Insurance Broker Tian Ruixiang Eyes 15,000 BTC Acquisition Through Equity Exchange Agreement

A Nasdaq-traded insurance brokerage has announced plans to receive Bitcoin from an undisclosed investor through an equity deal that incorporates a strategic alliance centered on artificial intelligence and cryptocurrency technologies.

Tian Ruixiang Holdings Ltd (Nasdaq: TIRX) has announced its entry into a strategic arrangement whereby an investor, whose identity remains undisclosed, would provide 15,000 Bitcoin as payment for an ownership position in the insurance brokerage firm.

Based on Bitcoin's (BTC) current trading price of approximately $75,000 at the moment of publication, the anticipated contribution carries an estimated worth of roughly $1.1 billion.

According to Tian Ruixiang's disclosure, the arrangement encompasses a strategic collaboration centered on artificial intelligence and cryptocurrency projects, which includes establishing a collaborative innovation laboratory designed to build AI-driven trading platforms and risk management solutions, blockchain technology infrastructure, decentralized application development, and offerings across layer-2 blockchain networks, decentralized finance protocols, and nonfungible token products.

The insurance brokerage characterized the other party solely as an international digital asset investment firm possessing expertise throughout cryptocurrency markets and technology sectors, while withholding details regarding transaction timelines, cryptocurrency custody protocols, or settlement procedures.

Established in 2010, Tian Ruixiang functions as an insurance intermediary serving China's market, delivering property insurance and casualty coverage through its network of subsidiary companies.

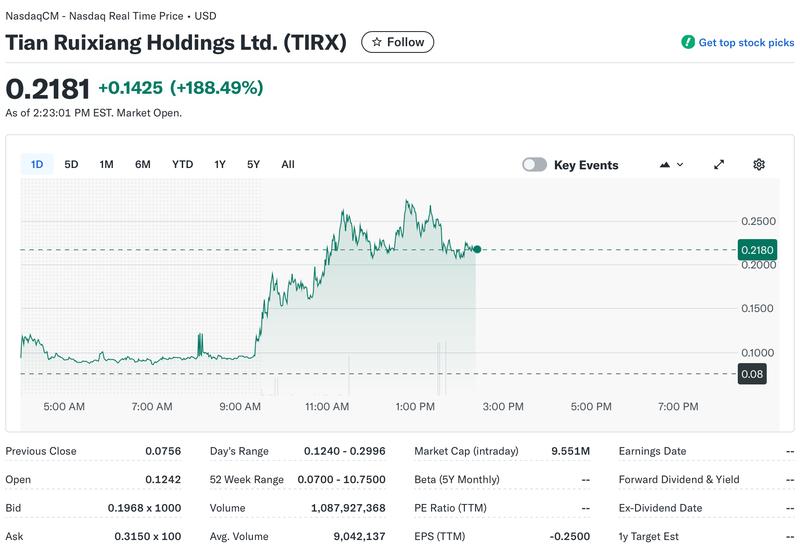

Following the public announcement, the company's stock price surged approximately 190% during early market hours, based on Yahoo Finance reporting, pushing its intraday valuation to roughly $9.5 million, a figure substantially lower than the suggested valuation of the Bitcoin transaction under consideration.

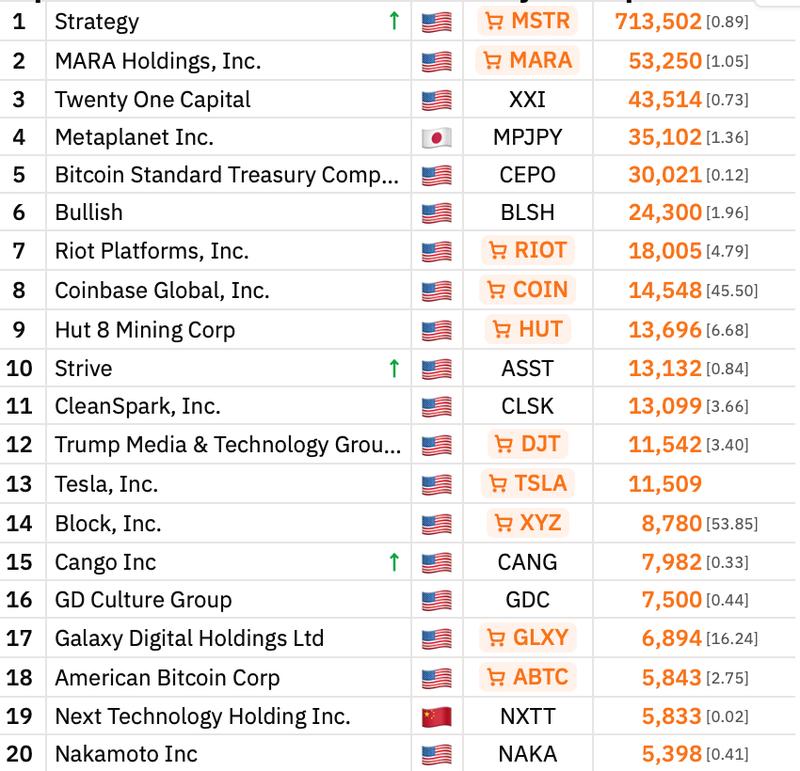

Should the transaction reach completion and Tian Ruixiang successfully obtains 15,000 Bitcoin, the company would secure a position as the eighth-largest publicly listed corporate Bitcoin treasury holder globally.

For context, Coinbase, the United States-based cryptocurrency trading platform, maintains a treasury of 14,548 Bitcoin, whereas Riot Platforms, a company specializing in Bitcoin mining operations, possesses 18,005 BTC, based on information from BitcoinTreasuries.NET.

This development comes after a Jan. 30 filing wherein Tian Ruixiang revealed it had entered advanced negotiations to purchase an unidentified Hong Kong–headquartered insurance brokerage specializing in AI-enhanced and crypto-integrated wealth management services.

Bitcoin treasury companies in the red as market weakens

Approximately 200 publicly listed corporations presently maintain Bitcoin reserves within their corporate balance sheets, holding a collective total of around 1,135,671 BTC. However, given Bitcoin's recent downward price movement, multiple firms that established treasury holdings are currently experiencing unrealized financial losses.

Strategy, which initiated its Bitcoin purchasing program in August 2020, maintains an average purchase price of $76,052 per Bitcoin, positioning its portfolio underwater given that Bitcoin has declined to levels beneath $75,000 at the time of this writing.

A newer market participant, Twenty One Capital, established by co-founder Jack Mallers, introduced its corporate treasury strategy in April and currently maintains 43,514 Bitcoin, establishing it as the third-largest corporate Bitcoin holder. The organization most recently reported an average cost basis of $87,280 per Bitcoin.

Although corporate Bitcoin treasury strategies initially attracted significant interest from institutional Wall Street investors, their stock market valuations have experienced difficulties as the wider cryptocurrency market has deteriorated.

During December, Altan Tutar, who serves as co-founder and chief executive officer of cryptocurrency yield generation platform MoreMarkets, shared with Cointelegraph that the majority of digital asset treasury corporations face low survival probability in 2026, forecasting that treasury companies concentrated on alternative cryptocurrencies will experience failure first.

Ryan Chow, who co-founded the Bitcoin-focused platform Solv Protocol, expressed similar sentiments, stating that numerous Bitcoin treasury corporations appear "unlikely to survive the next downturn."