman-Rub emphasized widespread public backing for legislative measures that would ease restrictions on stablecoins and tokenization, while also streamlining tax compliance obligations.

Following the US-mediated ceasefire agreement in the Gaza conflict, Hirshman-Rub characterized 2026 as a "defining year" for Israel's digital assets sector.

"The public in Israel has already embraced this technology, and now political leaders must take action," Hirshman-Rub explained to Cointelegraph during the Tel Aviv event. "Over 25% of the population has engaged in cryptocurrency transactions within the past five years, and more than 20% are currently holding digital assets," he noted, referencing the KPMG study.

Consistent expansion as the digital asset sector transforms

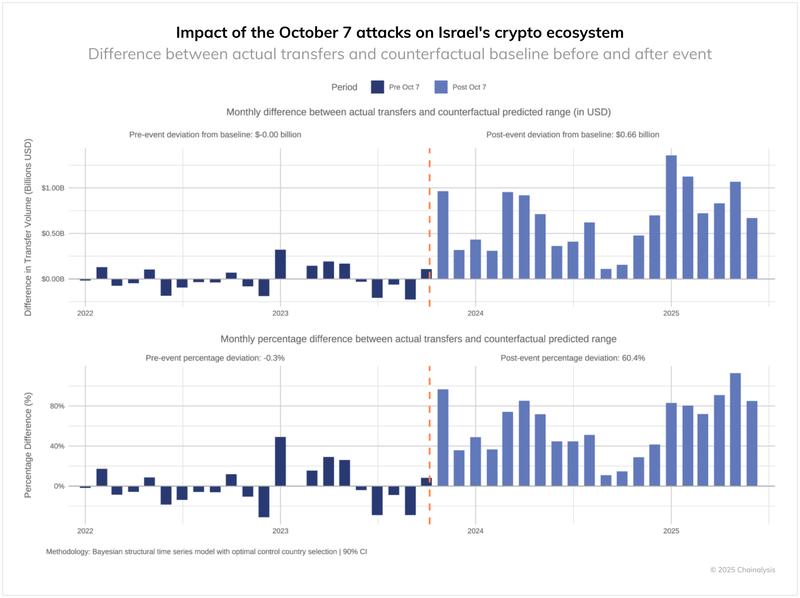

A Chainalysis report released in October demonstrated that the crypto economy in this G-20 nation has experienced consistent expansion, with inflows exceeding $713 billion over the past year. These figures indicate a substantial surge in cryptocurrency trading volumes following the Hamas attacks in October 2023, which were maintained through robust retail participation, according to the report.

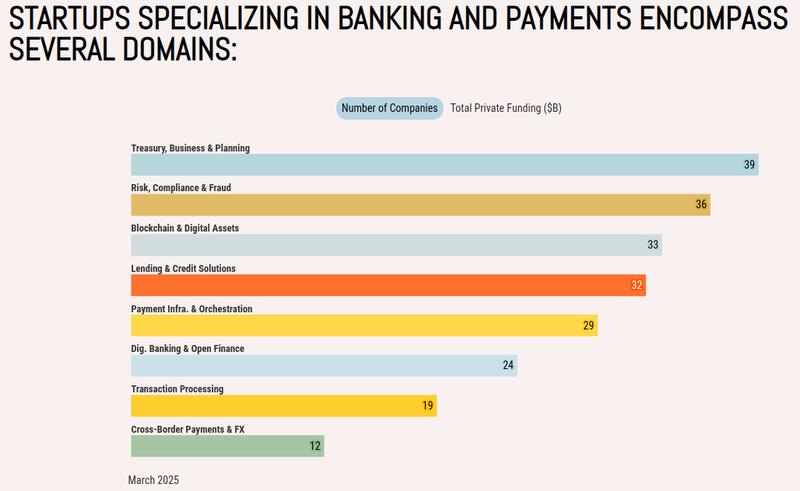

Companies based in Israel, including Fireblocks and Starkware, have secured leading roles in the worldwide digital assets sector and count among the Forum's sponsors. Data from NGO Startup Nation Central indicates that over 160 companies founded locally have captured more than 5% of the $30 billion in global sector investment, with a workforce exceeding 2,500 individuals, predominantly concentrated in the greater Tel Aviv region.

"The challenge lies in the fact that when a company here reveals its involvement with digital assets, banks in Israel either refuse to provide services to that company or demand that the company's legal counsel make an unfeasible declaration guaranteeing that no funds derived from digital assets will be deposited into Israeli bank accounts," explained Hirshman-Rub. "It might not always be an explicit rejection, but rather a process of delay, continually adding requirements in what becomes an endless due diligence cycle."

Another obstacle the organization aims to address involves an income tax ordinance that imposes penalties on token distribution to employees when structured as stock options. Traditional stock options granted to employees face taxation at a 25% rate, whereas tokenized options are subject to a 50% tax rate for equivalent value.

A comprehensive national approach

In July, the National Crypto Strategy Committee of the country delivered an interim report to the Israeli Knesset for legislative examination. The committee laid out a strategic blueprint supported by five fundamental pillars, encompassing the establishment of a single regulator, developing rules for token issuance, and achieving banking sector integration.

In August, a new Voluntary Disclosure Procedure was released by the Israel Tax Authority, providing taxpayers with an opportunity to reveal previously undisclosed income and assets, including digital assets, while receiving immunity from criminal prosecution. This marked the agency's third effort to establish a disclosure framework.

Nevertheless, the agency announced last month that taxpayer engagement has thus far been below anticipated levels, though it pledged to continue the initiative until the conclusion of August 2026.

"The Israeli banking system is not willing to accept cryptocurrency, and it is also very difficult to bring in funds as a result of selling cryptocurrency. There is no doubt that this also affects the willingness to make voluntary disclosure, because in the end people do not just want to pay the tax, but to use the money."

Tax Authority director Shay Aharonovich