Kaiko Research Suggests Bitcoin's $60K Plunge Could Signal Bear Market Midpoint

Market experts remain divided over whether this price decline marks the bottom of the cycle or simply a temporary pause ahead of additional losses.

The dramatic price correction experienced by Bitcoin earlier this month could signify a pivotal "halfway point" within the ongoing bear market, new analysis from Kaiko Research indicates.

According to data from TradingView, Bitcoin (BTC) dropped to $59,930 on Friday, representing the cryptocurrency's weakest performance since October 2024 and prior to US President Donald Trump's re-election victory.

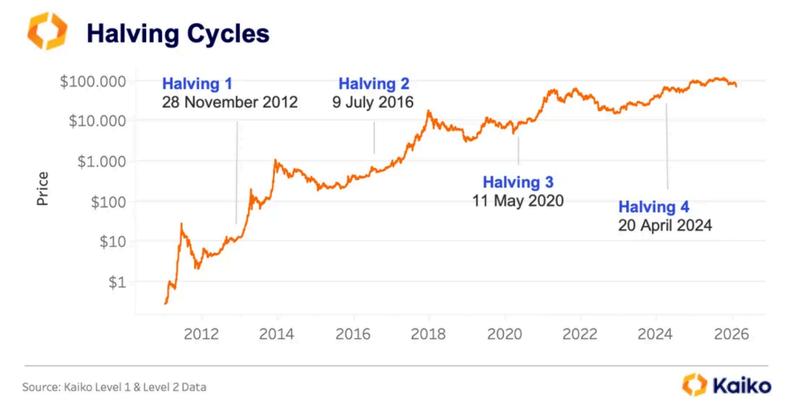

This downturn indicates the market has transitioned away from the euphoric period following the halving event and entered what Kaiko characterized as a conventionally typical bear market phase that generally extends approximately 12 months before a fresh accumulation stage commences.

According to a research note provided to Cointelegraph on Monday, Kaiko Research stated that Bitcoin's 32% plunge represented the most substantial price correction witnessed since the 2024 Bitcoin halving event and could signify the "halfway point" within the present bear market.

Examination of on-chain data and relative performance metrics across digital assets shows a market nearing crucial technical support thresholds that will establish whether the four-year cycle structure continues to hold.

Kaiko

The report from Kaiko emphasized multiple developing onchain indicators of a bear market, including a 30% reduction in total spot cryptocurrency trading volume among the 10 largest centralized exchanges, declining from approximately $1 trillion in October 2025 to $700 billion in November.

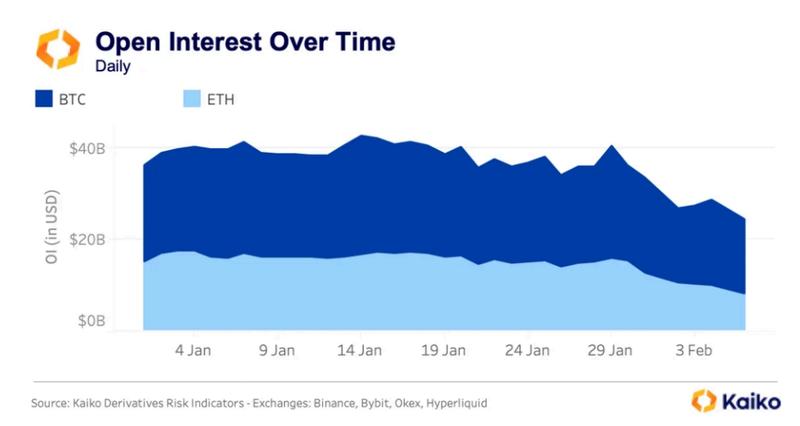

Simultaneously, the combined futures open interest for Bitcoin and Ether (ETH) fell from $29 billion to $25 billion throughout the previous week, representing a 14% decrease that Kaiko indicated demonstrates continued deleveraging activity.

