January witnesses surge in Bitcoin miner wallet transfers despite minimal confirmed public sales

Blockchain analytics reveal approximately 49,000 BTC exited mining wallets over a 48-hour period, yet publicly available disclosures indicate these movements don't represent widespread selling.

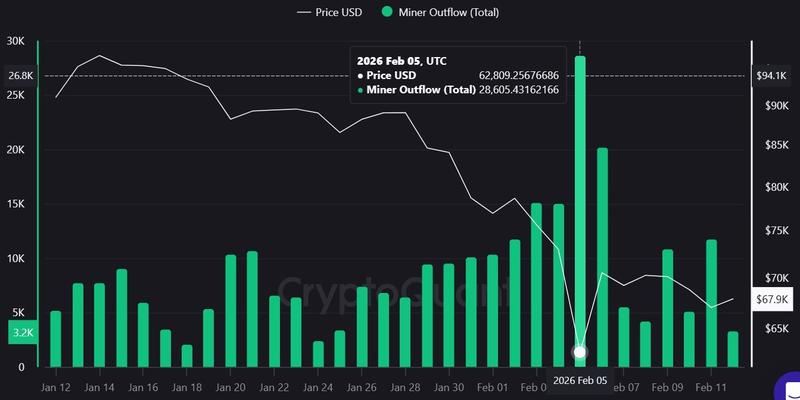

Wallet outflows from Bitcoin mining operations surged to 28,605 BTC on Feb. 5, representing approximately $1.8 billion in value, marking one of the most substantial single-day movements since November 2024, occurring as cryptocurrency markets experienced significant volatility.

An additional 20,169 Bitcoin (BTC), valued at approximately $1.4 billion, departed from wallets associated with mining operations on Feb. 6, based on analytics from CryptoQuant. The previous surge of similar magnitude took place on Nov. 12, 2024, recording outflows of 30,187 BTC.

These elevated outflows aligned with significant market volatility, as BTC prices fluctuated from approximately $62,809 on Feb. 5 before climbing back to $70,544 within 24 hours. Substantial transfers from mining wallets during periods of market turbulence frequently attract attention from market observers due to their potential indication of forthcoming selling pressure.

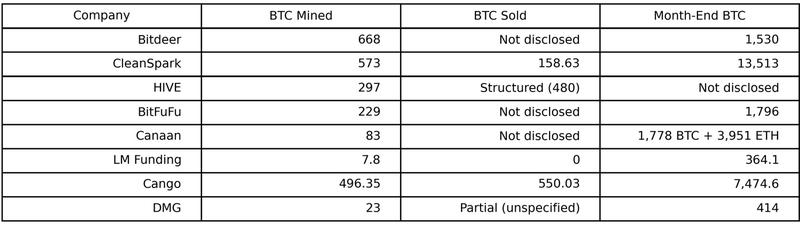

A total of eight mining companies have published their January operational data to date: CleanSpark, Bitdeer, Hive Digital Technologies, BitFuFu, Canaan, LM Funding America, Cango and DMG Blockchain Solutions. These firms collectively reported mining approximately 2,377 BTC throughout January. This aggregate production figure falls significantly short of the 28,605 BTC that moved from mining wallets on Feb. 5 alone.

Outflows likely reflect broader ecosystem flows

The magnitude of outflows recorded on Feb. 5 and Feb. 6 surpasses the total January mining output from all publicly reporting companies examined by Cointelegraph.

When aggregating the confirmed January disposals from CleanSpark, Cango and DMG, the verified selling volume represents only a small portion of the 28,605 BTC that exited wallets in the single day.

It's important to note that miner wallet outflows don't necessarily translate to mass selling or immediate liquidation on spot markets.

CryptoQuant's methodology indicates that miner outflow data encompasses transfers to cryptocurrency exchanges alongside internal reorganization between wallets and movements to various other parties, which means this indicator alone cannot verify whether the Bitcoin actually reached the open market for sale.

Considering the substantial volume of these transfers compared to the publicly reported sales from mining firms, the wallet movements could potentially represent operations beyond the major, publicly-traded mining companies.

Public miner disclosures show mixed treasury moves

CleanSpark's January disclosure revealed production of 573 BTC while disposing of 158.63 BTC throughout the period, concluding the month holding 13,513 BTC in corporate reserves.

Cango's operations yielded 496.35 BTC while the company disclosed liquidating 550.03 BTC, announcing its intention to continue monetizing newly mined Bitcoin to finance the growth of its artificial intelligence and inference platform operations.

Subsequently on Feb. 9, this same company liquidated another 4,451 BTC, generating approximately $305 million to reduce a Bitcoin-collateralized lending obligation and provide capital for its strategic shift toward AI operations.

Alternative strategies emerged among other mining operators. Canaan's mining activities produced 83 BTC while expanding its digital asset holdings to 1,778 BTC and 3,951 ETH. LM Funding's operations generated 7.8 BTC with zero reported sales, increasing its corporate treasury to 364.1 BTC.

Separately, Hive implemented structured pledge arrangements involving 480 BTC designed to maintain operational liquidity while continuing mining activities.

Reporting patterns vary across the mining industry, with certain operators publishing monthly operational updates regularly, while others release information sporadically or have transitioned to quarterly reporting schedules.

Winter storms affect US miner hashrates

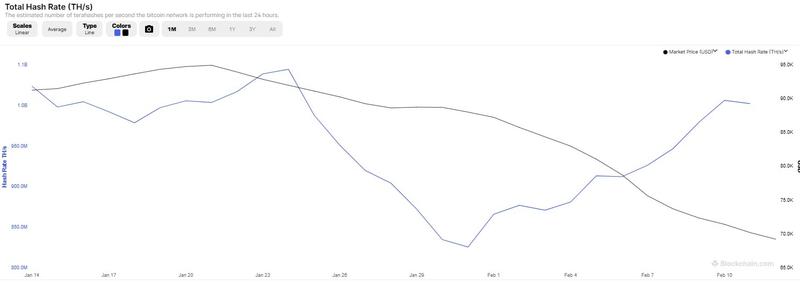

The Bitcoin network's total hashrate experienced dramatic fluctuations during late January as extreme winter weather systems impacted multiple regions across the United States. Bitcoin's hashrate declined to 663 exahashes per second across a two-day period on Jan. 27, representing a reduction exceeding 40%.

This transient reduction occurred as mining operations scaled back activities to support regional electrical infrastructure stability during periods of extreme cold temperatures and elevated energy consumption. Mining companies headquartered in the United States documented diminished operational uptime, with Marathon Digital Holdings and Iren among those experiencing pronounced short-term reductions in daily mining output.

Analytics from Blockchain.com demonstrated that network hashrate rebounded during early February following the decline experienced throughout the final week of January.