Institutional appetite for prediction markets grows as Jump Trading pursues Polymarket, Kalshi equity: Report

Traditional financial market liquidity providers are reportedly entering the prediction market space, marking a transition toward increased market depth, trading volumes and mainstream institutional engagement.

A Chicago-headquartered quantitative trading firm, Jump Trading, is reportedly preparing to take minority equity positions in both Polymarket and Kalshi, two leading prediction market platforms, highlighting the increasing institutional appetite for this rapidly developing sector.

According to a Bloomberg report published Monday, the equity positions would be granted in return for Jump Trading's commitment to provide trading liquidity across both platforms, as revealed by sources with knowledge of the ongoing negotiations.

Although the report stopped short of revealing precise ownership percentages, Bloomberg indicated that Jump's equity stake in Polymarket would be proportional to the amount of liquidity the firm eventually delivers to the platform.

Established over twenty years ago, Jump Trading has maintained a significant presence in proprietary financial markets trading and has pursued an aggressive expansion strategy into the digital asset space. The firm has operated simultaneously as a market maker and venture capital investor within crypto markets, supporting blockchain infrastructure initiatives and trading platforms through its related investment divisions.

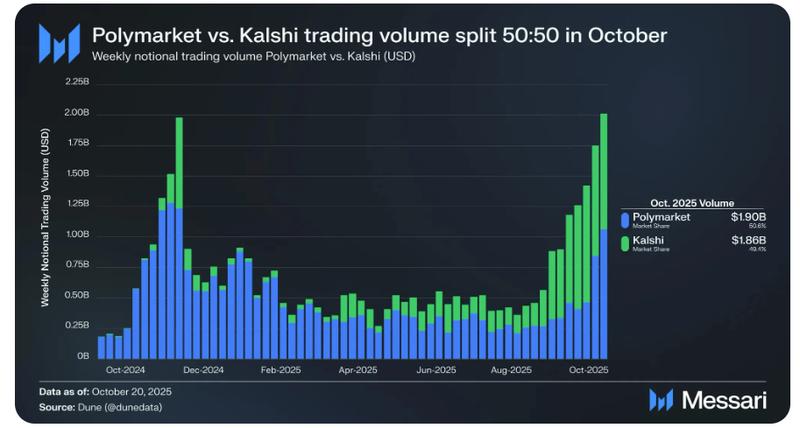

Both Polymarket and Kalshi represent the dominant forces in the prediction market industry, each achieving valuations in the multibillion-dollar range following their most recent capital-raising efforts.

According to earlier reporting by Cointelegraph, Polymarket successfully raised $2 billion from Intercontinental Exchange, the parent organization of the New York Stock Exchange, establishing the company's valuation at $9 billion. Kalshi followed in early December, securing $1 billion in new funding that valued the platform at $11 billion.

Though both platforms facilitate user trading on real-world event outcomes, their operational frameworks differ significantly. Polymarket functions as a decentralized platform constructed on the Polygon blockchain, enabling onchain settlement mechanisms for prediction contracts, while Kalshi operates as a centralized exchange under federal regulatory oversight in the United States.

Prediction markets gain traction, but still face regulatory hurdles

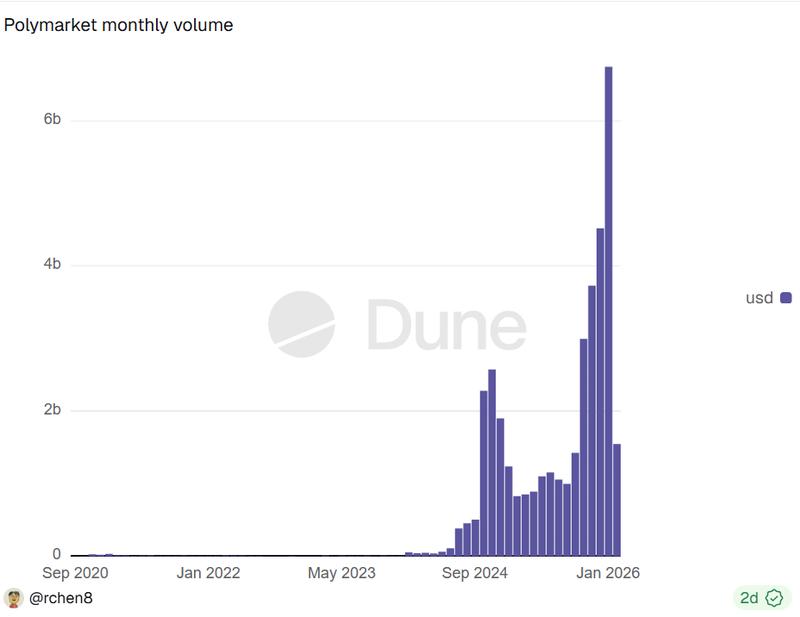

The prediction market sector captured widespread mainstream recognition following Polymarket's event contracts successfully predicting the 2024 US presidential election results, demonstrating the industry's capabilities as a real-time information aggregation and risk-pricing mechanism. Sector analysts currently project that prediction markets may generate trading volumes reaching into the trillions of dollars annually before the decade concludes.

Research and consulting firm Eilers & Krejcik Gaming, which focuses on the worldwide gambling and gaming sectors, has pinpointed sports-related contracts as a primary catalyst for the anticipated growth trajectory. In statements to CNBC during December, Chris Grove, partner emeritus at Eilers & Krejcik, projected that sports betting activities could represent approximately half of the sector's forecasted expansion.

Notwithstanding the sector's growth prospects, Grove issued a warning that legal and regulatory obstacles may decelerate the pace of widespread adoption.

Operating as a federally regulated prediction market platform, Kalshi has obtained authorization from the US Commodity Futures Trading Commission to function as a Designated Contract Market. Nevertheless, the platform is encountering resistance from state-level authorities. State regulators in Nevada, Maryland, New Jersey and Ohio have mounted challenges against Kalshi's product offerings, resulting in active litigation proceedings and cease-and-desist enforcement actions.