Stacks Integration Coming to Fireblocks Platform for Enterprise Bitcoin DeFi Access

Bitcoin's approximately 10-minute block time presents significant obstacles for the implementation of decentralized finance solutions.

On Wednesday, Fireblocks, a company specializing in institutional-grade cryptocurrency infrastructure, made an announcement regarding its plans to integrate Stacks, which functions as a decentralized finance (DeFi) layer built on top of the Bitcoin protocol. This integration aims to provide institutional customers with opportunities for lending and generating yields.

According to a Stacks spokesperson who spoke with Cointelegraph, the integration works around Bitcoin's 10-minute block time constraint by utilizing the Stacks blockchain, which processes blocks with an average time of approximately 29 seconds.

Every transaction processed on Stacks ultimately settles onto the Bitcoin ledger to achieve finality. According to the Stacks spokesperson, eliminating the 10-minute BTC block time obstacle addresses one of the primary concerns frequently raised by financial institutions considering the adoption of Bitcoin-based DeFi applications.

Fireblocks stated that the integration is scheduled to launch in "early" 2026, though the company did not provide a specific date for when the rollout will be completed.

This partnership between Fireblocks and Stacks demonstrates ongoing institutional appetite for Bitcoin DeFi products, even as the market experiences a downturn that has seen the Bitcoin (BTC) price decline approximately 40% from its record high of over $125,000 that was achieved in October 2025.

Bitcoin DeFi: the future of onchain finance?

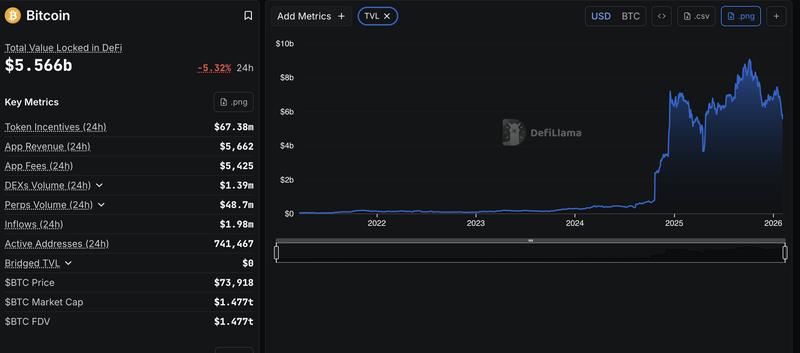

According to data from DeFiLlama, approximately $5.5 billion in total value locked (TVL) existed within Bitcoin-based DeFi applications at the time of writing.

DeFiLlama data shows that TVL in Bitcoin DeFi applications started climbing in October 2024, jumping from approximately $704 million to more than $9 billion by October 2025, then falling back to present levels.

By comparison, approximately $103 billion represented the total value locked throughout the entire crypto ecosystem at the time of publication.

Advocates of Bitcoin DeFi argue that applications constructed on the Bitcoin protocol will ultimately supplant the traditional financial system with decentralized alternatives that make financial access more democratic.

BitWise investment company's chief investment officer, Matt Hougan, predicted that the Bitcoin DeFi sector has the potential to expand into a $200 billion market.

Nevertheless, according to Markus Bopp, the CEO of crypto infrastructure company Trac Systems, the expansion of second-layer solutions on Bitcoin along with decentralized finance applications developed on top of the protocol may pose risks to the decentralization of the base layer.