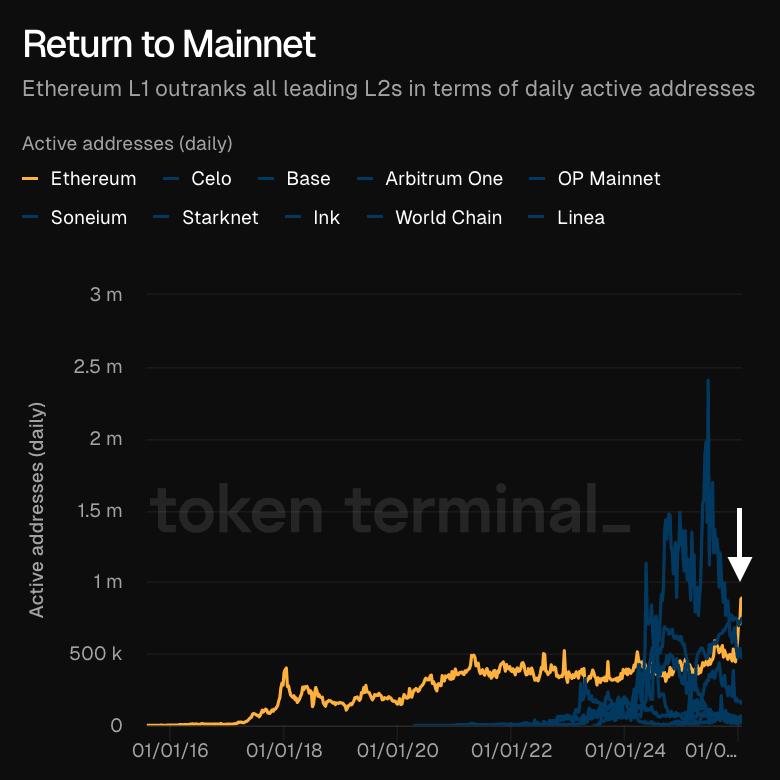

Layer-2 Networks Fall Behind Ethereum Mainnet in Daily Active User Metrics

In January, Ethereum's mainnet eclipsed all layer-2 solutions in terms of daily active addresses, with security experts pointing to address poisoning campaigns as a partial explanation for the increase.

Activity levels on Ethereum's primary network have exceeded those recorded on layer-2 scaling solutions, even as transaction costs stay at minimal levels, although not all participants may represent legitimate users engaging with the platform.

On Thursday, Token Terminal announced a "return to mainnet" phenomenon, noting that Ethereum's daily active addresses have climbed above those of all prominent layer-2 networks.

The recent uptick in active addresses approached the 1 million mark on a daily basis, with data from Etherscan indicating that active addresses peaked at approximately 1.3 million on Jan. 16 before stabilizing at roughly 945,000 daily active addresses in subsequent days.

This number exceeds that of all layer-2 blockchain networks, including widely-used platforms such as Arbitrum One, Base Chain, and OP Mainnet. According to L2Beat data, the aggregate value locked across all layer-2 solutions currently sits at $45 billion, representing a 17% decline over the previous 12 months.

Activity on the Ethereum network has experienced a notable increase this month in the wake of the Fusaka upgrade that took place in December, which brought about a substantial reduction in transaction costs. That said, not all of this activity may represent authentic user engagement.

Address poisoning attacks spike

On Monday, security researcher Andrey Sergeenkov indicated that the increase in network activity may be partially explained by dusting or address poisoning attack campaigns.

The address poisoning technique involves malicious actors transmitting minimal transactions from wallet addresses that closely mirror authentic ones, tricking users into selecting the incorrect address when executing a transaction.

The economic feasibility of such attacks has increased due to the collapse in network transaction costs, which has made it more affordable to flood the network with spam transactions.

"It's reasonable to conclude that the recent spike in Ethereum network activity is being materially driven by address poisoning campaigns," analysts at blockchain security firm Cyvers told Cointelegraph on Wednesday.

According to Cyvers' analysts, behavioral classification methods and statistical correlation analysis "strongly suggest that address poisoning is not a marginal factor, but a significant contributor to the recent rise in Ethereum transaction volume."

Ethereum still king for asset tokenization

Despite the presence of questionable activity, Ethereum "remains the preferred blockchain for on-chain assets," according to a report published by ARK Invest on Wednesday. The value of assets residing on Ethereum has now crossed the $400 billion threshold, and the worldwide market for tokenized assets has the potential to exceed $11 trillion by 2030, the report noted.

The majority of these assets consist of stablecoins, with Ethereum holding a dominant 56% share of on-chain stablecoins, along with a commanding 66% share of all tokenized real-world assets when layer-2 networks are factored into the calculation, based on data from RWA.xyz.