Although Bitcoin has returned to alignment with the traditional four-year halving cycle since the year began, establishing the severity of the present bear market remains complicated, given that "many catalysts that fueled BTC's rally to $126,000 are still in effect," according to Shawn Young, chief analyst at MEXC Research.

"With oversold indicators emerging on multiple timeframes, the rebound conversation around BTC is more a question of when, not if," Young said, adding that Bitcoin may be entering a new cycle that will only become clear over the next year.

Is $60,000 the bear market bottom?

The critical question facing investors concerns whether the decline to $60,000 constitutes the floor of the ongoing bear market. This price point roughly corresponds with Bitcoin's 200-week moving average, a level that has traditionally functioned as long-term support.

Nevertheless, additional market volatility should be anticipated given the lack of crypto-specific market drivers, Nicolai Sondergaard, research analyst at cryptocurrency intelligence platform Nansen, told Cointelegraph, adding:

With that said, it is still very hard to say if it means we are going back to the conventional 4-year cycle. I have seen many prominent figures in the space air the idea, but equally many who do not think so.

Nicolai Sondergaard, Nansen

Nevertheless, Kaiko highlighted that a 52% retracement from Bitcoin's prior all-time high appears "unusually shallow" when compared to earlier bear market cycles.

A retracement ranging from 60% to 68% would "align more closely" with historical price drawdowns, suggesting a Bitcoin cycle bottom in the vicinity of $40,000 to $50,000, according to Kaiko.

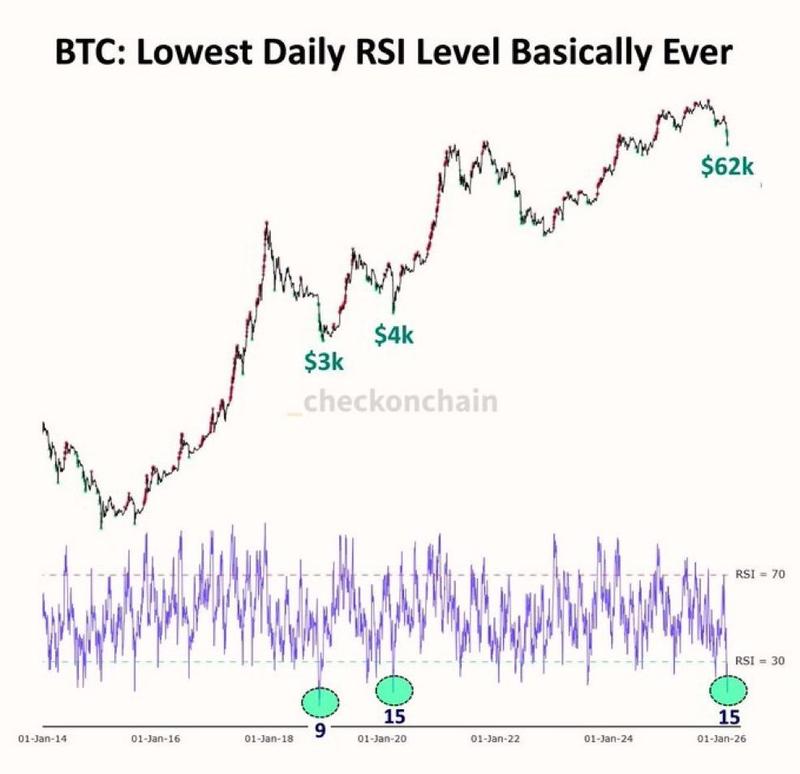

Despite this outlook, certain market observers contend that $60,000 has already established a local bottom. Market analyst and MN Capital founder Michaël van de Poppe characterized the drop to $60,000 as the local market bottom for Bitcoin's valuation, pointing to historically low investor sentiment readings and a critical decline in the Relative Strength Index, which plummeted to levels not observed since 2018 and 2020.