Solana faces downward pressure to $50 while blockchain metrics suggest potential floor

Technical analysis across various timeframes suggests SOL is positioned for a decline to $50 in the near term. Can the "extreme" readings on SOL's MVRV indicator act as a safeguard against further depreciation?

The price action for Solana's SOL (SOL) token has remained under significant selling pressure following its sharp decline to $67 on Feb. 6. Currently trading more than 72% beneath its peak of $295, multiple indicators point to the possibility that further losses could materialize.

Key takeaways:

- Technical chart patterns for Solana indicate a bearish trajectory targeting $50.

- MVRV band analysis points to a potential bottom formation for SOL, though this signal stands as an anomaly.

- Consistent inflows into spot Solana ETFs demonstrate ongoing investor appetite, offering potential for near-term price stabilization.

Technical chart analysis points to $50 target for SOL

The most recent price decline for Solana has resulted in the breach of critical support zones, establishing a head-and-shoulders (H&S) formation visible on the weekly timeframe.

A chart analysis from cryptocurrency trader Bitcoinsensus revealed SOL confirming a H&S technical pattern, suggesting additional downward movement may be forthcoming.

"The next level of support sits around the $50-$60 area."

Analysis of the two-day timeframe reveals that SOL had breached the H&S pattern's neckline at the $120 level on Jan. 30. Using traditional pattern measurement methodology—which involves measuring the distance from the head to the neckline and projecting it downward from the breakdown point—the target arrives at $57, which would represent an additional 30% decline from current price levels.

Taking a closer look, price action was testing support established by the lower boundary of a bearish flag formation at the $80 level on the daily timeframe, according to the chart presented below.

Should the daily candle close beneath the $80 threshold, it would validate the bearish flag pattern, creating a pathway for further depreciation toward the pattern's measured objective of $48. This scenario would translate to total losses reaching 41%.

MVRV pricing bands suggest Solana may be bottoming

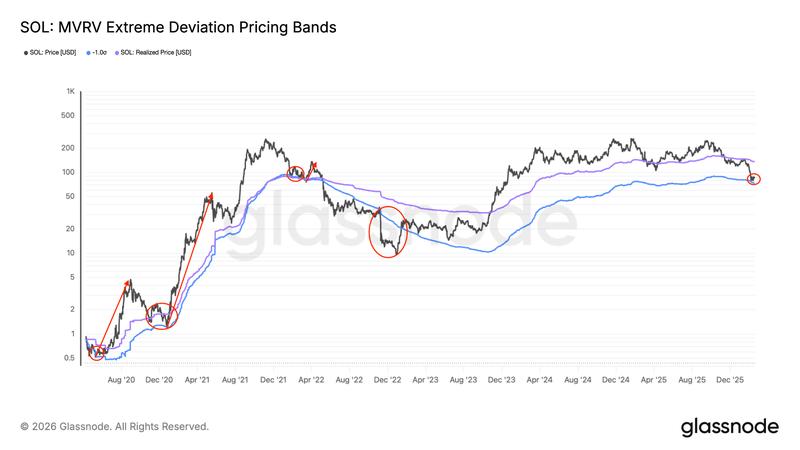

Should SOL fall below $80, the initial support level emerges at $73, which corresponds to the lower boundary of the MVRV pricing bands. These bands function as onchain indicators that reveal whether SOL is changing hands above or below the average acquisition price of coins based on their last movement onchain.

Throughout its trading history, SOL's valuation has dropped to or beneath the lowest MVRV band preceding substantial upward price movements. Evidence of this pattern emerged in March 2022, when the SOL price surged 87% over a three-week period to reach $140 following a test of the lowest MVRV deviation band near $75. Comparable recovery patterns were observed previously in June 2022 and December 2020.

The connection between Solana and the FTX exchange collapse in November 2022 resulted in a substantial breach below this band, with the token's price plummeting an additional 70% before establishing a bottom near $7 in December of that year.

Investment flows into Solana ETFs offer support

Spot Solana exchange-traded funds (ETFs) domiciled in the United States have maintained their appeal among investors, with these financial instruments registering positive inflows on 66 of 74 trading days, demonstrating sustained institutional appetite since their introduction in late October 2025.

According to data from SoSoValue, the spot SOL ETFs recorded $2.9 million in net inflows on Tuesday, elevating their aggregate inflows to $877 million while total net assets under management exceeded $726 billion.

Additionally, worldwide Solana-focused investment vehicles recorded cumulative net inflows totaling $31 million throughout the week concluding Feb. 13.

These figures underscore the consistent institutional appetite for SOL-based exchange-traded products, despite concurrent weakness in the spot market price.