Metaplanet remains committed to Bitcoin purchases amid market collapse

Despite severe declines affecting both Metaplanet's stock price and the broader cryptocurrency market, CEO Simon Gerovich maintains the firm's strategy of accumulating Bitcoin.

Simon Gerovich, chief executive of Metaplanet, has reaffirmed his commitment to the firm's Bitcoin-centric approach even as the broader cryptocurrency industry experienced one of its most severe market corrections witnessed since 2022.

"[T]here is no change to Metaplanet's strategy. We will steadily continue to accumulate Bitcoin, expand revenue and prepare for the next phase of growth," Gerovich said Friday on X, according to a machine translation of his post.

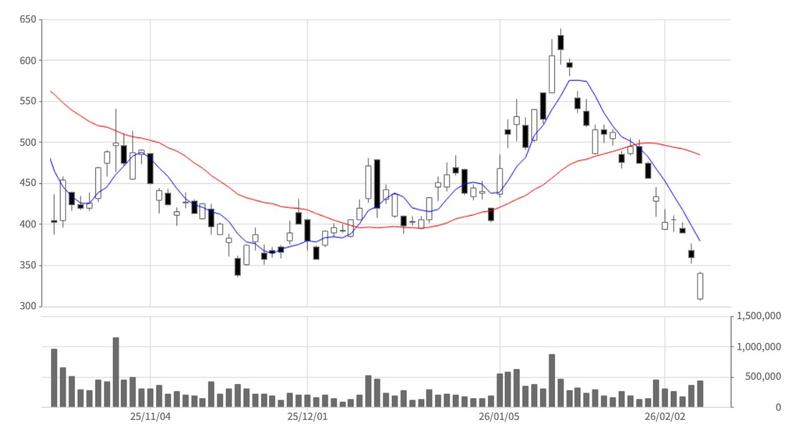

Shares of Metaplanet trading on the Tokyo Stock Exchange concluded Friday's session with a decline of 5.56%, settling at 340 yen (approximately $2.16).

Among publicly-traded companies holding Bitcoin (BTC) in their corporate treasuries, this crypto whale ranks fourth in position, trailing Strategy, MARA holdings and Twenty One Capital. According to data from BitcoinTreasuries.NET, Metaplanet's holdings stood at 35,102 as of Friday.

Companies holding Bitcoin treasuries face unrealized losses

By Friday's close, Bitcoin had declined approximately 50% from the all-time peak of $126,080 that it reached in October, 2025. Market sentiment, as measured by the Crypto Fear & Greed Index, plummeted to levels not witnessed since the collapse of Terra Luna back in May 2022.

Data from Coinglass reveals that Thursday saw the liquidation of $1.844 billion worth of leveraged long positions in cryptocurrency markets.

Public companies with substantial Bitcoin holdings were similarly reflecting losses across their financial statements. Strategy, which holds the distinction of being the largest publicly-traded Bitcoin holder, reported a net loss of $12.4 billion during the fourth quarter of 2025, occurring as Bitcoin's price fell beneath the company's average acquisition price of $76,052.

During its Thursday earnings call, Strategy's stock price fell by 17%, despite the firm's assertion that its capital structure continued to be "stronger and more resilient" and that no significant debt obligations would mature until 2027.

Despite mounting losses, Strategy maintains buying activity

According to Strategy's most recent regulatory filing, the company acquired an additional 855 BTC on Monday, representing a purchase valued at approximately $75 million.

Similar to Strategy's approach, Metaplanet has not indicated any intention to reduce its position or liquidate its Bitcoin reserves. Data from BitcoinTreasuries.NET shows that Metaplanet's average acquisition cost for its Bitcoin portfolio stands at $107,716.

Treasury companies focused on cryptocurrencies beyond Bitcoin are experiencing comparable stress. Bitmine, which operates an Ethereum-focused treasury strategy, maintained holdings of approximately 1.17 million Ether (ETH), while carrying more than $8.25 billion in paper losses that remain unrealized.