Solana RWAs Get Instant Stablecoin Conversion Through New Multiliquid-Metalayer Partnership

A newly established facility enables institutional investors to convert tokenized real-world assets into stablecoins without delay, solving a critical liquidity challenge in blockchain-based markets.

A new institutional liquidity facility designed to enable immediate redemptions for tokenized real-world assets (RWAs) on Solana has been unveiled through a partnership between Multiliquid and Metalayer Ventures.

Asset holders can now immediately exchange their tokenized positions for stablecoins through this facility. Metalayer Ventures handles the raising and management of capital, while Uniform Labs, the company responsible for developing the Multiliquid protocol, delivers infrastructure support and market operations, as stated in an announcement provided to Cointelegraph.

Traditional finance has repo markets, prime brokerage and overnight lending facilities. Tokenized markets have had nothing comparable, until now. This is the liquidity infrastructure that institutional RWA markets will require at scale.

Will Beeson, founder and CEO at Uniform Labs

The Bank for International Settlements issued a warning last year highlighting that tokenized money market funds encounter liquidity mismatches with the potential to magnify stress during times of heightened redemption demand.

Standing buyer delivers instant RWA liquidity

Operating as a permanent buyer for tokenized RWAs, Metalayer's facility acquires assets at a dynamic discount relative to net asset value.

While Metalayer Ventures furnishes and oversees the capital that backs redemptions, Multiliquid delivers the smart contract infrastructure utilized for pricing mechanisms, compliance enforcement and transaction settlement.

Initially, the vehicle will accommodate tokenized assets from issuers such as VanEck, Janus Henderson and Fasanara, encompassing tokenized Treasury funds along with selected alternative investment products.

Solana gains ground in tokenized RWAs

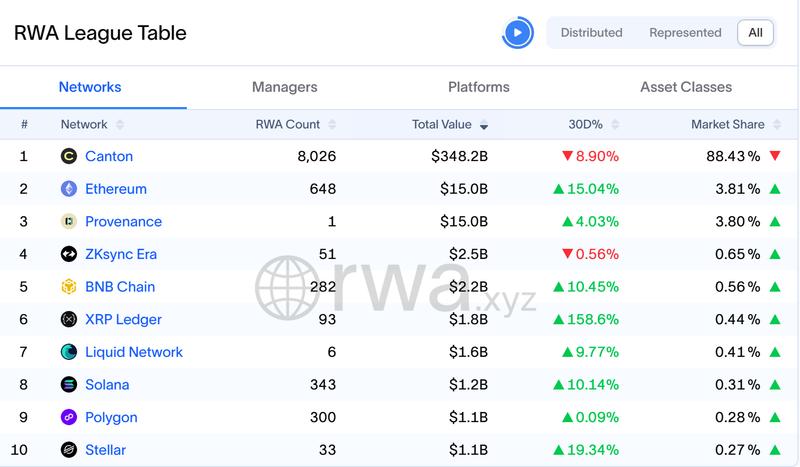

As a platform for tokenized RWAs, Solana (SOL) has developed into an increasingly significant venue. With approximately $1.2 billion represented across 343 assets, it holds the eighth position among blockchains by total RWA value, based on RWA.xyz data. Despite its market share remaining relatively modest at 0.31%, Solana demonstrates consistent momentum, having experienced RWA value growth exceeding 10% over the past month.

The three largest blockchains for tokenized RWAs measured by total value are Canton Network, Ethereum (ETH) and Provenance.

With more than $348 billion in RWAs and over 88% market share, Canton dominates the market. Holding $15 billion in tokenized assets, Ethereum ranks second, while Provenance also maintains $15 billion with fewer assets.