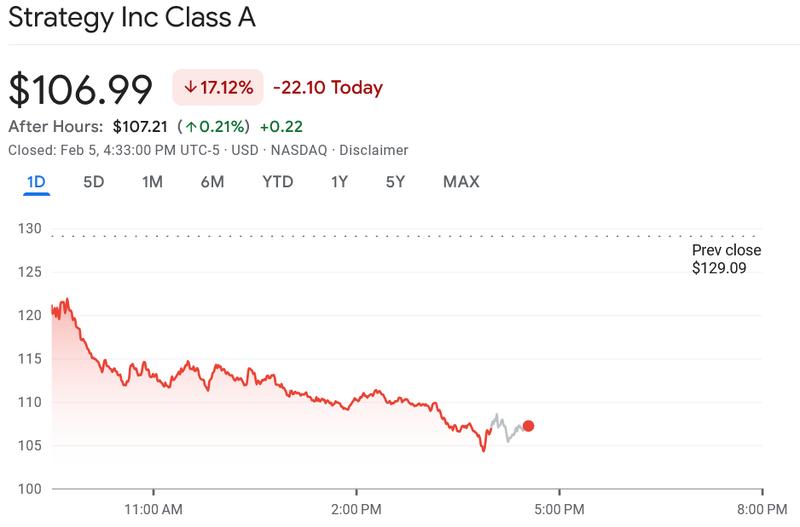

Strategy Posts $12.4B Q4 Deficit as Bitcoin Decline Triggers 17% Share Drop

Despite experiencing a 17.5% decline on Bitcoin investments, Strategy leaders Phong Le and Andrew Kang maintain the firm remains financially robust.

Strategy, the prominent Bitcoin acquisition firm, disclosed a net deficit of $12.4 billion for the final quarter of 2025, primarily attributed to a 22% decline in Bitcoin's value throughout the three-month period.

The cryptocurrency Bitcoin (BTC) achieved an all-time high of $126,000 in the beginning of October, before experiencing a significant downturn during the quarter that concluded on Dec. 31, dropping below $88,500. Year-to-date, Bitcoin has declined 30% to its current price of $64,500, now trading beneath Strategy's average acquisition cost of $76,052 per BTC.

On Thursday, Strategy (MSTR) announced that notwithstanding the substantial loss, fourth-quarter revenues increased by 1.9% on a year-over-year basis to reach $123 million, with growth partially attributed to its business intelligence division, though the recent cryptocurrency market downturn resulted in shares closing 17% lower on Thursday at $107.

The most recent Bitcoin price drop drove the cryptocurrency down to a Thursday low of $62,500, resulting in Strategy experiencing a 17.5% unrealized loss across its holdings of 713,502 Bitcoin.

Finance chief asserts Strategy maintains strong financial position

Notwithstanding the substantial quarterly deficit, Andrew Kang, Strategy's chief financial officer, declared in an official statement that the organization's capital structure is currently "stronger and more resilient today than ever before."

"Strategy has built a digital fortress anchored by 713,502 Bitcoins and our shift to Digital Credit, which aligns with our indefinite Bitcoin horizon."

During the fourth quarter, the corporation increased its cash reserves to $2.25 billion, providing sufficient liquidity for dividend distributions over a 30-month period, demonstrating financial resilience despite prevailing market challenges.

Additionally, Strategy faces no significant debt obligations coming due until 2027, which means the company is not facing immediate pressure to settle outstanding borrowings and is unlikely to be compelled to sell off Bitcoin assets to satisfy financial commitments in the immediate future.

During an earnings conference call with investors, Strategy's chief executive officer Phong Le emphasized that there is no justification for concern regarding the corporation's financial health and its Bitcoin acquisition strategy.

I'm not worried, we're not worried, and no, we're not having issues.

Le pointed out that Strategy's enterprise valuation continues to exceed its $45 billion Bitcoin holdings and emphasized that the company's $8.2 billion in convertible debt instruments represents merely approximately 13% net leverage, which falls below the leverage ratios of most companies listed in the Standard & Poor's 500 index.